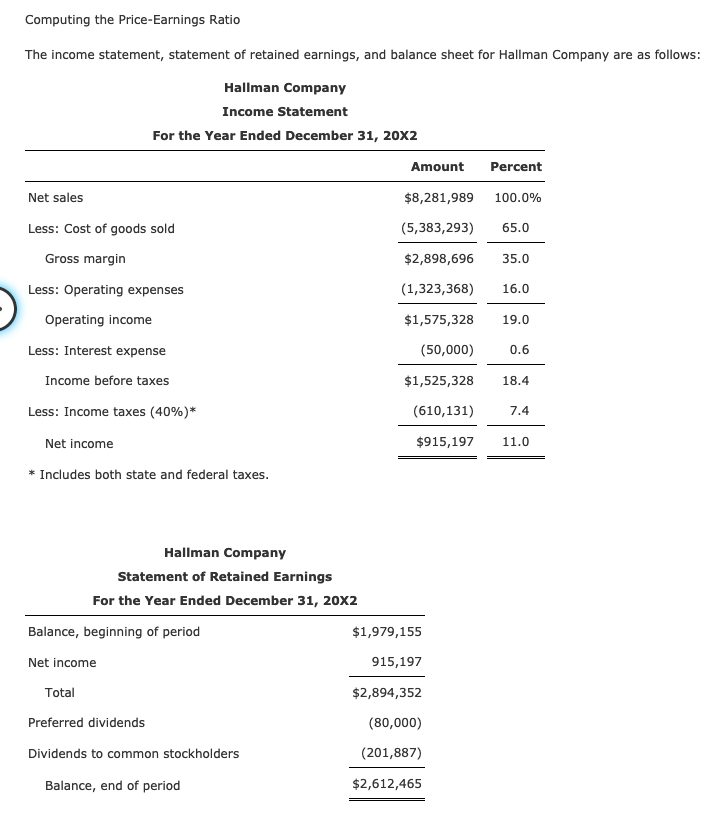

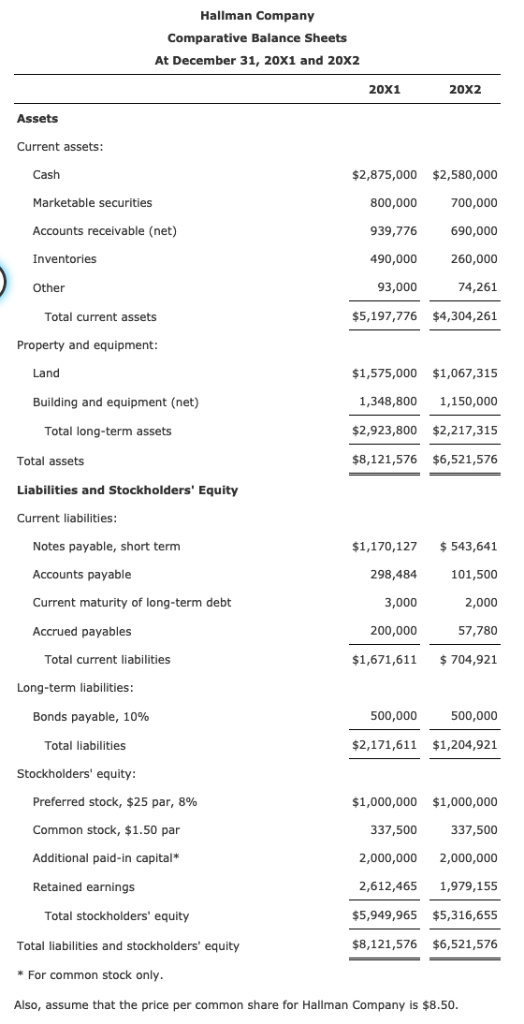

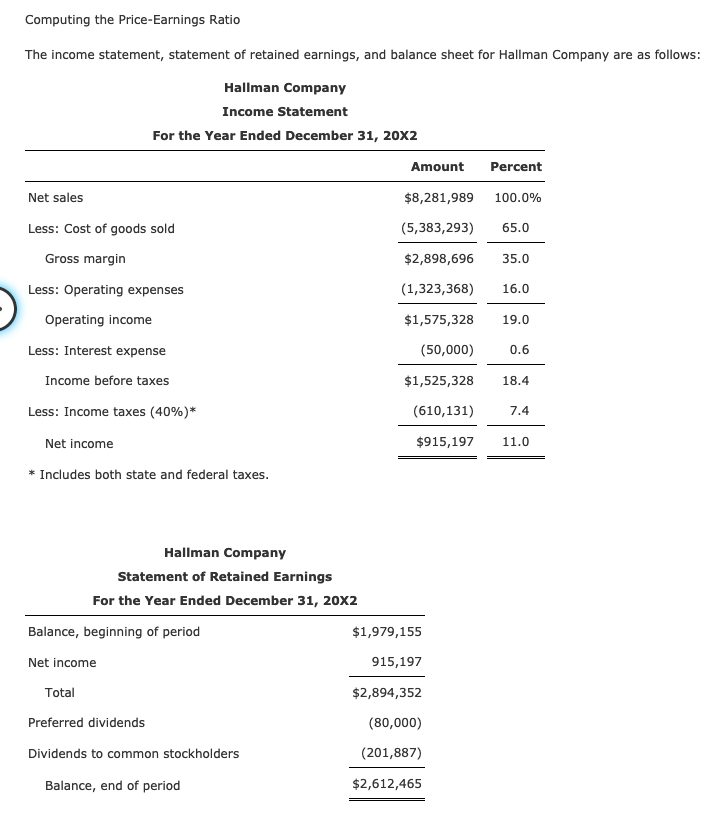

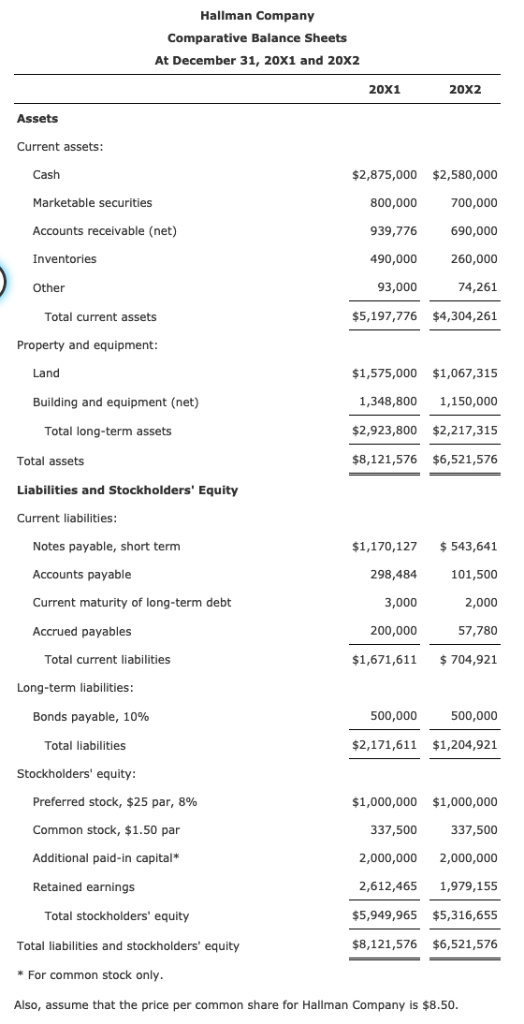

Computing the Price-Earnings Ratio The income statement, statement of retained earnings, and balance sheet for Hallman Company are as follows: Hallman Company Income Statement For the Year Ended December 31, 20X2 Amount Percent Net sales $8,281,989 100.0% (5,383,293) 65.0 $2,898,696 35.0 (1,323,368) 16.0 $1,575,328 19.0 (50,000 0.6 $1,525,328 18.4 (610,131) 7.4 $915,197 11.0 Less: Cost of goods sold Gross margin Less: Operating expenses Operating income Less: Interest expense Income before taxes Less: Income taxes (40%)" Net income * Includes both state and federal taxes Hallman Company Statement of Retained Earnings For the Year Ended December 31, 20X2 Balance, beginning of period $1,979,155 915,197 $2,894,352 (80,000) (201,887) $2,612,465 Net income Total Preferred dividends Dividends to common stockholders Balance, end of period Hallman Company Comparative Balance Sheets At December 31, 20X1 and 20X2 20x1 20X2 Assets Current assets Cash Marketable securities Accounts receivable (net) Inventories Other $2,875,000 $2,580,000 700,000 690,000 260,000 74,261 $5,197,776 $4,304,261 800,000 939,776 490,000 93,000 Total current assets Property and equipment Land $1,575,000 $1,067,315 1,348,800 1,150,000 $2,923,800 $2,217,315 $8,121,576 $6,521,576 Building and equipment (net) Total long-term assets Total assets Liabilities and Stockholders' Equity Current liabilities: Notes payable, short term Accounts payable Current maturity of long-term debt Accrued payables $1,170,127 543,641 101,500 2,000 57,780 $1,671,611 704,921 298,484 3,000 200,000 Total current liabilities Long-term liabilities 500,000 500,000 Bonds payable, 1096 $2,171,611 $1,204,921 Total liabilities Stockholders' equity Preferred stock, $25 par, 8% Common stock, $1.50 par Additional paid-in capital* Retained earnings $1,000,000 $1,000,000 337,500 2,000,000 2,000,000 2,612,465 1,979,155 $5,949,965 $5,316,655 $8,121,576 $6,521,576 337,500 Total stockholders' equity Total liabilities and stockholders' equity For common stock only Also, assume that the price per common share for Hallman Company is $8.50. Required: Compute the price-earnings ratio. Round your interim calculations and final answer to two decimal places