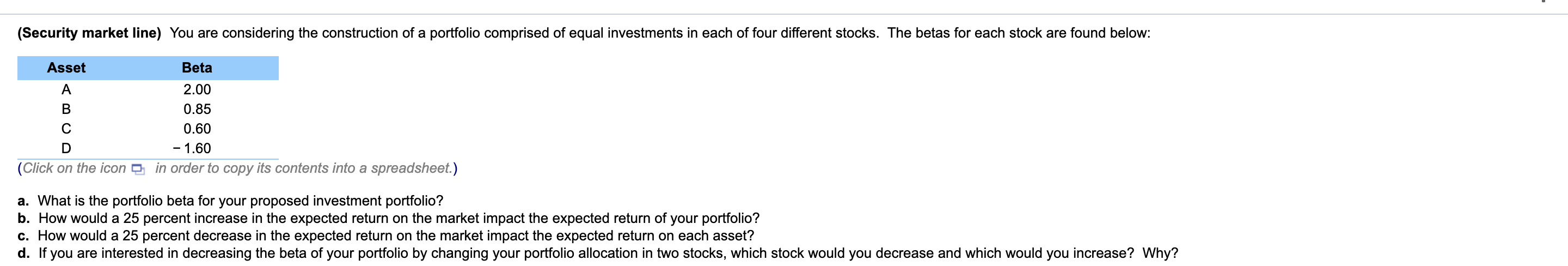

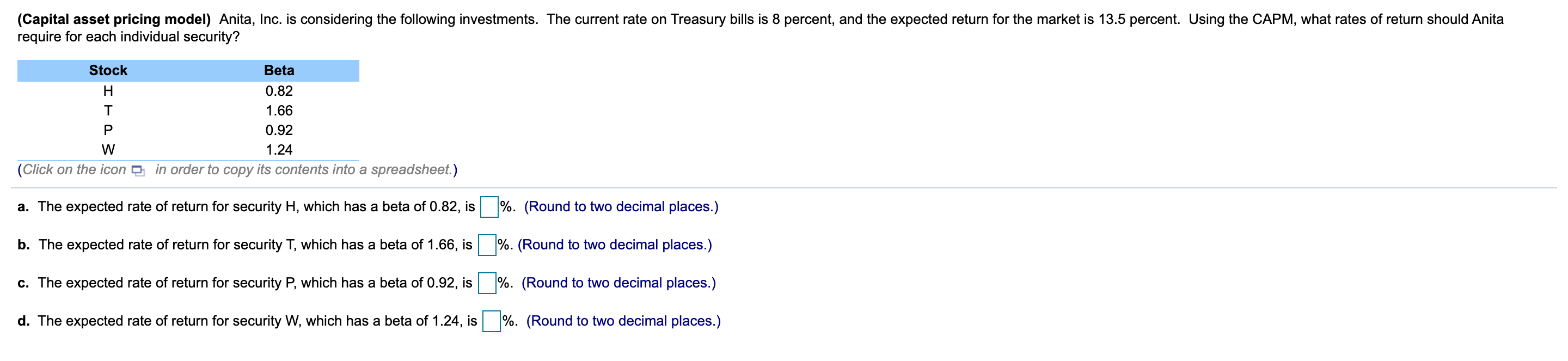

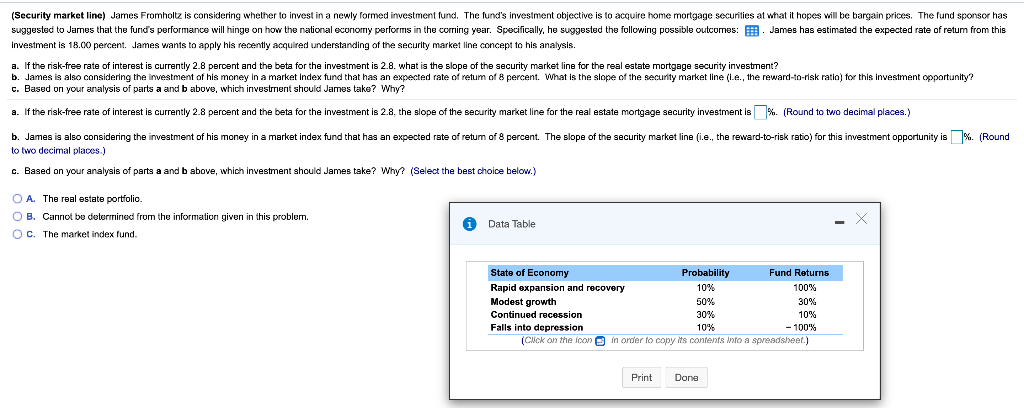

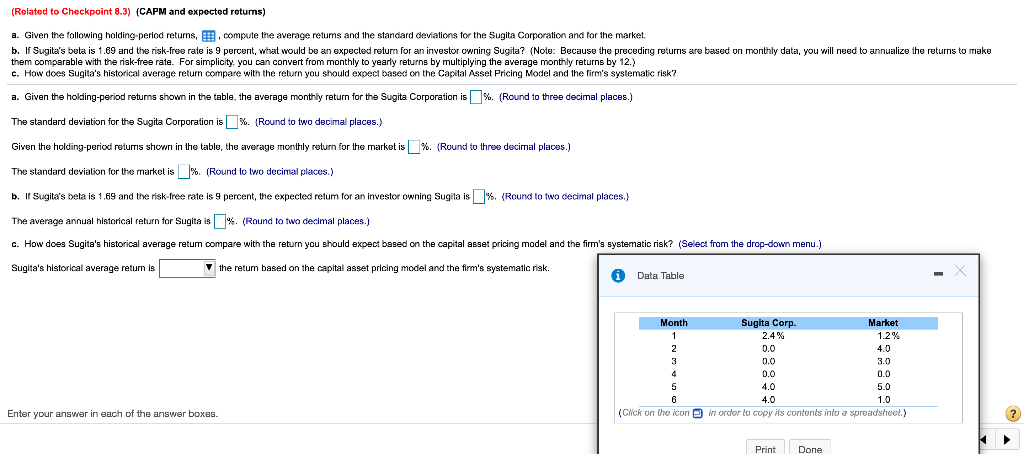

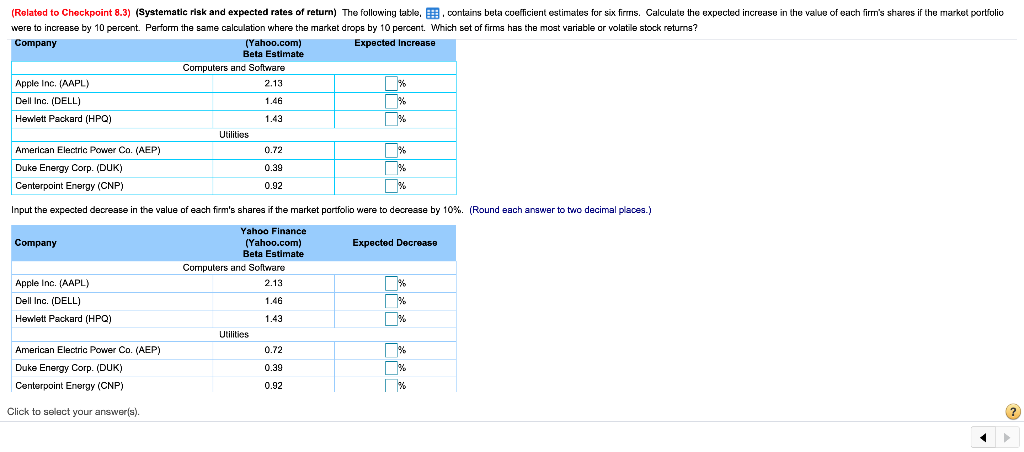

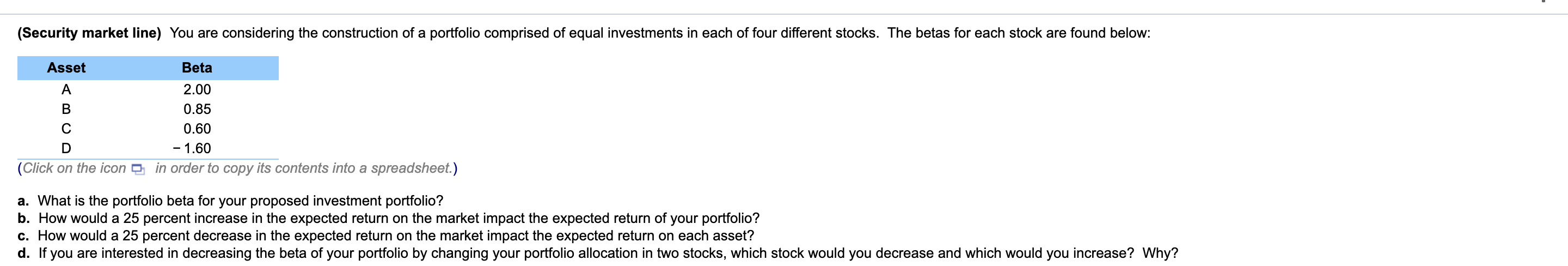

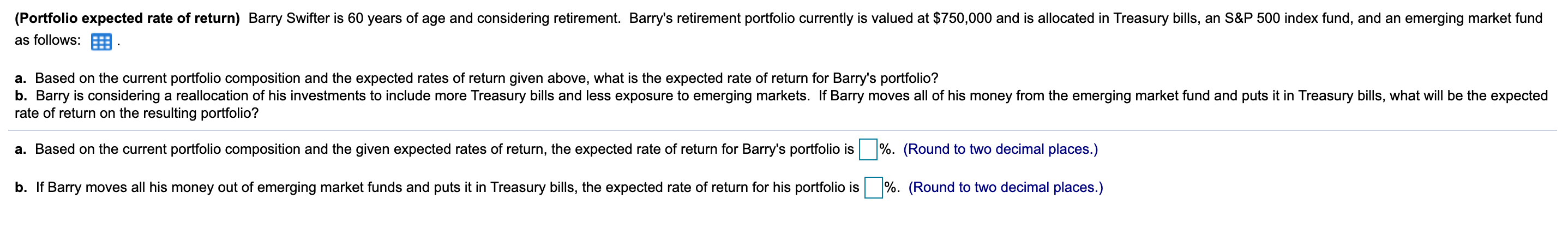

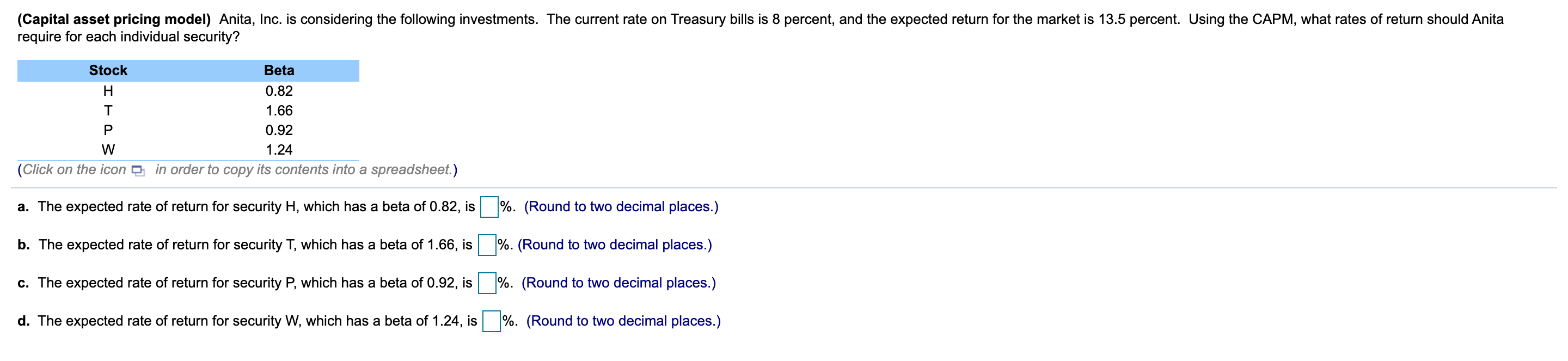

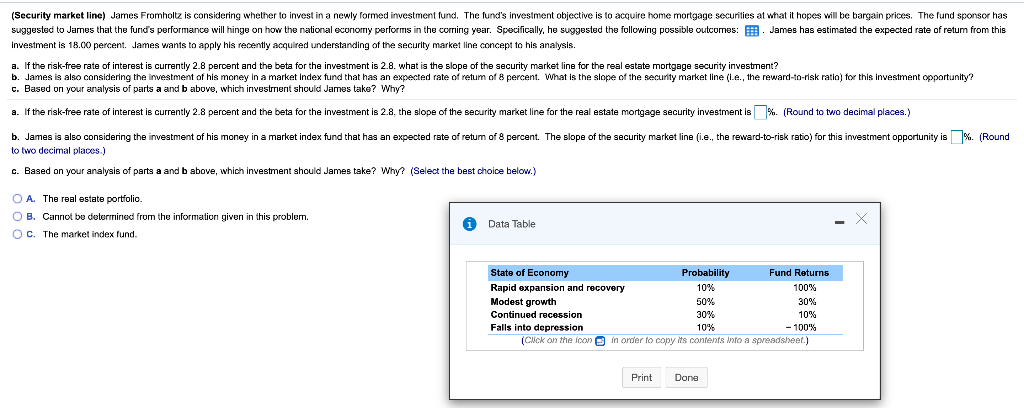

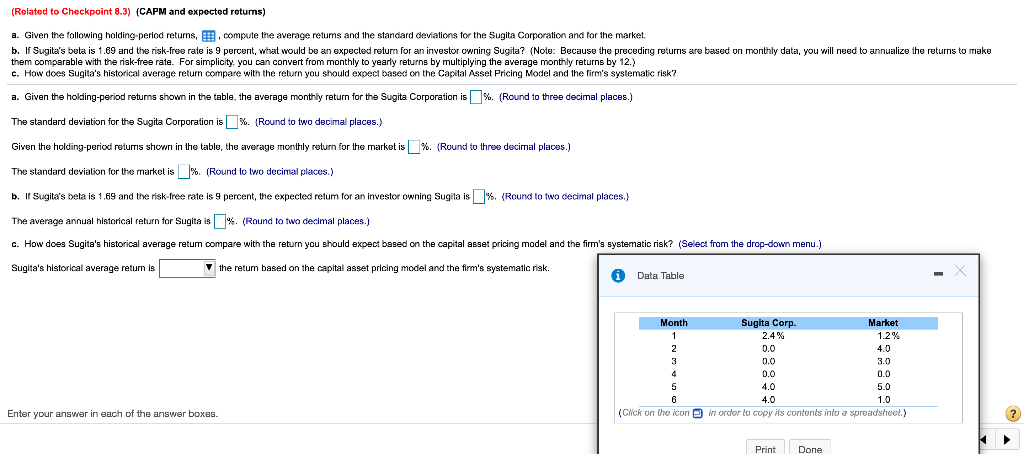

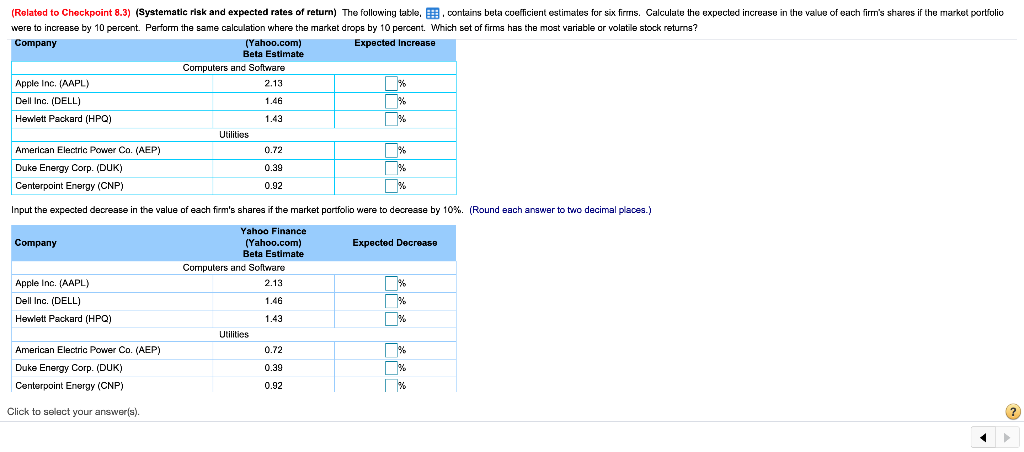

(Computing the standard deviation for a portfolio of two risky investments) Mary Guilott recently graduated from college and is evaluating an investment in two companies' common stock. She has collected the following information about the common stock of Firm A and Firm B: B a. If Mary decides to invest 10 percent of her money in Firm A's common stock and 90 percent in Firm B's common stock, what is the expected rate of return and the standard deviation of the portfolio return? b. If Mary decides to invest 90 percent of her money in Firm A's common stock and 10 percent in Firm B's common stock, what is the expected rate of return and the standard deviation of the portfolio return? c. Recompute your responses to both questions a and b, where the correlation between the two firms' stock returns is - 0.30. d. Summarize what your analysis tells you about portfolio risk when combining risky assets in a portfolio. (Security market line) You are considering the construction of a portfolio comprised of equal investments in each of four different stocks. The betas for each stock are found below: Asset Beta 2.00 B 0.85 0.60 D - 1.60 (Click on the icon in order to copy its contents into a spreadsheet.) a. What is the portfolio beta for your proposed investment portfolio? b. How would a 25 percent increase in the expected return on the market impact the expected return of your portfolio? c. How would a 25 percent decrease in the expected return on the market impact the expected return on each asset? d. If you are interested in decreasing the beta of your portfolio by changing your portfolio allocation in two stocks, which stock would you decrease and which would you increase? Why? (Portfolio expected rate of return) Barry Swifter is 60 years of age and considering retirement. Barry's retirement portfolio currently is valued at $750,000 and is allocated in Treasury bills, an S&P 500 index fund, and an emerging market fund as follows: a. Based on the current portfolio composition and the expected rates of return given above, what is the expected rate of return for Barry's portfolio? b. Barry is considering a reallocation of his investments to include more Treasury bills and less exposure to emerging markets. If Barry moves all of his money from the emerging market fund and puts it in Treasury bills, what will be the expected rate of return on the resulting portfolio? a. Based on the current portfolio composition and the given expected rates of return, the expected rate of return for Barry's portfolio is %. (Round to two decimal places.) b. If Barry moves all his money out of emerging market funds and puts it in Treasury bills, the expected rate of return for his portfolio is %. (Round to two decimal places.) (Capital asset pricing model) Anita, Inc. is considering the following investments. The current rate on Treasury bills is 8 percent, and the expected return for the market is 13.5 percent. Using the CAPM, what rates of return should Anita require for each individual security? Stock Beta H 0.82 T 1.66 P 0.92 W 1.24 (Click on the icon in order to copy its contents into a spreadsheet.) a. The expected rate of return for security H, which has a beta of 0.82, is %. (Round to two decimal places.) b. The expected rate of return for security T, which has a beta of 1.66, is %. (Round to two decimal places.) C. The expected rate of return for security P, which has a beta of 0.92, is %. (Round to two decimal places.) d. The expected rate of return for security W, which has a beta of 1.24, is %. (Round to two decimal places.) (Security market line) James Fromholtz is considering whether to invest in a newly formed investment fund. The fund's investment objective is to acquire home mortgage securities at what it hopes will be bargain prices. The fund sponsor has suggested to James that the fund's performance will hinge on how the national economy performs in the coming year. Specifically, he suggested the following possible outcomes: James has estimated the expected rate of retum from this investment is 18.00 percent. James wants to apply his recently acquired understanding of the security market line concept to his analysis. a. If the risk-free rate of interest is currently 2.8 percent and the beta for the investment is 2.8. what is the slope of the security market line for the real estate mortgage security investment? b. James is also considering the investment of his money in a market index fund that has an expected rate of return of 8 percent. What is the slope of the security market line (l.e., the reward-to-risk ratio) for this investment opportunity? 6. Based on your analysis of parts a and b above, which investment should James take? Why? a. If the risk-free rate of interest is currently 2.8 percent and the beta for the investment is 2.8. the slope of the security market line for the real estate mortgage security investment is %. (Round to two decimal places.) b. James is also considering the investment of his money in a market index fund that has an expected rate of return of 8 percent. The slope of the security market line (i.e., the reward-to-risk ratio) for this investment opportunity is % (Round to two decimal places.) c. Based on your analysis of parts a and b above, which investment should James take? Why? (Select the best choice below.) O A. The real estate portfolio. OB. Cannot be determined from the information given in this problem. O C. The market index Tund. Data Table State of Economy Probability Fund Returns Rapid expansion and recovery 10% 100% Modest growth 50% 30% Continued recession 30% 10% Falls into depression 10% 100% (Click on the icon in order to copy its contents into a spreadsheet.) Print Done (Related to Checkpoint 8.3) (CAPM and expected returns) a. Given the following holding-period returns, E.compute the average retums and the standard deviations for the Sugita Corporation and for the market. b. If Sugita's beta is 1.69 and the risk-free rate is 9 percent, what would be an expected return for an investor owning Sugita? (Note: Because the preceding returns are based on monthly data, you will need to annualize the returns to make them comparable with the risk-free rate. For simplicity, you can convert from monthly to yearly returns by multiplying the average monthly returns by 12.) c. How does Sugita's historical average return compare with the return you should expect based on the Capital Asset Pricing Model and the firm's systematic risk? a. Given the holding-period returns shown in the table, the average monthly return for the Sugita Corporation is %. (Round to three decimal places.) The standard deviation for the Sugita Corporation is %. (Round to two decimal places.) Given the holding-period returns shown in the table, the average monthly return for the market is %. {Round to three decimal places.) The standard deviation for the market is % (Round to two decimal places.) b. Ir Sugita's beta is 1,69 and the risk-free rate is 9 percent, the expected retum for an investor owning Sugita is %. (Round to two decimal places.) The average annual historical return for Sugita is%. (Round to two decimal places.) c. How does Sugita's historical average return compare with the return you should expect based on the capital asset pricing model and the firm's systematic risk? (Select from the drop-down menu.) Sugita's historical average retum is the return based on the capital asset pricing model and the firm's systematic risk. Data Table Month Sugita Corp Market 1 2.4% 1.2% 2 0.0 4.0 3 0.0 3.0 4 0.0 0.0 5 4.0 5.0 6 4.0 1.0 (Click on the icon in order to copy its contents into a spreadsheet.) Enter your answer in each of the answer boxes. ? Print Done (Related to Checkpoint 8.3) (Systematic risk and expected rates of return) The following table. . contains beta coefficient estimates for six firmris. Calculate the expected increase in the value of each firm's shares if the market portfolio were to increase by 10 percent. Perform the same calculation where the market drops by 10 percent. Which set of firms has the most variable or volatile stock returns? Company (Yahoo.com) Expected Increase Beta Estimate Computers and Software Apple Inc. (AAPL) 2.13 % Dell Inc. (DELL) 1.46 % Hewlett Packard (HPO) 1.43 % Utilities American Electric Power Co. (AEP) 0.72 % Duke Energy Corp. (DUK) 0.39 Centerpoint Energy (CNP) 0.92 % Input the expected decrease in the value of each firm's shares if the market portfolio were to decrease by 10%. (Round each answer to two decimal places.) Yahoo Finance Company (Yahoo.com) Expected Decrease Beta Estimate Computers and Software Apple Inc. (AAPL) 2.13 % Dell Inc. (DELL) 1.46 % Hewlett Packard (HPQ) 1.43 Utilities American Electric Power Co. (AEP) 0.72 Duke Energy Corp. (DUK) 0.39 % Centerpoint Energy (CNP) 0.92 Click to select your answer(s). ? (Computing the standard deviation for a portfolio of two risky investments) Mary Guilott recently graduated from college and is evaluating an investment in two companies' common stock. She has collected the following information about the common stock of Firm A and Firm B: B a. If Mary decides to invest 10 percent of her money in Firm A's common stock and 90 percent in Firm B's common stock, what is the expected rate of return and the standard deviation of the portfolio return? b. If Mary decides to invest 90 percent of her money in Firm A's common stock and 10 percent in Firm B's common stock, what is the expected rate of return and the standard deviation of the portfolio return? c. Recompute your responses to both questions a and b, where the correlation between the two firms' stock returns is - 0.30. d. Summarize what your analysis tells you about portfolio risk when combining risky assets in a portfolio. (Security market line) You are considering the construction of a portfolio comprised of equal investments in each of four different stocks. The betas for each stock are found below: Asset Beta 2.00 B 0.85 0.60 D - 1.60 (Click on the icon in order to copy its contents into a spreadsheet.) a. What is the portfolio beta for your proposed investment portfolio? b. How would a 25 percent increase in the expected return on the market impact the expected return of your portfolio? c. How would a 25 percent decrease in the expected return on the market impact the expected return on each asset? d. If you are interested in decreasing the beta of your portfolio by changing your portfolio allocation in two stocks, which stock would you decrease and which would you increase? Why? (Portfolio expected rate of return) Barry Swifter is 60 years of age and considering retirement. Barry's retirement portfolio currently is valued at $750,000 and is allocated in Treasury bills, an S&P 500 index fund, and an emerging market fund as follows: a. Based on the current portfolio composition and the expected rates of return given above, what is the expected rate of return for Barry's portfolio? b. Barry is considering a reallocation of his investments to include more Treasury bills and less exposure to emerging markets. If Barry moves all of his money from the emerging market fund and puts it in Treasury bills, what will be the expected rate of return on the resulting portfolio? a. Based on the current portfolio composition and the given expected rates of return, the expected rate of return for Barry's portfolio is %. (Round to two decimal places.) b. If Barry moves all his money out of emerging market funds and puts it in Treasury bills, the expected rate of return for his portfolio is %. (Round to two decimal places.) (Capital asset pricing model) Anita, Inc. is considering the following investments. The current rate on Treasury bills is 8 percent, and the expected return for the market is 13.5 percent. Using the CAPM, what rates of return should Anita require for each individual security? Stock Beta H 0.82 T 1.66 P 0.92 W 1.24 (Click on the icon in order to copy its contents into a spreadsheet.) a. The expected rate of return for security H, which has a beta of 0.82, is %. (Round to two decimal places.) b. The expected rate of return for security T, which has a beta of 1.66, is %. (Round to two decimal places.) C. The expected rate of return for security P, which has a beta of 0.92, is %. (Round to two decimal places.) d. The expected rate of return for security W, which has a beta of 1.24, is %. (Round to two decimal places.) (Security market line) James Fromholtz is considering whether to invest in a newly formed investment fund. The fund's investment objective is to acquire home mortgage securities at what it hopes will be bargain prices. The fund sponsor has suggested to James that the fund's performance will hinge on how the national economy performs in the coming year. Specifically, he suggested the following possible outcomes: James has estimated the expected rate of retum from this investment is 18.00 percent. James wants to apply his recently acquired understanding of the security market line concept to his analysis. a. If the risk-free rate of interest is currently 2.8 percent and the beta for the investment is 2.8. what is the slope of the security market line for the real estate mortgage security investment? b. James is also considering the investment of his money in a market index fund that has an expected rate of return of 8 percent. What is the slope of the security market line (l.e., the reward-to-risk ratio) for this investment opportunity? 6. Based on your analysis of parts a and b above, which investment should James take? Why? a. If the risk-free rate of interest is currently 2.8 percent and the beta for the investment is 2.8. the slope of the security market line for the real estate mortgage security investment is %. (Round to two decimal places.) b. James is also considering the investment of his money in a market index fund that has an expected rate of return of 8 percent. The slope of the security market line (i.e., the reward-to-risk ratio) for this investment opportunity is % (Round to two decimal places.) c. Based on your analysis of parts a and b above, which investment should James take? Why? (Select the best choice below.) O A. The real estate portfolio. OB. Cannot be determined from the information given in this problem. O C. The market index Tund. Data Table State of Economy Probability Fund Returns Rapid expansion and recovery 10% 100% Modest growth 50% 30% Continued recession 30% 10% Falls into depression 10% 100% (Click on the icon in order to copy its contents into a spreadsheet.) Print Done (Related to Checkpoint 8.3) (CAPM and expected returns) a. Given the following holding-period returns, E.compute the average retums and the standard deviations for the Sugita Corporation and for the market. b. If Sugita's beta is 1.69 and the risk-free rate is 9 percent, what would be an expected return for an investor owning Sugita? (Note: Because the preceding returns are based on monthly data, you will need to annualize the returns to make them comparable with the risk-free rate. For simplicity, you can convert from monthly to yearly returns by multiplying the average monthly returns by 12.) c. How does Sugita's historical average return compare with the return you should expect based on the Capital Asset Pricing Model and the firm's systematic risk? a. Given the holding-period returns shown in the table, the average monthly return for the Sugita Corporation is %. (Round to three decimal places.) The standard deviation for the Sugita Corporation is %. (Round to two decimal places.) Given the holding-period returns shown in the table, the average monthly return for the market is %. {Round to three decimal places.) The standard deviation for the market is % (Round to two decimal places.) b. Ir Sugita's beta is 1,69 and the risk-free rate is 9 percent, the expected retum for an investor owning Sugita is %. (Round to two decimal places.) The average annual historical return for Sugita is%. (Round to two decimal places.) c. How does Sugita's historical average return compare with the return you should expect based on the capital asset pricing model and the firm's systematic risk? (Select from the drop-down menu.) Sugita's historical average retum is the return based on the capital asset pricing model and the firm's systematic risk. Data Table Month Sugita Corp Market 1 2.4% 1.2% 2 0.0 4.0 3 0.0 3.0 4 0.0 0.0 5 4.0 5.0 6 4.0 1.0 (Click on the icon in order to copy its contents into a spreadsheet.) Enter your answer in each of the answer boxes. ? Print Done (Related to Checkpoint 8.3) (Systematic risk and expected rates of return) The following table. . contains beta coefficient estimates for six firmris. Calculate the expected increase in the value of each firm's shares if the market portfolio were to increase by 10 percent. Perform the same calculation where the market drops by 10 percent. Which set of firms has the most variable or volatile stock returns? Company (Yahoo.com) Expected Increase Beta Estimate Computers and Software Apple Inc. (AAPL) 2.13 % Dell Inc. (DELL) 1.46 % Hewlett Packard (HPO) 1.43 % Utilities American Electric Power Co. (AEP) 0.72 % Duke Energy Corp. (DUK) 0.39 Centerpoint Energy (CNP) 0.92 % Input the expected decrease in the value of each firm's shares if the market portfolio were to decrease by 10%. (Round each answer to two decimal places.) Yahoo Finance Company (Yahoo.com) Expected Decrease Beta Estimate Computers and Software Apple Inc. (AAPL) 2.13 % Dell Inc. (DELL) 1.46 % Hewlett Packard (HPQ) 1.43 Utilities American Electric Power Co. (AEP) 0.72 Duke Energy Corp. (DUK) 0.39 % Centerpoint Energy (CNP) 0.92 Click to select your answer(s)