Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Computing Impairment of Intangible Assets Stiller Company had the following information for its three intangible assets. 1. Patent: A patent was purchased for $220,000 on

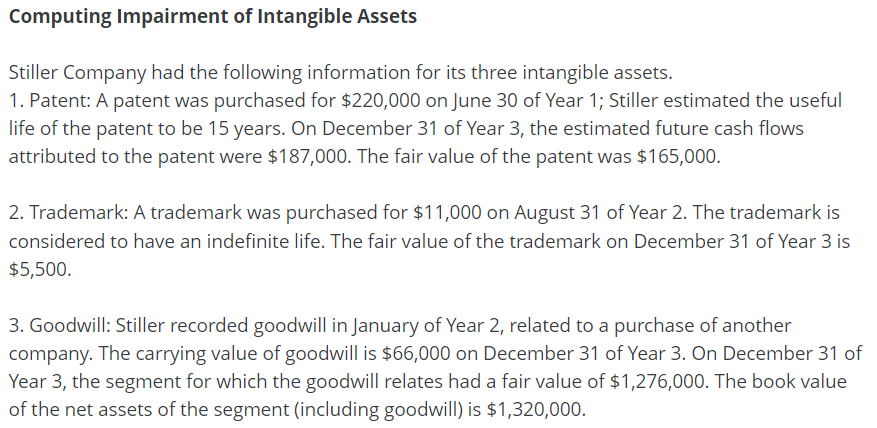

Computing Impairment of Intangible Assets Stiller Company had the following information for its three intangible assets. 1. Patent: A patent was purchased for $220,000 on June 30 of Year 1; Stiller estimated the useful life of the patent to be 15 years. On December 31 of Year 3, the estimated future cash ows attributed to the patent were $187,000. The fair value of the patent was $165,000. 2. Trademark: A trademark was purchased for $11,000 on August 31

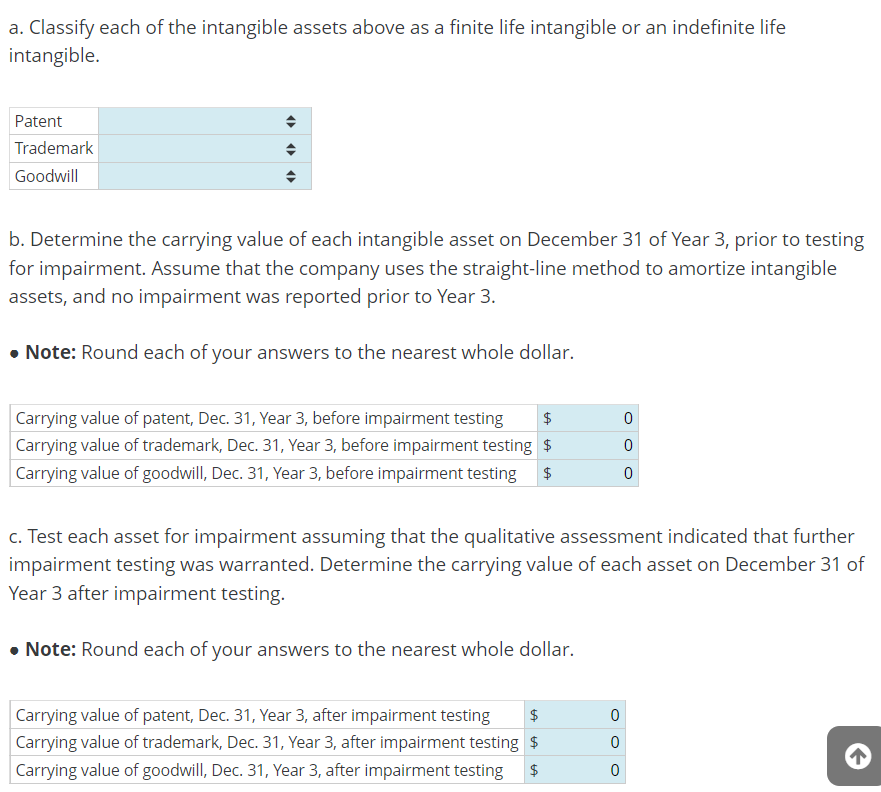

Computing Impairment of Intangible Assets Stiller Company had the following information for its three intangible assets. 1. Patent: A patent was purchased for $220,000 on June 30 of Year 1; Stiller estimated the useful life of the patent to be 15 years. On December 31 of Year 3 , the estimated future cash flows attributed to the patent were $187,000. The fair value of the patent was $165,000. 2. Trademark: A trademark was purchased for $11,000 on August 31 of Year 2. The trademark is considered to have an indefinite life. The fair value of the trademark on December 31 of Year 3 is $5,500. 3. Goodwill: Stiller recorded goodwill in January of Year 2, related to a purchase of another company. The carrying value of goodwill is $66,000 on December 31 of Year 3. On December 31 of Year 3, the segment for which the goodwill relates had a fair value of $1,276,000. The book value of the net assets of the segment (including goodwill) is $1,320,000. a. Classify each of the intangible assets above as a finite life intangible or an indefinite life intangible. b. Determine the carrying value of each intangible asset on December 31 of Year 3, prior to testing for impairment. Assume that the company uses the straight-line method to amortize intangible assets, and no impairment was reported prior to Year 3. - Note: Round each of your answers to the nearest whole dollar. c. Test each asset for impairment assuming that the qualitative assessment indicated that further impairment testing was warranted. Determine the carrying value of each asset on December 31 of Year 3 after impairment testing. - Note: Round each of your answers to the nearest whole dollar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started