Computer Analytic Technology Systems (CATS) Corporation is a manufacturer of computer components. CATS had recently doubled its plant capacity, opened new sales offices outside its home territory, and launched an expensive advertising campaign. You have been hired as a consultant and have been asked to answer each question below. Be sure to show all calculations and state any assumptions that you make (though I am not sure you need to make any). Financial statements and other miscellaneous data are provided below.

D) Compute total net operating capital does for CATS for 20Y3 and 20Y4 using the investor-supplied capital approach.

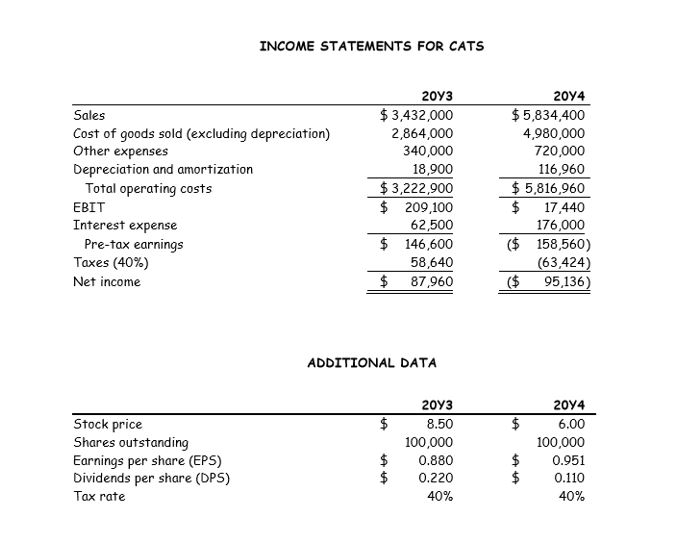

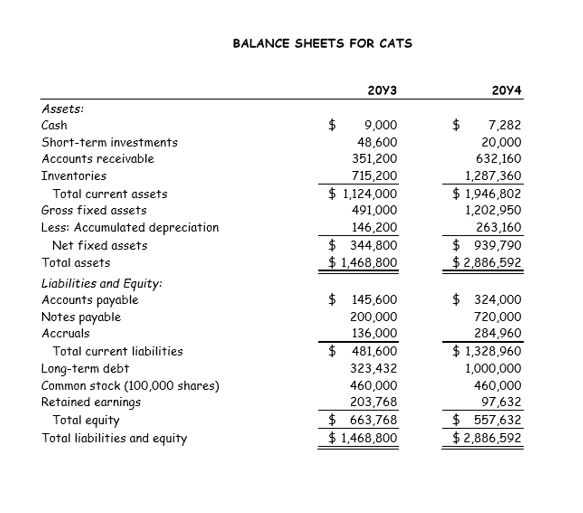

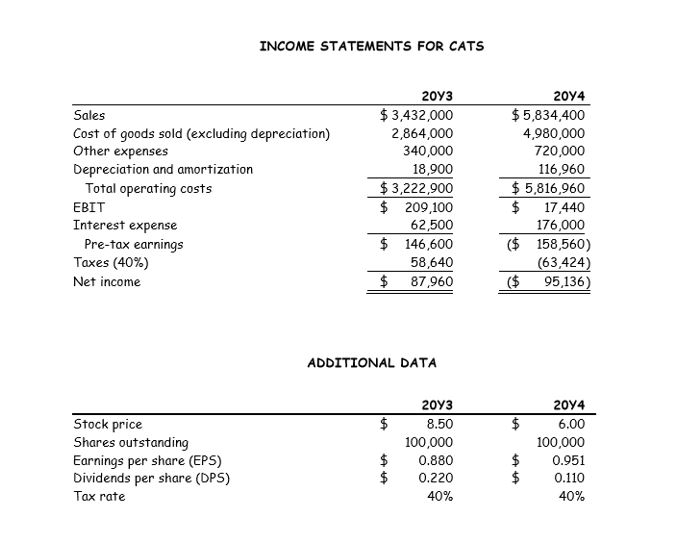

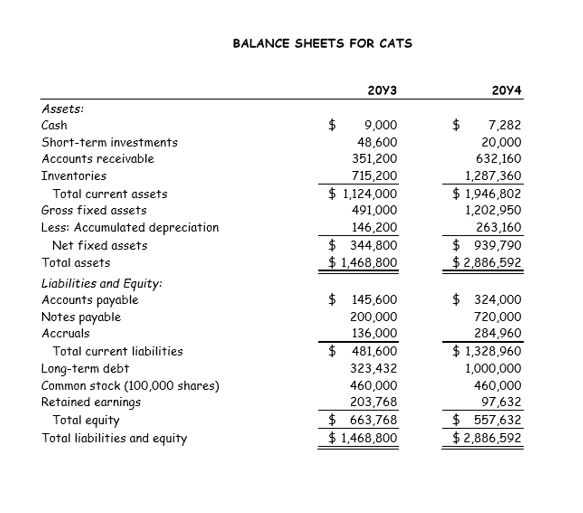

INCOME STATEMENTS FOR CATS Sales Cost of goods sold (excluding depreciation) Other expenses Depreciation and amortization Total operating costs EBIT Interest expense Pre-tax earnings Taxes (40%) Net income 2013 $ 3,432,000 2,864,000 340,000 18,900 $3,222,900 $ 209,100 62,500 $ 146,600 58,640 $ 87,960 2014 $5,834,400 4,980,000 720,000 116,960 $ 5,816,960 17,440 176,000 ($ 158,560) (63,424) ($ 95,136) ADDITIONAL DATA $ $ Stock price Shares outstanding Earnings per share (EPS) Dividends per share (DPS) Tax rate 2013 8.50 100,000 0.880 0.220 40% 2014 6.00 100,000 0.951 0.110 40% $ $ $ ta BALANCE SHEETS FOR CATS 2013 2014 $ 9,000 48,600 351,200 715,200 $ 1,124,000 491,000 146,200 $ 344,800 $ 1,468,800 7,282 20,000 632,160 1,287,360 $ 1,946,802 1,202,950 263,160 $ 939,790 $ 2,886,592 Assets: Cash Short-term investments Accounts receivable Inventories Total current assets Gross fixed assets Less: Accumulated depreciation Net fixed assets Total assets Liabilities and Equity: Accounts payable Notes payable Accruals Total current liabilities Long-term debt Common stock (100,000 shares) Retained earnings Total equity Total liabilities and equity $ 145,600 200,000 136,000 $ 481,600 323,432 460,000 203,768 $ 663,768 $ 1,468,800 $ 324,000 720,000 284,960 $ 1,328,960 1,000,000 460,000 97,632 $ 557,632 $ 2,886,592 INCOME STATEMENTS FOR CATS Sales Cost of goods sold (excluding depreciation) Other expenses Depreciation and amortization Total operating costs EBIT Interest expense Pre-tax earnings Taxes (40%) Net income 2013 $ 3,432,000 2,864,000 340,000 18,900 $3,222,900 $ 209,100 62,500 $ 146,600 58,640 $ 87,960 2014 $5,834,400 4,980,000 720,000 116,960 $ 5,816,960 17,440 176,000 ($ 158,560) (63,424) ($ 95,136) ADDITIONAL DATA $ $ Stock price Shares outstanding Earnings per share (EPS) Dividends per share (DPS) Tax rate 2013 8.50 100,000 0.880 0.220 40% 2014 6.00 100,000 0.951 0.110 40% $ $ $ ta BALANCE SHEETS FOR CATS 2013 2014 $ 9,000 48,600 351,200 715,200 $ 1,124,000 491,000 146,200 $ 344,800 $ 1,468,800 7,282 20,000 632,160 1,287,360 $ 1,946,802 1,202,950 263,160 $ 939,790 $ 2,886,592 Assets: Cash Short-term investments Accounts receivable Inventories Total current assets Gross fixed assets Less: Accumulated depreciation Net fixed assets Total assets Liabilities and Equity: Accounts payable Notes payable Accruals Total current liabilities Long-term debt Common stock (100,000 shares) Retained earnings Total equity Total liabilities and equity $ 145,600 200,000 136,000 $ 481,600 323,432 460,000 203,768 $ 663,768 $ 1,468,800 $ 324,000 720,000 284,960 $ 1,328,960 1,000,000 460,000 97,632 $ 557,632 $ 2,886,592