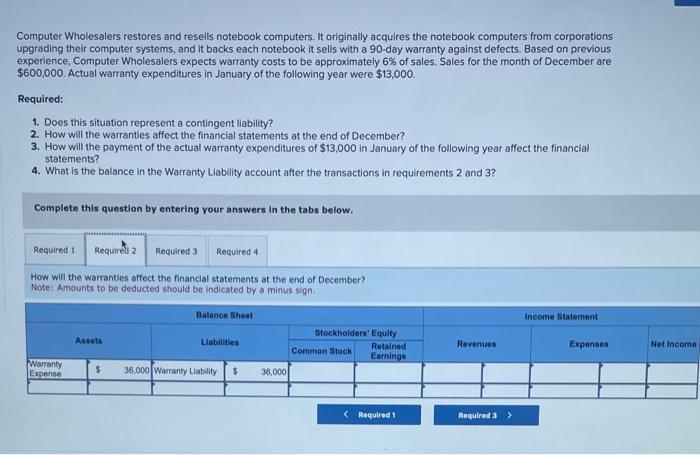

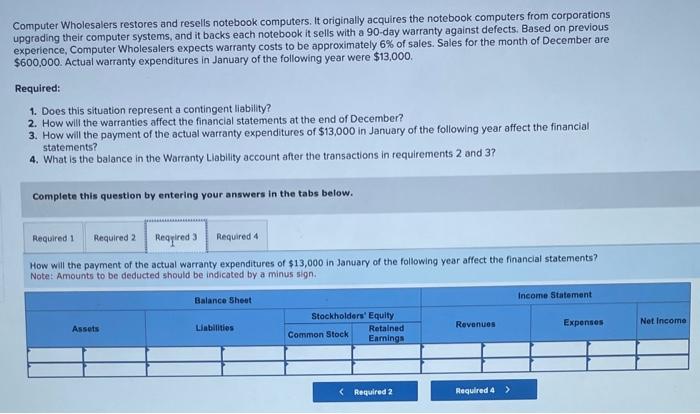

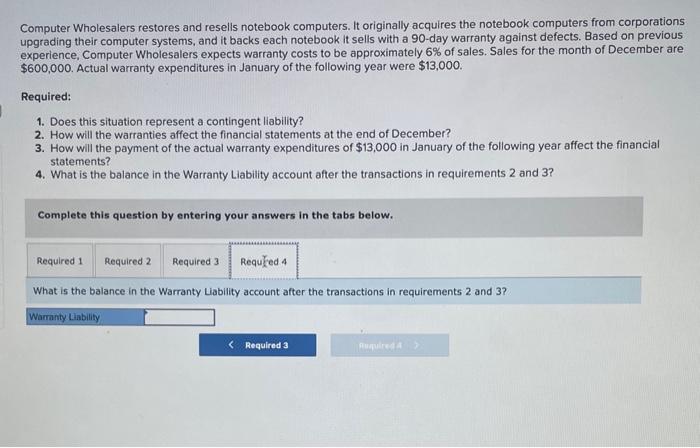

Computer Wholesalers restores and resells notebook computers. It originally acquires the notebook computers from corporations upgrading their computer systems, and it backs each notebook it sells with a 90-day warranty against defects. Based on previous experience, Computer Wholesalers expects warranty costs to be approximately 6% of sales. Sales for the month of December are $600,000. Actual warranty expenditures in January of the following year were $13,000. Required: 1. Does this situation represent a contingent liability? 2. How will the warranties affect the financial statements at the end December? 3. How will the payment of the actual warranty expenditures of $13,000 in January of the following year affect the financial statements? 4. What is the balance in the Warranty Liability account after the transactions in requirements 2 and 3 ? Complete this question by entering your answers in the tabs below. Does this situation represent a contingent liability? Computer Wholesalers restores and resells notebook computers. It originally acquires the notebook computers from corporations upgrading their computer systems, and it backs each notebook it sells with a 90 -day warranty against defects. Based on previous experience, Computer Wholesalers expects warranty costs to be approximately 6% of sales. Sales for the month of December are $600,000. Actual warranty expenditures in January of the following year were $13,000. Required: 1. Does this situation represent a contingent liability? 2. How will the warranties affect the financial statements at the end of December? 3. How will the payment of the actual warranty expenditures of $13,000 in January of the following year affect the financial statements? 4. What is the balance in the Warranty Liability account after the transactions in requirements 2 and 3 ? Complete this question by entering your answers in the tabs below. How will the warranties affect the financial statements at the end of December? Note: Amounts to be deducted should be indicated by a minus sign. Computer Wholesalers restores and resells notebook computers. It originally acquires the notebook computers from corporations upgrading their computer systems, and it backs each notebook it sells with a 90 -day warranty against defects, Based on previous experience, Computer Wholesalers expects warranty costs to be approximately 6% of sales. Sales for the month of December are $600,000. Actual warranty expenditures in January of the following year were $13,000. Required: 1. Does this situation represent a contingent liability? 2. How will the warranties affect the financial statements at the end of December? 3. How will the payment of the actual warranty expenditures of $13,000 in January of the following year affect the financial statements? 4. What is the balance in the Worranty Liability account after the transactions in requirements 2 and 3 ? Complete this question by entering your answers in the tabs below. How will the payment of the actual warranty expenditures of $13,000 in January of the following year affect the financial statements? Note: Amounts to be deducted should be indicated by a minus sign. Computer Wholesalers restores and resells notebook computers. It originally acquires the notebook computers from corporations upgrading their computer systems, and it backs each notebook it sells with a 90 -day warranty against defects. Based on previous experience, Computer Wholesalers expects warranty costs to be approximately 6% of sales. Sales for the month of December are $600,000. Actual warranty expenditures in January of the following year were $13,000. Required: 1. Does this situation represent a contingent liability? 2. How will the warranties affect the financial statements at the end of December? 3. How will the payment of the actual warranty expenditures of $13,000 in January of the following year affect the financial statements? 4. What is the balance in the Warranty Liability account after the transactions in requirements 2 and 3 ? Complete this question by entering your answers in the tabs below. What is the balance in the Warranty Liability account after the transactions in requirements 2 and 3