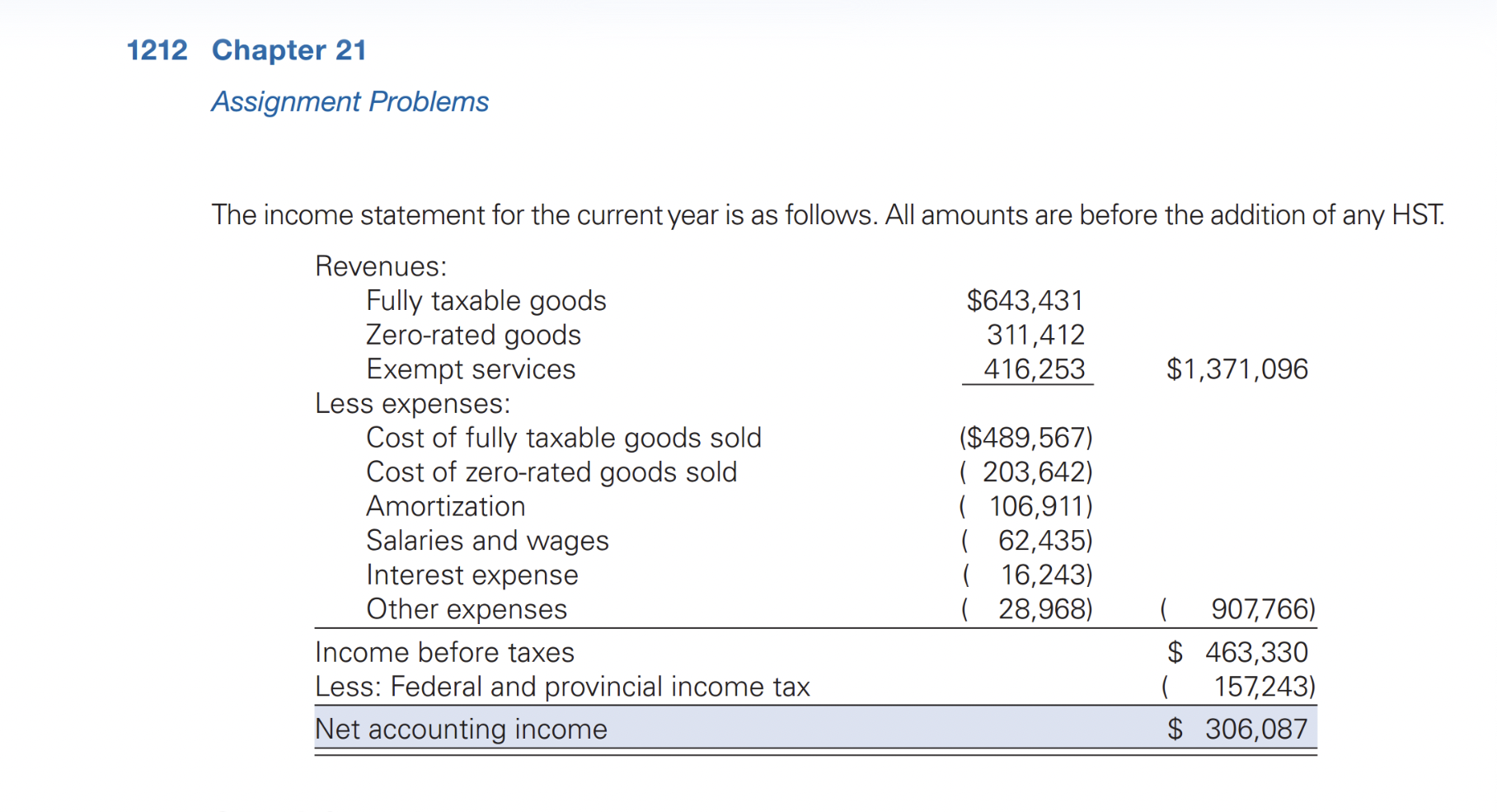

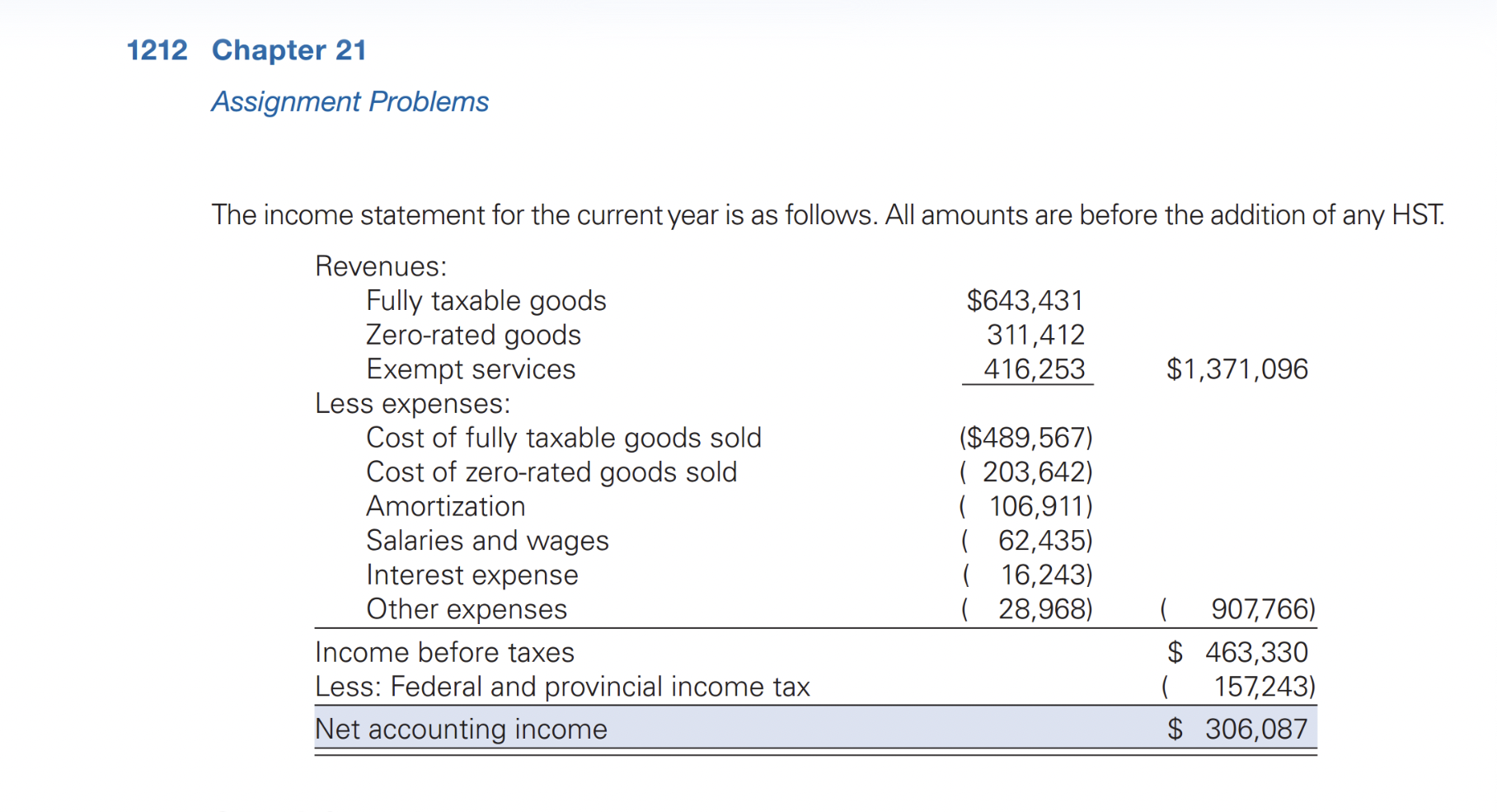

Conan Doyle carries on a business as a sole proprietor. The business is located in New-foundland and goes by the name Conans Comics. All of the business is carried on solely in Newfoundland. The business is an HST registrant that sells both fully taxable and zero-rated goods. In addition, Conans Comics provides exempt services. The business is an annual fler for HST purposes.

Other Information: 1. Purchases of fully taxable goods amounted to $489,567 and purchases of zero-rated goods were $203,642. 2. Capital expenditures for this period amounted to $1,950,000, with HST being paid on all amounts. Of this total, $1,260,000 was for a building that will be used 35% for the provision of fully taxable supplies, 25% for zero-rated supplies, and 40% for exempt supplies. The remain-ing $690,000 was for equipment that will be used 38% in the provision of fully taxable sup-plies, 27% for zero-rated supplies, and 35% for exempt supplies. 3. Of the other expenses, 62% were related to the provision of fully taxable supplies, 24% for zero-rated supplies, and 14% for exempt supplies. 4. Of the salaries and wages, 65% were attributable to employees involved in providing exempt supplies.

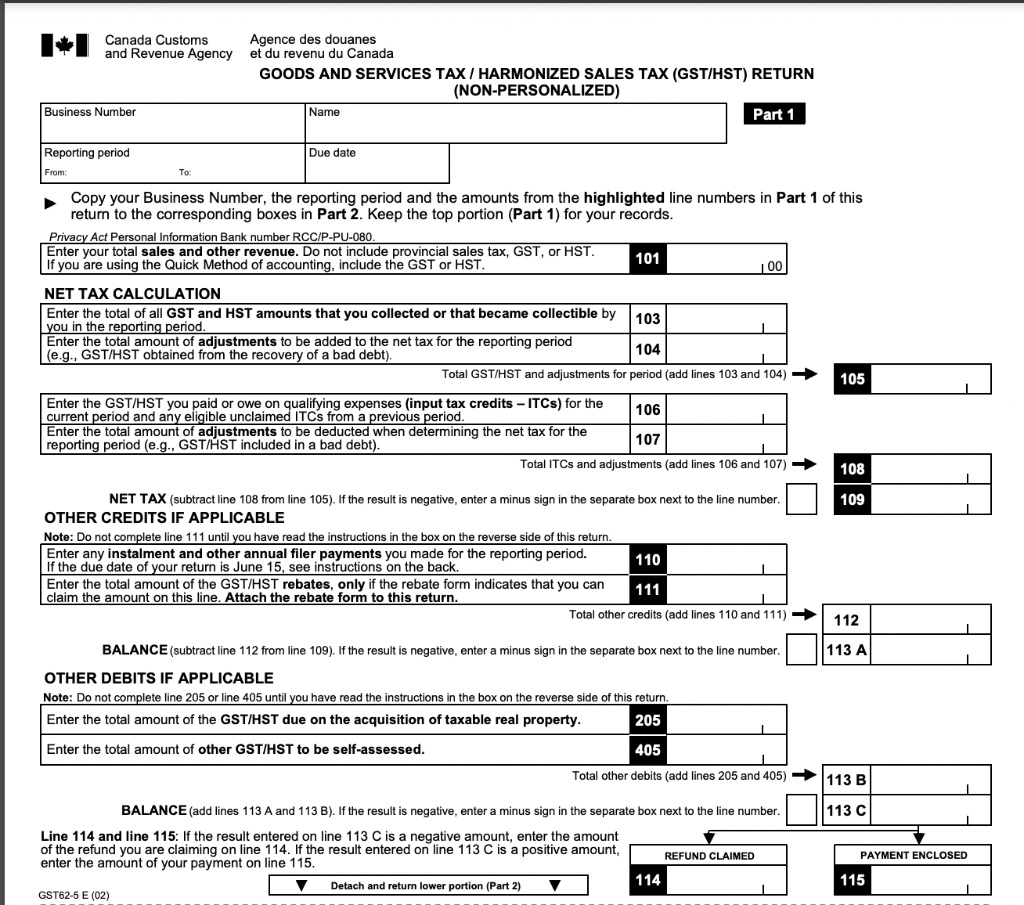

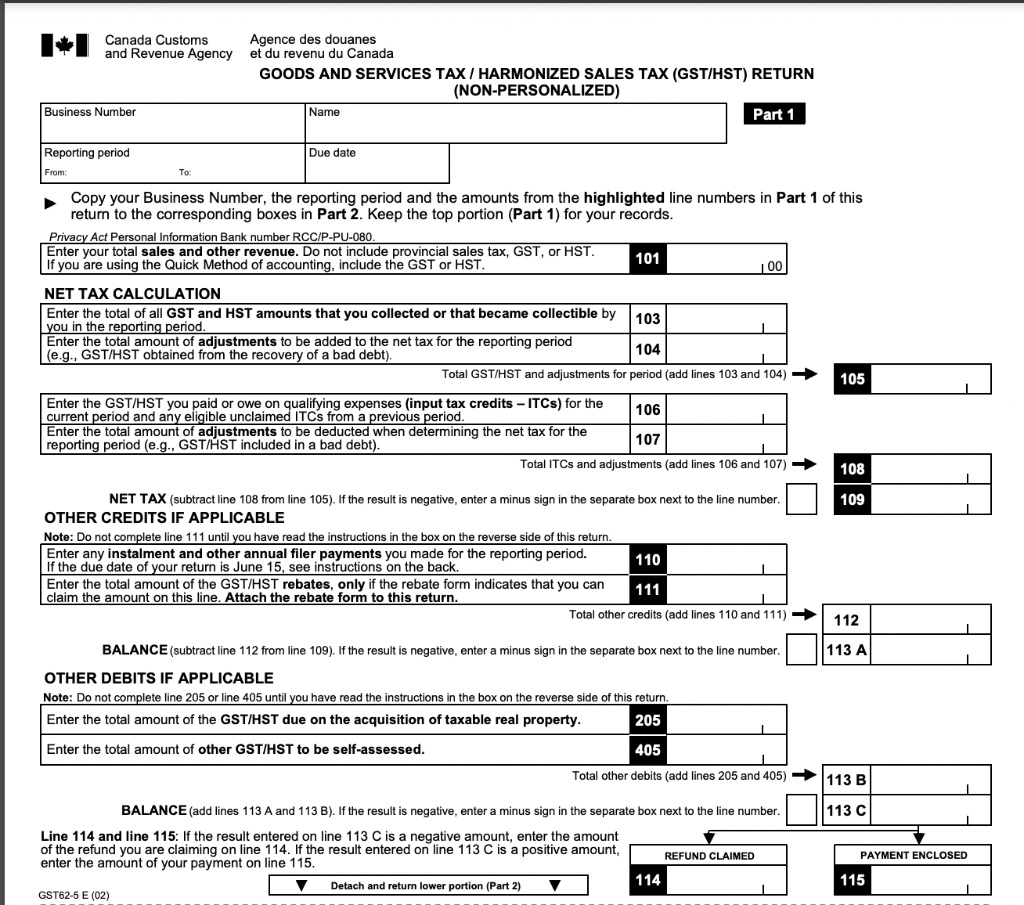

According to this information Please fill attached form or give answers accordingly in sequence.

The income statement for the current year is as follows. All amounts are before the addition of any HST. GOODS AND SERVICES TAX / HARMONIZED SALES TAX (GST/HST) RETURN INON_PFRSONAI I7FnI Copy your Business Number, the reporting period and the amounts from the highlighted line numbers in Part 1 of thi return to the corresponding boxes in Part 2. Keep the top portion (Part 1) for your records. Privacy Act Personal Information Bank number RCC/P-PU-080. Enter your total sales and other revenue. Do not include provincial sales tax, GST, or HST. If you are using the Quick Method of accounting, include the GST or HST. 101+100 Total GST/HST and adjustments for period (add lines 103 and 104) \begin{tabular}{|l} ECl \\ \hline E \\ re \end{tabular} NET TAX (subtract line 108 from line 105). If the result is negative, enter a minus sign in the separate box next to the line number. OTHER CREDITS IF APPLICABLE BALANCE (subtract line 112 from line 109). If the result is negative, enter a minus sign in the separate box next to the line number. 113 OTHER DEBITS IF APPLICABLE Note: Do not comblete line 205 or line 405 until vou have read the instructions in the box on the reverse side of this return. Line 114 and line 115: If the result entered on line 113C is a negative amount, enter the amount of the refund you are claiming on line 114 . If the result entered on line 113C is a positive amount, enter the amount of your payment on line 115 . The income statement for the current year is as follows. All amounts are before the addition of any HST. GOODS AND SERVICES TAX / HARMONIZED SALES TAX (GST/HST) RETURN INON_PFRSONAI I7FnI Copy your Business Number, the reporting period and the amounts from the highlighted line numbers in Part 1 of thi return to the corresponding boxes in Part 2. Keep the top portion (Part 1) for your records. Privacy Act Personal Information Bank number RCC/P-PU-080. Enter your total sales and other revenue. Do not include provincial sales tax, GST, or HST. If you are using the Quick Method of accounting, include the GST or HST. 101+100 Total GST/HST and adjustments for period (add lines 103 and 104) \begin{tabular}{|l} ECl \\ \hline E \\ re \end{tabular} NET TAX (subtract line 108 from line 105). If the result is negative, enter a minus sign in the separate box next to the line number. OTHER CREDITS IF APPLICABLE BALANCE (subtract line 112 from line 109). If the result is negative, enter a minus sign in the separate box next to the line number. 113 OTHER DEBITS IF APPLICABLE Note: Do not comblete line 205 or line 405 until vou have read the instructions in the box on the reverse side of this return. Line 114 and line 115: If the result entered on line 113C is a negative amount, enter the amount of the refund you are claiming on line 114 . If the result entered on line 113C is a positive amount, enter the amount of your payment on line 115