Question

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2004. For each investment proposal, the relevant cash flows

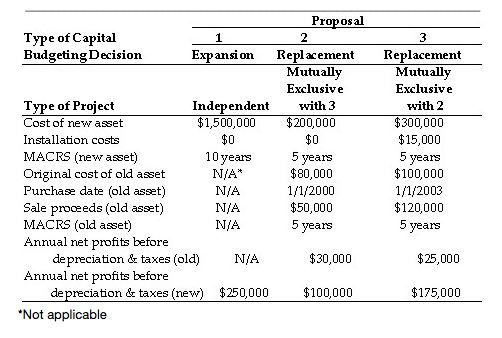

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2004. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

For Proposal 3, the annual incremental after-tax cash flow from operations for year 3 is ________. (See Table 8.4.)

a.) $90,150

b.) $75,150

c.) $109,140

d.) $45,000

Prop osall Type of Capital BudgetingDecisioin Expansion Replacement Replacement Mutually Exclusive with 2 $300,000 $15,000 5 years $100,000 1/1/2003 $120,000 years Mutually Exclusive Type of Project Cost of new asset Installation costs MACRS (new asset) Original cost of old asset Purchae date (old asset) Sale proceeds (old asset) MACRS (old asset) Annual net profits before Independent with3 1,500,000 $0 10years N/A* N/A N/A N/A $200,000 $0 5 years $80,000 1/1/2000 $50,000 yearS depreciation & taxes (old)N/A $30,000 $25,000 Annual net profits before depreciation & taxes (new) $250,000 $100,000 $175,000 Not applicable Prop osall Type of Capital BudgetingDecisioin Expansion Replacement Replacement Mutually Exclusive with 2 $300,000 $15,000 5 years $100,000 1/1/2003 $120,000 years Mutually Exclusive Type of Project Cost of new asset Installation costs MACRS (new asset) Original cost of old asset Purchae date (old asset) Sale proceeds (old asset) MACRS (old asset) Annual net profits before Independent with3 1,500,000 $0 10years N/A* N/A N/A N/A $200,000 $0 5 years $80,000 1/1/2000 $50,000 yearS depreciation & taxes (old)N/A $30,000 $25,000 Annual net profits before depreciation & taxes (new) $250,000 $100,000 $175,000 Not applicableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started