Answered step by step

Verified Expert Solution

Question

1 Approved Answer

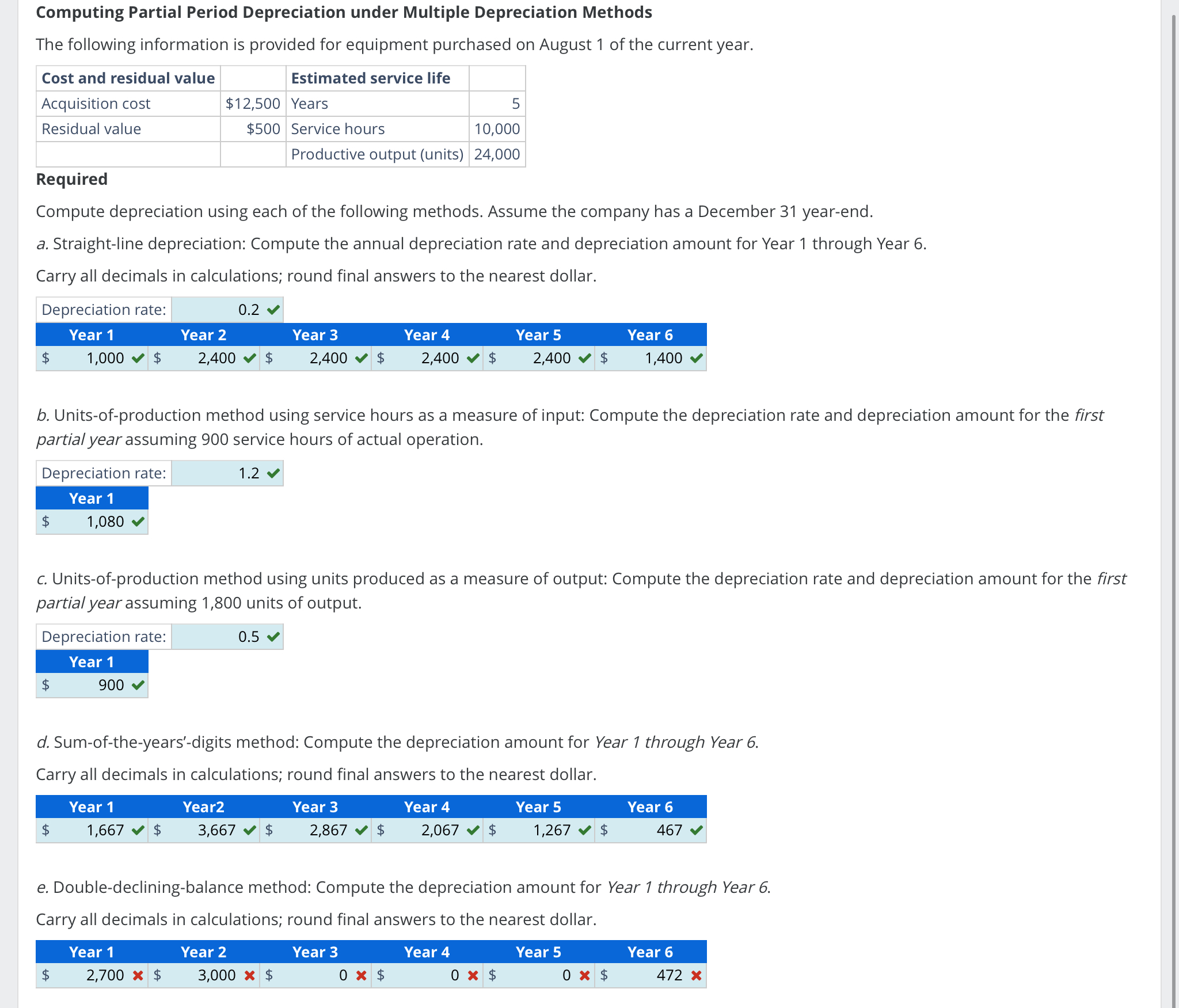

Computing Partial Period Depreciation under Multiple Depreciation Methods The following information is provided for equipment purchased on August 1 of the current year. Required Compute

Computing Partial Period Depreciation under Multiple Depreciation Methods

The following information is provided for equipment purchased on August of the current year.

Required

Compute depreciation using each of the following methods. Assume the company has a December yearend.

a Straightline depreciation: Compute the annual depreciation rate and depreciation amount for Year through Year

Carry all decimals in calculations; round final answers to the nearest dollar.

b Unitsofproduction method using service hours as a measure of input: Compute the depreciation rate and depreciation amount for the first

partial year assuming service hours of actual operation.

Year

$

c Unitsofproduction method using units produced as a measure of output: Compute the depreciation rate and depreciation amount for the first

partial year assuming units of output.

e Doubledecliningbalance method: Compute the depreciation amount for Year through Year

Carry all decimals in calculations; round final answers to the nearest dollar.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started