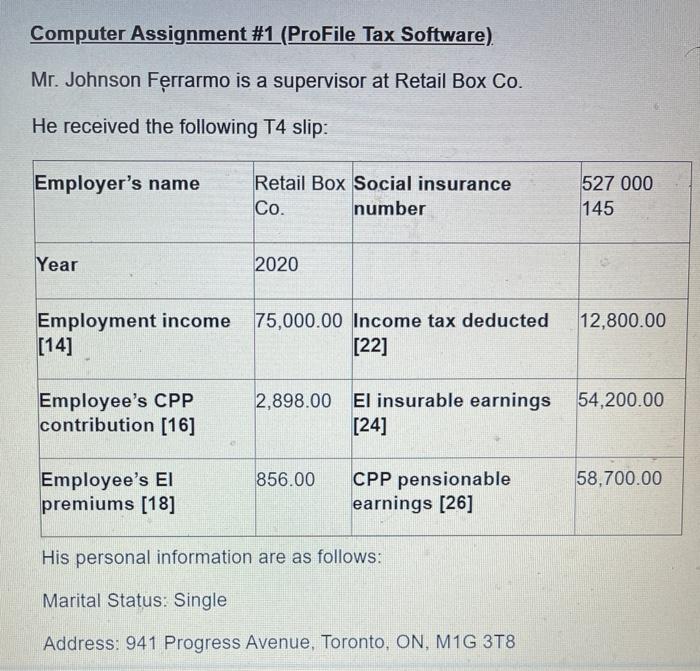

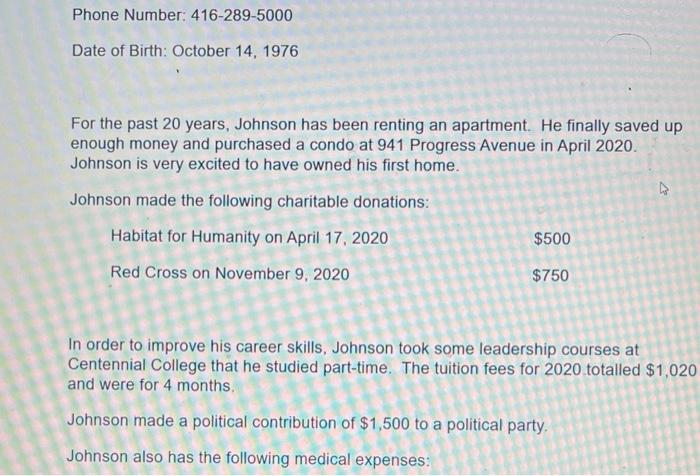

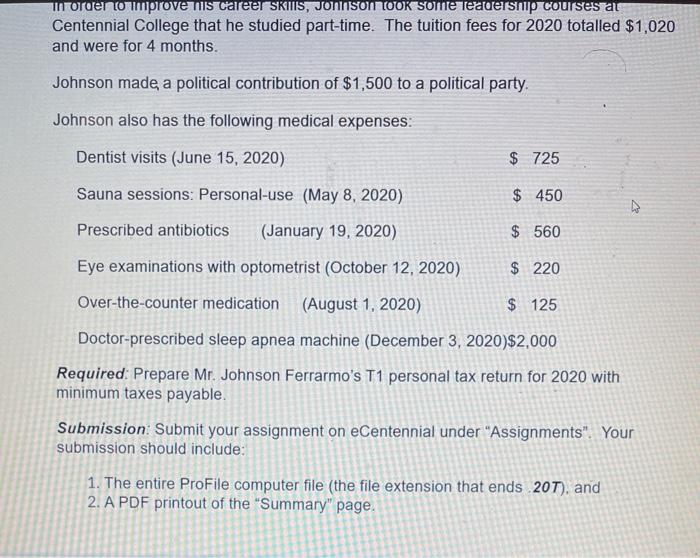

Computer Assignment #1 (ProFile Tax Software) Mr. Johnson Ferrarmo is a supervisor at Retail Box Co. He received the following T4 slip: Employer's name Retail Box Social insurance Co. number 527 000 145 Year 2020 12,800.00 Employment income 75,000.00 Income tax deducted [14] [22] Employee's CPP contribution [16] 2,898.00 El insurable earnings 54,200.00 [24] 856.00 58,700.00 Employee's EI premiums [18] CPP pensionable earnings [26] His personal information are as follows: Marital Status: Single Address: 941 Progress Avenue, Toronto, ON, M1G 3T8 Phone Number: 416-289-5000 Date of Birth: October 14, 1976 For the past 20 years, Johnson has been renting an apartment. He finally saved up enough money and purchased a condo at 941 Progress Avenue in April 2020. Johnson is very excited to have owned his first home. V Johnson made the following charitable donations: Habitat for Humanity on April 17, 2020 Red Cross on November 9, 2020 $500 $750 In order to improve his career skills, Johnson took some leadership courses at Centennial College that he studied part-time. The tuition fees for 2020 totalled $1,020 and were for 4 months, Johnson made a political contribution of $1,500 to a political party, Johnson also has the following medical expenses: Ti ordemo improve his career skills, JonnsonOOK some readership courses at Centennial College that he studied part-time. The tuition fees for 2020 totalled $1,020 and were for 4 months. Johnson made a political contribution of $1,500 to a political party Johnson also has the following medical expenses: Dentist visits (June 15, 2020) $ 725 Sauna sessions: Personal-use (May 8, 2020) $ 450 Prescribed antibiotics (January 19, 2020) $ 560 Eye examinations with optometrist (October 12, 2020) $ 220 Over-the-counter medication (August 1, 2020) $ 125 Doctor-prescribed sleep apnea machine (December 3, 2020)$2,000 Required: Prepare Mr. Johnson Ferrarmo's T1 personal tax return for 2020 with minimum taxes payable. Submission: Submit your assignment on eCentennial under "Assignments". Your submission should include: 1. The entire ProFile computer file (the file extension that ends 20T), and 2. A PDF printout of the "Summary" page