Answered step by step

Verified Expert Solution

Question

1 Approved Answer

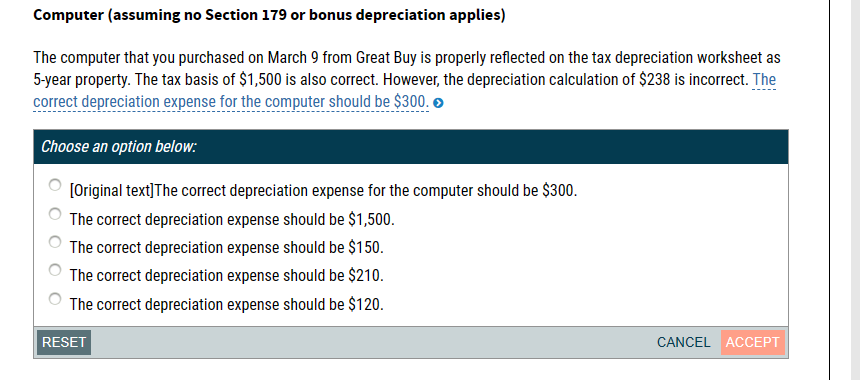

Computer (assuming no Section 179 or bonus depreciation applies) The computer that you purchased on March 9 from Great Buy is properly reflected on

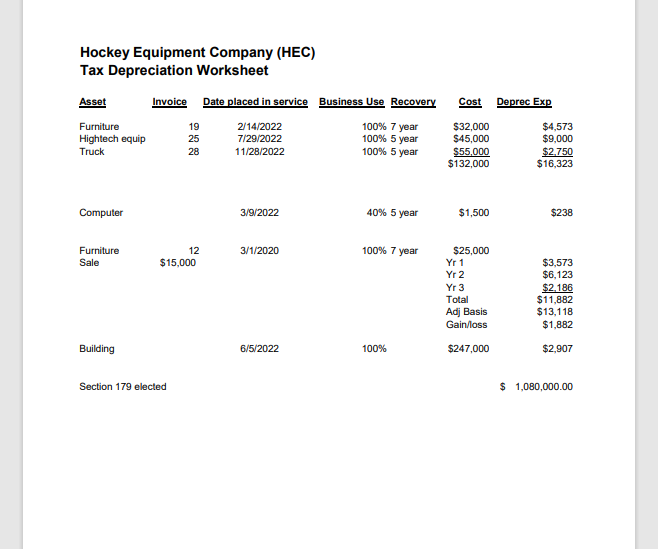

Computer (assuming no Section 179 or bonus depreciation applies) The computer that you purchased on March 9 from Great Buy is properly reflected on the tax depreciation worksheet as 5-year property. The tax basis of $1,500 is also correct. However, the depreciation calculation of $238 is incorrect. The correct depreciation expense for the computer should be $300. > Choose an option below: [Original text] The correct depreciation expense for the computer should be $300. The correct depreciation expense should be $1,500. The correct depreciation expense should be $150. The correct depreciation expense should be $210. The correct depreciation expense should be $120. RESET CANCEL ACCEPT Hockey Equipment Company (HEC) Tax Depreciation Worksheet Asset Invoice Date placed in service Business Use Recovery Cost Deprec Exp Furniture 19 2/14/2022 100% 7 year $32,000 $4,573 Hightech equip 25 7/29/2022 100% 5 year $45,000 $9,000 Truck 28 11/28/2022 100% 5 year $55,000 $2,750 $132,000 $16,323 Computer 3/9/2022 40% 5 year $1,500 $238 Furniture 12 3/1/2020 100% 7 year $25,000 Sale $15,000 Yr 1 $3,573 Yr 2 $6,123 Yr 3 $2.186 Total $11,882 Adj Basis $13,118 Gain/loss $1,882 Building 6/5/2022 100% $247,000 $2,907 Section 179 elected $ 1,080,000.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started