Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Computing income taxes) Sales for L. B. Menielle Inc. during the past year amounted to $5.13 million. The firm provides parts and supplies for oil

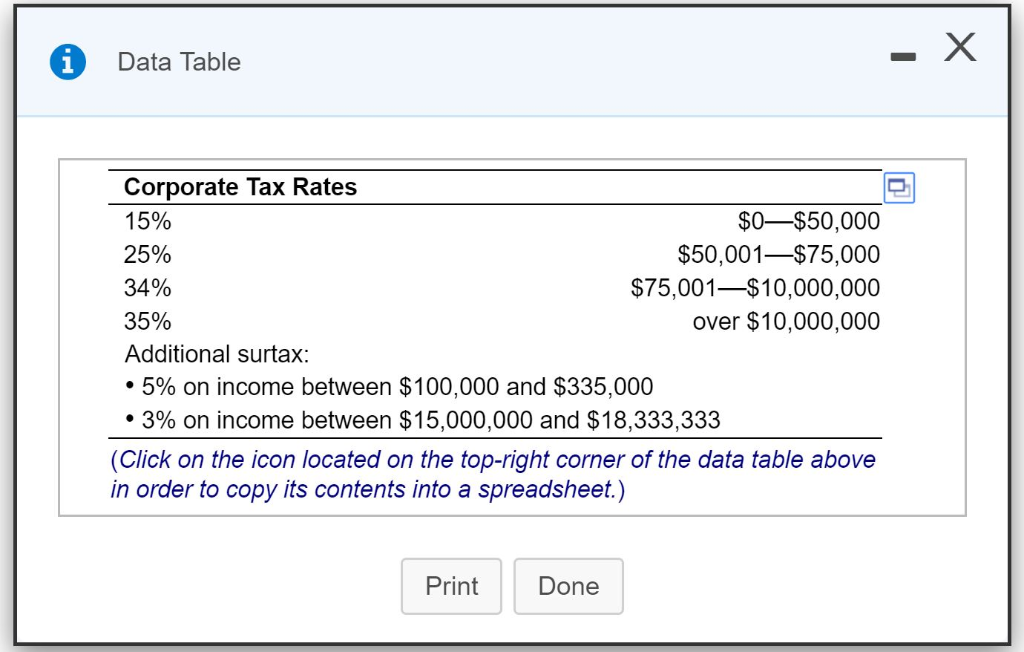

(Computing income taxes) Sales for L. B. Menielle Inc. during the past year amounted to $5.13 million. The firm provides parts and supplies for oil field service companies. Gross profits for the year were $3.16 million. Operating expenses totaled $1.12 million. The interest income from the securities owned was $21,000. The firm's interest expense was $103,000. Calculate the corporations tax liability by using the corporate tax rate structure in the image below.

- X Data Table Corporate Tax Rates $0-$50,000 15% 25% $50,001-$75,000 34% $75,001$10,000,000 over $10,000,000 35% Additional surtax: 5% on income between $100,000 and $335,000 3% on income between $15,000,000 and $18,333,333 corner of the data table above (Click on the icon located on the top-right in order to copy its contents into a spreadsheet.) Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started