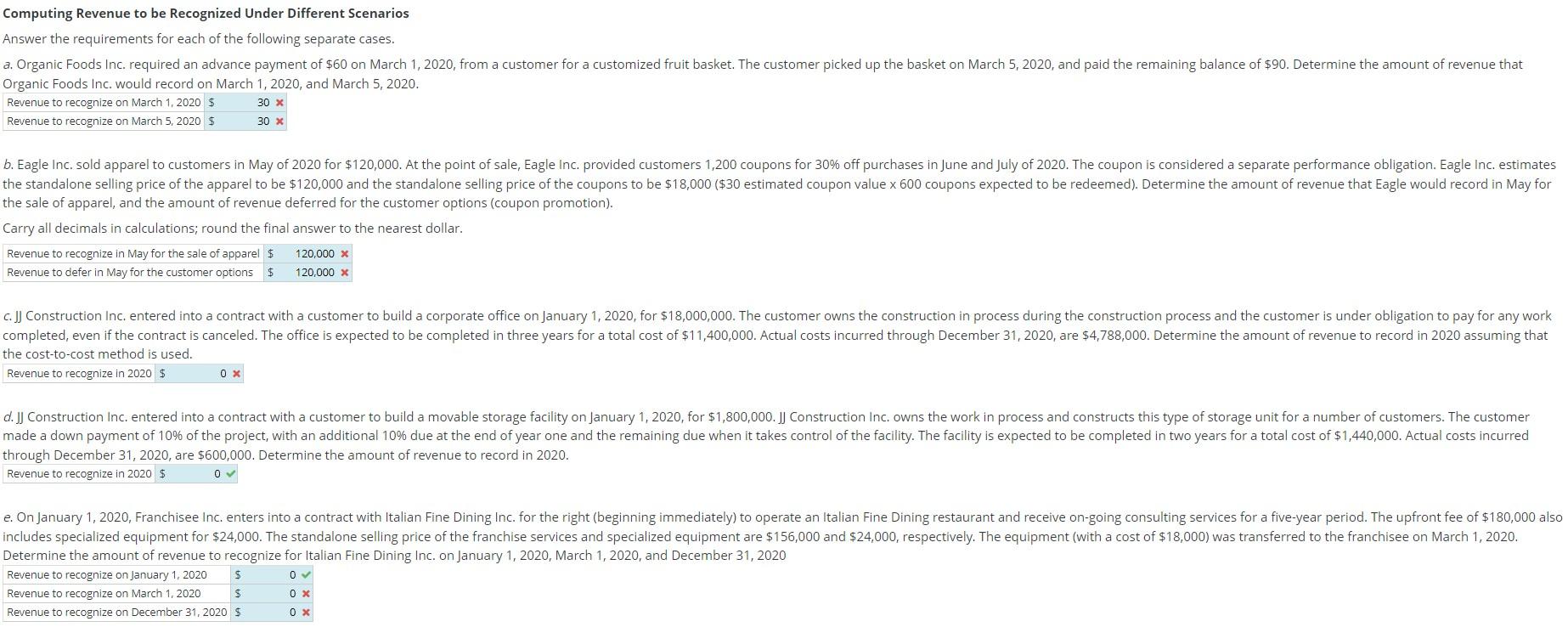

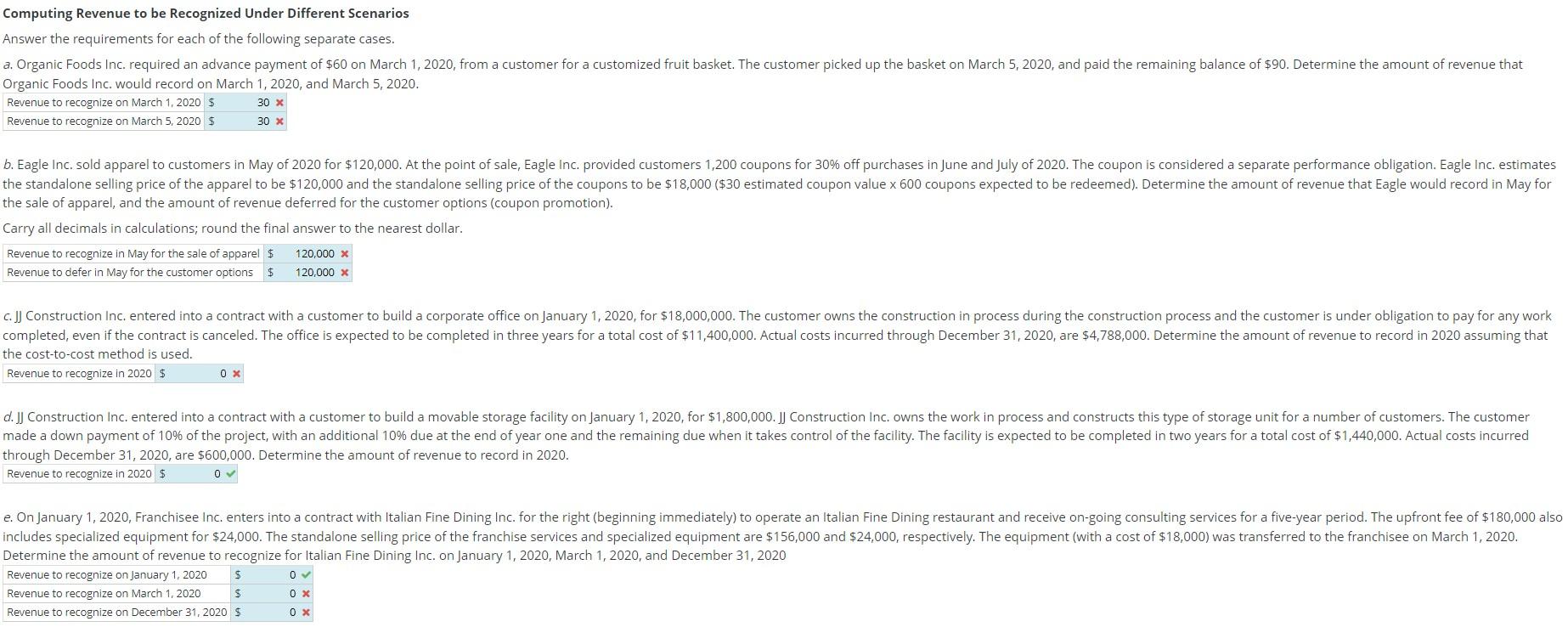

Computing Revenue to be recognized Under Different Scenarios Answer the requirements for each of the following separate cases. a. Organic Foods Inc. required an advance payment of $60 on March 1, 2020, from a customer for a customized fruit basket. The customer picked up the basket on March 5, 2020, and paid the remaining balance of $90. Determine the amount of revenue that Organic Foods Inc. would record on March 1, 2020, and March 5, 2020. Revenue to recognize on March 1, 2020 $ 30 x Revenue to recognize on March 5, 2020 $ 30 X b. Eagle Inc. sold apparel to customers in May of 2020 for $120,000. At the point of sale, Eagle Inc. provided customers 1,200 coupons for 30% off purchases in June and July of 2020. The coupon is considered a separate performance obligation. Eagle Inc. estimates the standalone selling price of the apparel to be $120,000 and the standalone selling price of the coupons to be $18,000 ($30 estimated coupon value x 600 coupons expected to be redeemed). Determine the amount of revenue that Eagle would record in May for the sale of apparel, and the amount of revenue deferred for the customer options (coupon promotion). Carry all decimals in calculations; round the final answer to the nearest dollar. Revenue to recognize in May for the sale of apparel $ 120,000 X Revenue to defer in May for the customer options $ 120,000 X c. ] Construction Inc. entered into a contract with a customer to build a corporate office on January 1, 2020, for $18,000,000. The customer owns the construction in process during the construction process and the customer is under obligation to pay for any work completed, even if the contract is canceled. The office is expected to be completed in three years for a total cost of $11,400,000. Actual costs incurred through December 31, 2020, are $4,788,000. Determine the amount of revenue to record in 2020 assuming that the cost-to-cost method is used. Revenue to recognize in 2020 $ OX d. JJ Construction Inc. entered into a contract with a customer to build a movable storage facility on January 1, 2020, for $1,800,000. JJ Construction Inc. owns the work in process and constructs this type of storage unit for a number of customers. The customer made a down payment of 10% of the project, with an additional 10% due at the end of year one and the remaining due when it takes control of the facility. The facility is expected to be completed in two years for a total cost of $1,440,000. Actual costs incurred through December 31, 2020, are $600,000. Determine the amount of revenue to record in 2020. Revenue to recognize in 2020 $ 0 e. On January 1, 2020, Franchisee Inc. enters into a contract with Italian Fine Dining Inc. for the right (beginning immediately) to operate an Italian Fine Dining restaurant and receive on-going consulting services for a five-year period. The upfront fee of $180,000 also includes specialized equipment for $24,000. The standalone selling price of the franchise services and specialized equipment are $156,000 and $24,000, respectively. The equipment (with a cost of $18,000) was transferred to the franchisee on March 1, 2020. Determine the amount of revenue to recognize for Italian Fine Dining Inc. on January 1, 2020, March 1, 2020, and December 31, 2020 Revenue to recognize on January 1, 2020 $ Revenue to recognize on March 1, 2020 OX Revenue to recognize on December 31, 2020 $ $ OX Computing Revenue to be recognized Under Different Scenarios Answer the requirements for each of the following separate cases. a. Organic Foods Inc. required an advance payment of $60 on March 1, 2020, from a customer for a customized fruit basket. The customer picked up the basket on March 5, 2020, and paid the remaining balance of $90. Determine the amount of revenue that Organic Foods Inc. would record on March 1, 2020, and March 5, 2020. Revenue to recognize on March 1, 2020 $ 30 x Revenue to recognize on March 5, 2020 $ 30 X b. Eagle Inc. sold apparel to customers in May of 2020 for $120,000. At the point of sale, Eagle Inc. provided customers 1,200 coupons for 30% off purchases in June and July of 2020. The coupon is considered a separate performance obligation. Eagle Inc. estimates the standalone selling price of the apparel to be $120,000 and the standalone selling price of the coupons to be $18,000 ($30 estimated coupon value x 600 coupons expected to be redeemed). Determine the amount of revenue that Eagle would record in May for the sale of apparel, and the amount of revenue deferred for the customer options (coupon promotion). Carry all decimals in calculations; round the final answer to the nearest dollar. Revenue to recognize in May for the sale of apparel $ 120,000 X Revenue to defer in May for the customer options $ 120,000 X c. ] Construction Inc. entered into a contract with a customer to build a corporate office on January 1, 2020, for $18,000,000. The customer owns the construction in process during the construction process and the customer is under obligation to pay for any work completed, even if the contract is canceled. The office is expected to be completed in three years for a total cost of $11,400,000. Actual costs incurred through December 31, 2020, are $4,788,000. Determine the amount of revenue to record in 2020 assuming that the cost-to-cost method is used. Revenue to recognize in 2020 $ OX d. JJ Construction Inc. entered into a contract with a customer to build a movable storage facility on January 1, 2020, for $1,800,000. JJ Construction Inc. owns the work in process and constructs this type of storage unit for a number of customers. The customer made a down payment of 10% of the project, with an additional 10% due at the end of year one and the remaining due when it takes control of the facility. The facility is expected to be completed in two years for a total cost of $1,440,000. Actual costs incurred through December 31, 2020, are $600,000. Determine the amount of revenue to record in 2020. Revenue to recognize in 2020 $ 0 e. On January 1, 2020, Franchisee Inc. enters into a contract with Italian Fine Dining Inc. for the right (beginning immediately) to operate an Italian Fine Dining restaurant and receive on-going consulting services for a five-year period. The upfront fee of $180,000 also includes specialized equipment for $24,000. The standalone selling price of the franchise services and specialized equipment are $156,000 and $24,000, respectively. The equipment (with a cost of $18,000) was transferred to the franchisee on March 1, 2020. Determine the amount of revenue to recognize for Italian Fine Dining Inc. on January 1, 2020, March 1, 2020, and December 31, 2020 Revenue to recognize on January 1, 2020 $ Revenue to recognize on March 1, 2020 OX Revenue to recognize on December 31, 2020 $ $ OX