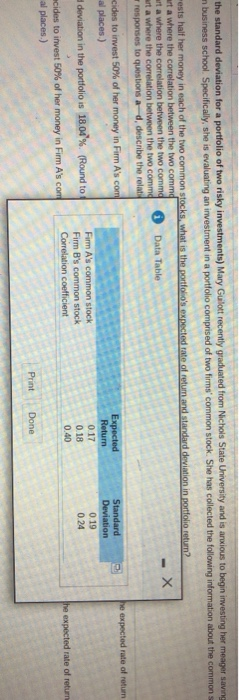

(Computing the standard deviation for a portfolio of two risky investments Mary Gulo recently graded from Nichols State Unversity and is a s to begin investing her meget vigs as a way of ww what she has learned in business School Specifically, she is evaluating an investment in a pontono comprised of two firms common stock. She has collected the flowing information about the common stock of Fm Aandom BBW and standard deviation in portfolio a Mary invests at the money in each of the common stocks, what is the portfolios expected t o b. Answer part a where the correlation between the two common stock investment is to c. Answer part a where the correlation between the two common stock investments is to +1 d. Answer part a where the correlation between the two common stock investments is equal to-1 e. Using your responses to questions a d, describe the relationship between the correlation and the risk of the portfolio a Mary decides to invest 10 wo decimal places) of her money in Fim As common stock and 50% in common stock and the comiation between the stocks is 0.40, then the expected rate of return in the portis 175% Round The standard deviation in the port is 1804% Hound to two decimal places) b. If Mary decides to invest 50% of the money in Form As common stock and son in Form to two decimal places.) 's common stock and the correlation between the two stocks , then the expected to return in the portfolos 123% Round the standard deviation for a portfolio of two risky investments) Mary Gulott recently graduated from Nichols State University and is anxious to begin investing her meager saving n business school. Specifically, she is evaluating an investment in a portfolio comprised of two firms' common stock. She has collected the following information about the commons folio return? ests half her money in each of the two common stocks, what is the portfolios expected rate of retum and standard deviation in art a where the correlation between the two comma art a where the correlation between the two commg Data Table art a where the correlation between the two comma responses to questions a d , describe the relati he expected rate of return cides to invest 50% of her money in Firm A's com al places) Expected Return Standard Deviation 017 0 19 deviation in the portfolio is 18.04% (Round to Firm A's common stock Firm B's common stock Correlation coefficient 0.24 0.18 0.40 he expected rate of return acides to invest 50% of her money in Firm A's con al places.) Print Done