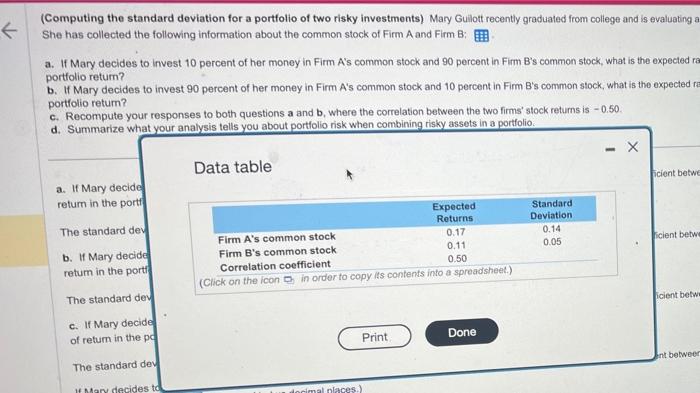

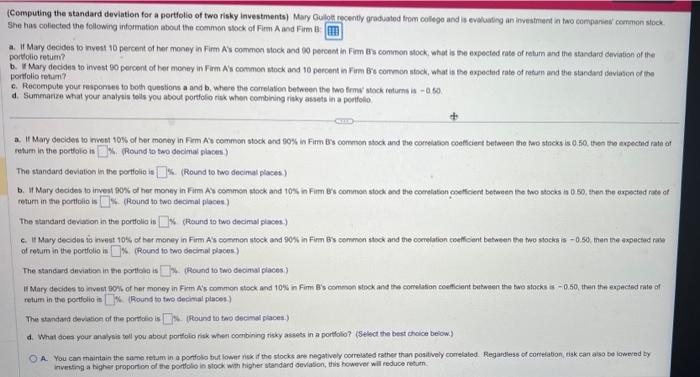

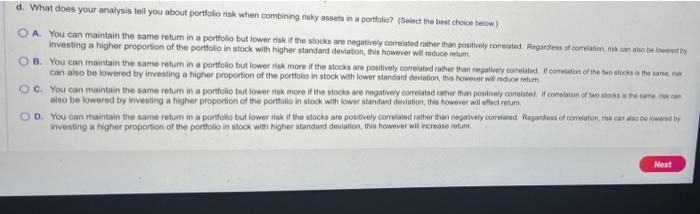

(Computing the standard deviation for a portfolio of two risky investments) Mary Gullott recently graduated from college and is evaluating She has collected the following information about the common stock of Firm A and Firm B: a. If Mary decides to invest 10 percent of her money in Firm A's common stock and 90 percent in Firm B's common stock, what is the expected ra portfolio retum? b. If Mary decides to invest 90 percent of her money in Firm A's common stock and 10 percent in Firm B's common stock, what is the expected r portiolio retum? c. Recompute your responses to both questions a and b, where the correlation between the two firms' stock returns is -0.50 . d. Summarize what your analysis tells you about portfolio risk when combining risky assets in a portfolio: Data table a. If Mary decide return in the portf The standard dev b. If Mary decide retum in the portf The standard dev (Cemputing the standard deviation for a portfolio of two risky investments) Mary Gullot recenty graduatod lrom collego and is evaluatiog an investmeent in tao conpanies conmen stock She has coliected the following information about the coenmon stock of Firm A and Firm B : a. If Mary decides to nyest 10 percent of her money in Firm As common slock and 90 perceot in Firm Bss conmon stocki what is the expected mate of return and the atandard deviation of the porthic retuen? b. If Mary deedes to invest 90 porcent of her money in Firm. As common stock and 10 percent in Firm Brs comnon stock, what is the oxpectind rate of retum and the standard seiviaten of the portiolio rehum? 6. Recompote your response to both questions a and b, where the correlation between the hao frmy stock returns is - a to d. Summarize what your analysis teds you about portfolio risk whon combining risky assets in a porfolfo setum in the pertolo is G. (Round to two docimal placest) The standard deviation in the portolic is 6. (Round to hwo decimal places.) mtum in the portiolia is 4 (Round to two decimal places.) The standard devason in the portolia is 4 (tround is two decimal places.) c. If Mary deodes 10 mvest 10% of ber money in Firm As common stock and 90% in Firm Bs commen stock and the conelation coettioent between the tho socks is - 0.50 , than be axpectad rate of renuin in the portfolio is 6 (RRound to two decimal places.) The standard diviation in the portlolia is (4. (Round to two decimul places) retum in the poettolio is 6 (Round to two decinal places) d. What does your anayysis twil you abous portfolo risk when conbining tisky assess in a portholio? (Setect the best doice beiow.) inverting a hegher proportion of the pottolio is siodk wh higher standard gevaton, tiss howerer will reduce return. d. What does your analysis toll you about portfolio risk when combining risky assets in a portfolio? (Seidct the beat cheice beiow.) investing a higher proportion of the pertlolo in stock with higher standard deviaton, this bowever will recuce netum. can alse be lowered by investing a higher proportion of the portiolio in stock with lewest stancand deviation, the however whe podias retum. also be lowered by investing a higher proportion of the portiolio in slock wilh lower standand deviation, the honever wil eAloct retum. investine a higher proportion of the pertolie in stock wits higher standard deviation, this hovever wil increate hatim