Answered step by step

Verified Expert Solution

Question

1 Approved Answer

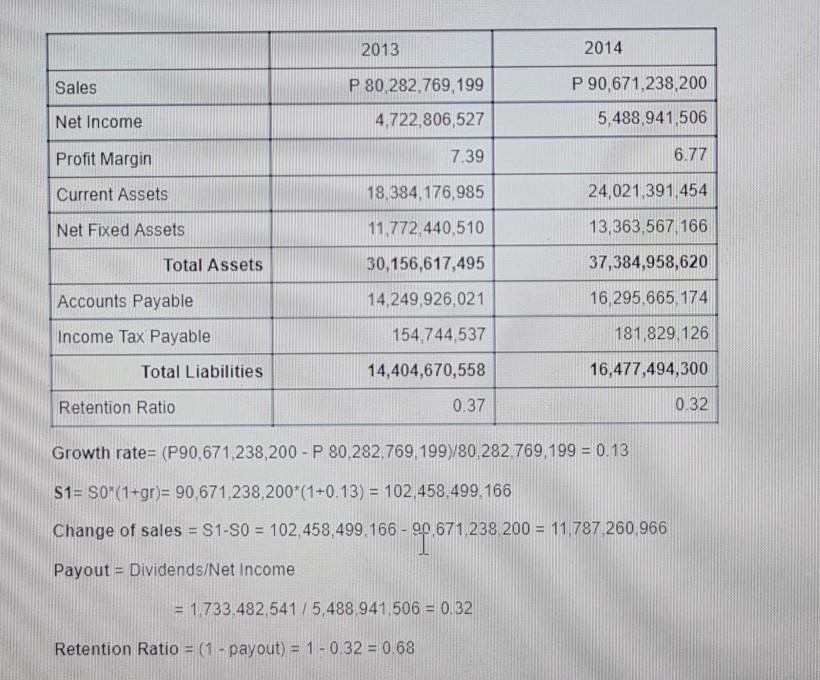

Concept of Additional Funds Needed: What is the AFN? 2013 2014 Sales P 90,671,238,200 P 80,282,769,199 4.722.806,527 Net Income 5,488,941,506 Profit Margin 7.39 6.77 Current

Concept of Additional Funds Needed:

What is the AFN?

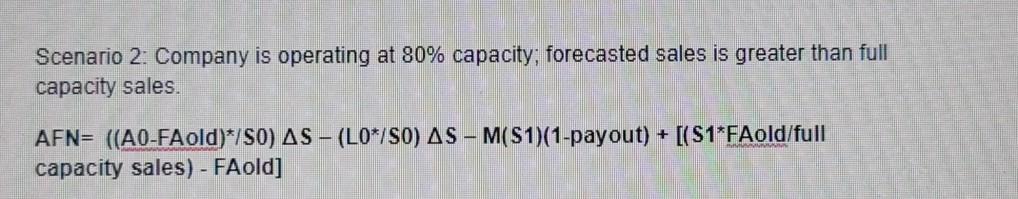

2013 2014 Sales P 90,671,238,200 P 80,282,769,199 4.722.806,527 Net Income 5,488,941,506 Profit Margin 7.39 6.77 Current Assets 18,384, 176,985 24,021,391,454 Net Fixed Assets 11.772 440,510 13,363,567 166 Total Assets 30,156,617,495 37,384,958,620 Accounts Payable 14,249,926,021 16,295 665 174 Income Tax Payable 154.744,537 181,829.126 Total Liabilities 14,404,670,558 16,477,494,300 Retention Ratio 0.37 0.32 Growth rate= (P90,671,238,200 - P 80.282,769,1997/80 282.769.199 = 0.13 S1= SOM(1+gr)= 90,671,238,200*(1+0.13) = 102 458 499.166 Change of sales = S1-S0 = 102,458,499.166 - 90 671,238 200 = 11,787 260 966 Payout = Dividends/Net Income = 1.733.482,541/5,488.941,506 = 0.32 Retention Ratio = (1 - payout) = 1 -0.32 = 0.68 Scenario 2: Company is operating at 80% capacity; forecasted sales is greater than full capacity sales. AFN= ((A0-FAold)*/80) AS - (L0*/80) AS - M(S1)(1-payout) + [(S1*FAold/full capacity sales) - FAold]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started