Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Computer Academic Press faces three potential contingency situations, described below. Computer's year ends December 31, 2024. Required: Determine the appropriate means of reporting each situation

Computer Academic Press faces three potential contingency situations, described below. Computer's year ends December 31, 2024.

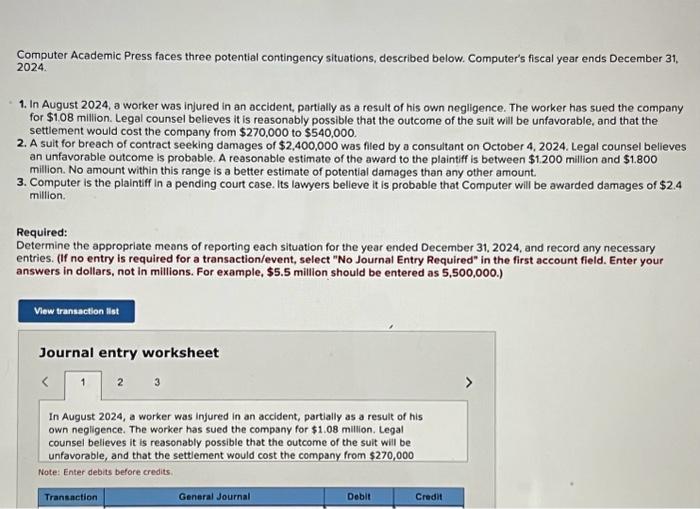

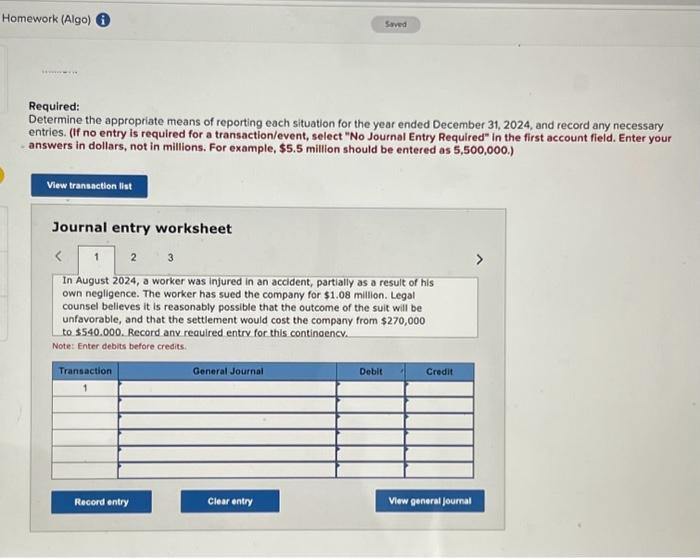

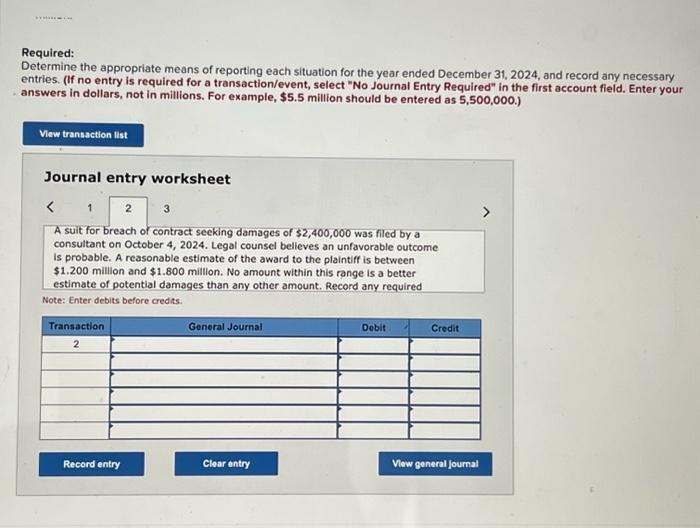

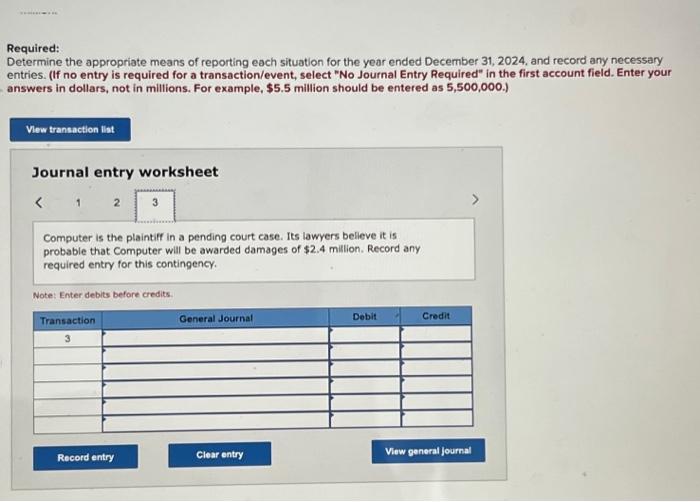

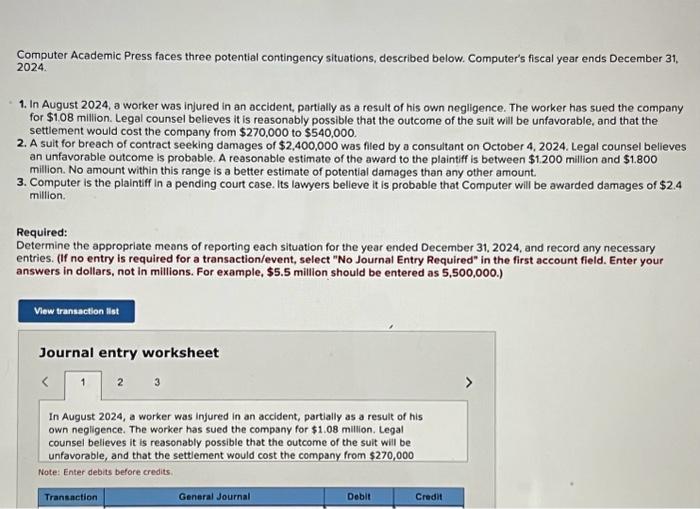

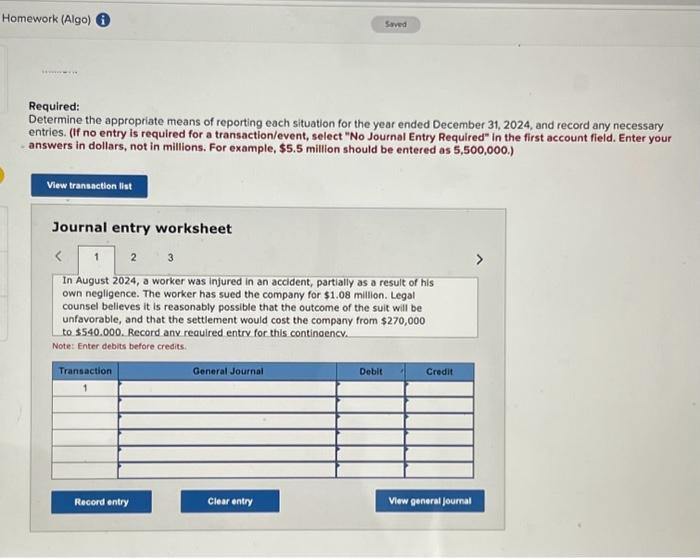

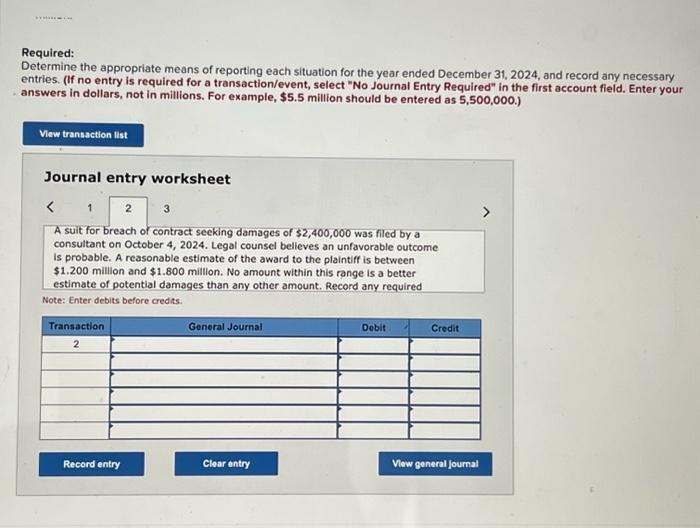

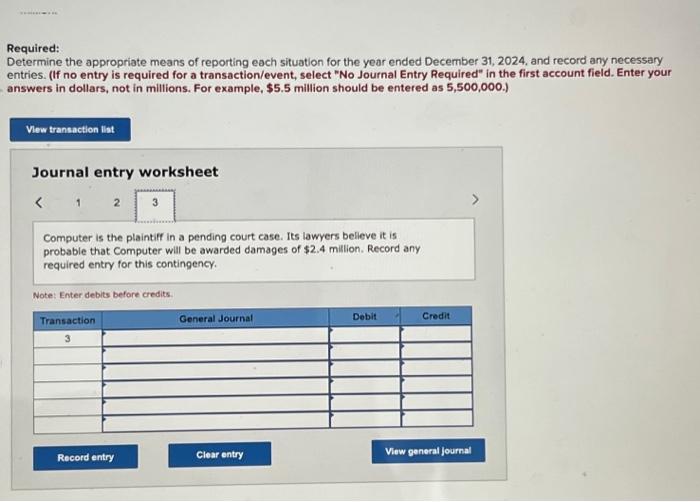

Required: Determine the appropriate means of reporting each situation for the year ended December 31, 2024, and record any necessary entries. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions. For example, $5.5 million should be entered as 5,500,000.) Journal entry worksheet A suit for breach or contract seeking damages of $2,400,000 was filed by a consultant on October 4, 2024. Legal counsel believes an unfavorable outcome is probable. A reasonable estimate of the award to the plaintiff is between $1.200 million and $1.800 million. No amount within this range is a better estimate of potential damages than any other amount. Record any required Note: Enter debits before credits. Required: Determine the appropriate means of reporting each situation for the year ended December 31, 2024, and record any necessary entries. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions. For example, $5.5 million should be entered as 5,500,000.) Journal entry worksheet Computer Academic Press faces three potential contingency situations, described below. Computer's fiscal year ends December 31 , 2024. 1. In August 2024, a worker was injured in an accident, partially as a result of his own negligence. The worker has sued the company for $1.08 million. Legal counsel believes it is reasonably possible that the outcome of the suit will be unfavorable, and that the settlement would cost the company from $270,000 to $540,000. 2. A suit for breach of contract seeking damages of $2,400,000 was filed by a consultant on October 4,2024 . Legal counsel believes an unfavorable outcome is probable. A reasonable estimate of the award to the plaintiff is between $1.200 million and $1.800 million. No amount within this range is a better estimate of potential damages than any other amount. 3. Computer is the plaintiff in a pending court case. Its lawyers belleve it is probable that Computer will be awarded damages of $2.4 million. Required: Determine the appropriate means of reporting each situation for the year ended December 31, 2024, and record any necessary entries. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions. For example, $5.5 million should be entered as 5,500,000.) Journal entry worksheet In August 2024, a worker was injured in an accident, partially as a result of his own negligence. The worker has sued the company for $1.08 million. Legal counsel believes it is reasonably possible that the outcome of the suit will be unfavorable, and that the settlement would cost the company from $270,000 Note: Enter debits before credits. Required: Determine the appropriate means of reporting each situation for the year ended December 31, 2024, and record any necessary entries. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions. For example, $5.5 million should be entered as 5,500,000.) Journal entry worksheet 1 Computer is the plaintiff in a pending court case. Its lawyers believe it is probable that Computer will be awarded damages of $2.4 million. Record any required entry for this contingency. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started