Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Computeing Cash flows statement from Operating activites. (using both direct and indirect method) Using the following financial statements and supplementary information, prepare the 2019 Statement

Computeing Cash flows statement from Operating activites. (using both direct and indirect method)

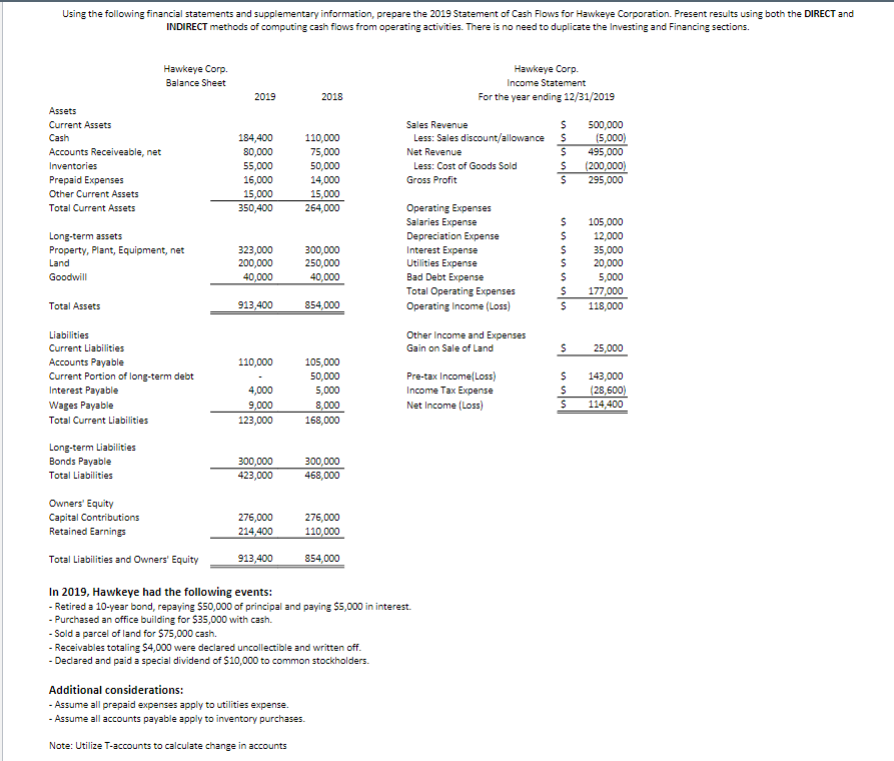

Using the following financial statements and supplementary information, prepare the 2019 Statement of Cash Flows for Hawkeye Corporation. Present results using both the DIRECT and INDIRECT methods of computing cash flows from operating activities. There is no need to duplicate the Investing and Financing sections. Hawkeye Corp Balance Sheet 2019 2018 Assets Current Assets Cash Accounts Receiveable, net Inventories Prepaid Expenses Other Current Assets Total Current Assets 184,400 80,000 55,000 16,000 15,000 350,400 110,000 75,000 50,000 14,000 15,000 264,000 Hawkeye Corp. Income Statement For the year ending 12/31/2019 Sales Revenue 5 500,000 Less: Sales discount/allowance 5 (5,000) Net Revenue s 495,000 Less: Cost of Goods Sold $ 200,000) Gross Profit S 295,000 Operating Expenses Salaries Expense S 105,000 Depreciation Expense 12,000 Interest Expense 35,000 Utilities Expense 20,000 Bad Debt Expense $ 5,000 Total Operating Expenses $ 177,000 Operating Income (Loss) 118,000 Other Income and Expenses Gain on Sale of Land $ 25,000 Pre-tax IncomeLoss) $ 143,000 Income Tax Expense $ (28,500) Net Income (Loss) $ 114,400 Long-term assets Property, Plant, Equipment, net Land Goodwill Total Assets 323,000 200,000 40,000 300,000 250,000 40,000 nun 913,400 854,000 110,000 4,000 9,000 123,000 105,000 50,000 5,000 8,000 168,000 Liabilities Current Liabilities Accounts Payable Current Portion of long-term debt Interest Payable Wages Payable Total Current Liabilities Long-term Liabilities Bonds Payable Total Liabilities Owners' Equity Capital Contributions Retained Earnings Total Liabilities and Owners' Equity 300,000 423,000 300,000 468,000 276,000 214,400 275,000 110,000 913,400 854,000 In 2019, Hawkeye had the following events: - Retired a 10-year bond, repaying $50,000 of principal and paying $5,000 in interest. - Purchased an office building for $35,000 with cash. - Sold a parcel of land for $75,000 cash. - Receivables totaling S4,000 were declared uncollectible and written off. - Decared and paid a special dividend of $10,000 to common stockholders. Additional considerations: - Assume all prepaid expenses apply to utilities expense. - Assume all accounts payable apply to inventory purchases. Note: Utilize T-accounts to calculate change in accountsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started