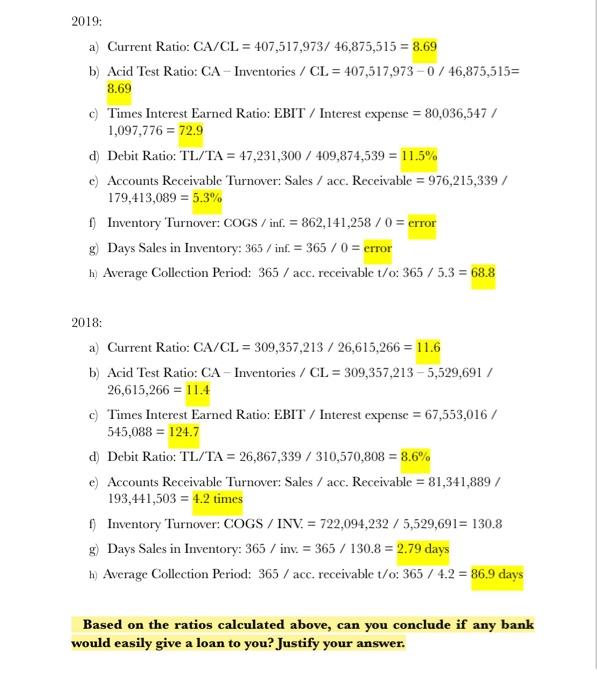

conclude if any bank would easily give a loan to you? justify your answer.

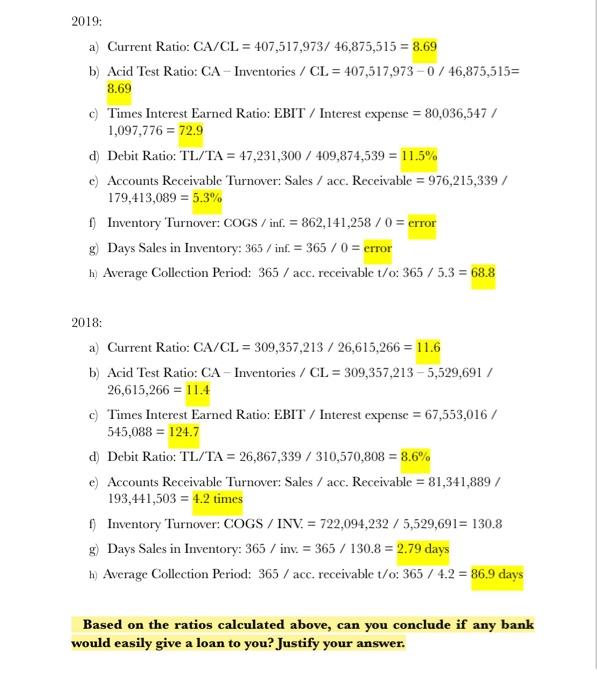

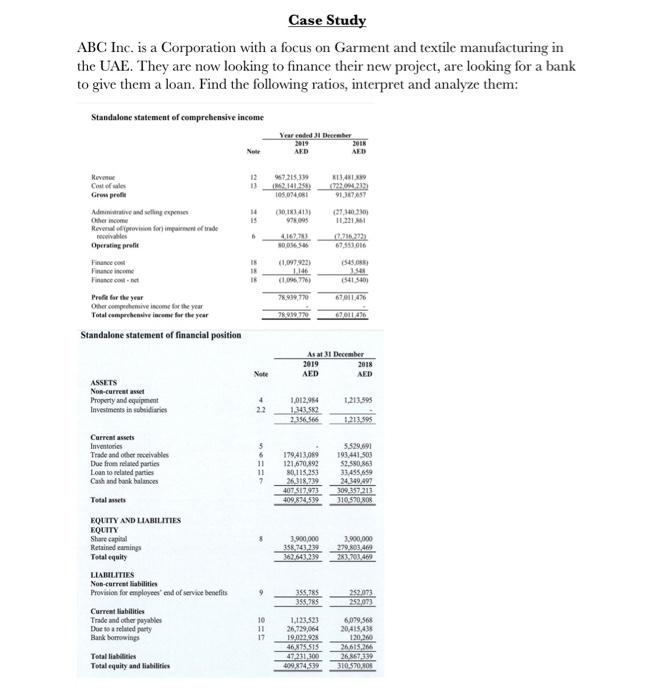

Case Study ABC Inc. is a Corporation with a focus on Garment and textile manufacturing in the UAE. They are now looking to finance their new project, are looking for a bank to give them a loan. Find the following ratios, interpret and analyze them: Standalone statement of comprehensive income Year eaded Berber 2019 AED AED Note 12 11 97215 IM LOS. 074081 134 (722.04.2123 91.37457 14 15 (10181413 98.00 137.320330 0216232 675530 NDOMS Have Castles Gren profie Aditive and selling experies Oher.com Render for imponerade Operating profile Finance.com France Finance cont Prole for the year Other comme income for the year Total comprehensive in for the year Standalone statement of financial position 18 IS 114 (10846, 776) 15415400 78.919,770 670114 782070 GOGO As at 31 December 2019 2018 AED AED ASSETS Non-current Property and equipment Investments in subsidiaries 1.213.395 4 22 1,012,954 141562 2356.566 0212595 Current assets Inventores Trade and other roeivables Due from related parties Loan to related parties Cash and bank balances Total assets 5 6 11 11 7 179,413,089 121.670,292 80,115,250 2318219 407 517,273 5.529.691 193.441.500 $2.50 33,455.659 24.340.407 309 357213 110.520.08 3,900,000 358,743,239 3625429 3.900.000 279.903.469 EQUITY AND LIABILITIES EQUITY Share capital Retained coming Total equity LIABILITIES Non-current liabilities Provision for employees' end of service benefits Current liabilities Trade and other payables Due ord party Bank borrowing Totallit Total equity and liabilities 9 355,785 385,285 262.073 252,073 10 11 17 1.123.523 26,729,064 1902,925 4675515 47 231,100 409874,599 6,079,565 20415,435 120,200 26615,266 26. 67.13 310.570,000 2019: a) Current Ratio: CA/CL = 407,517,973/ 46,875,515 = 8.69 b) Acid Test Ratio: CA - Inventories / CL = 407,517,973 - 0 / 46,875,515= 8.69 c) Times Interest Earned Ratio: EBIT / Interest expense = 80,036,547 / 1,097,776 = 72.9 d) Debit Ratio: TL/TA = 47,231,300 / 409,874,539 = 11.5% c) Accounts Receivable Turnover: Sales / acc. Receivable = 976,215,339/ 179,413,089 = 5.3% f) Inventory Turnover: COGS / inf. = 862,141,258 / 0 = error g) Days Sales in Inventory: 365 / inf. = 365 / 0 = error h) Average Collection Period: 365 / acc. receivablet/o: 365 / 5.3 = 68.8 2018: a) Current Ratio: CA/CL = 309,357,213 / 26,615,266 = 11.6 b) Acid Test Ratio: CA - Inventories / CL = 309,357,213-5,529,691 / 26,615,266 = 11.4 c) Times Interest Earned Ratio: EBIT / Interest expense = 67,553,016/ 545,088 = 124.7 d) Debit Ratio: TL/TA = 26,867,339 / 310,570,808 = 8.6% e) Accounts Receivable Turnover: Sales / acc. Receivable = 81,341,889/ 193,441,503 = 4.2 times 1) Inventory Turnover: COGS / INV. = 722,094,232 / 5,529,691= 130.8 g) Days Sales in Inventory: 365 / inv. = 365 / 130.8 = 2.79 days h) Average Collection Period: 365 / acc. receivablet/o: 365 / 4.2 = 86.9 days Based on the ratios calculated above, can you conclude if any bank would easily give a loan to you? Justify your answer. Case Study ABC Inc. is a Corporation with a focus on Garment and textile manufacturing in the UAE. They are now looking to finance their new project, are looking for a bank to give them a loan. Find the following ratios, interpret and analyze them: Standalone statement of comprehensive income Year eaded Berber 2019 AED AED Note 12 11 97215 IM LOS. 074081 134 (722.04.2123 91.37457 14 15 (10181413 98.00 137.320330 0216232 675530 NDOMS Have Castles Gren profie Aditive and selling experies Oher.com Render for imponerade Operating profile Finance.com France Finance cont Prole for the year Other comme income for the year Total comprehensive in for the year Standalone statement of financial position 18 IS 114 (10846, 776) 15415400 78.919,770 670114 782070 GOGO As at 31 December 2019 2018 AED AED ASSETS Non-current Property and equipment Investments in subsidiaries 1.213.395 4 22 1,012,954 141562 2356.566 0212595 Current assets Inventores Trade and other roeivables Due from related parties Loan to related parties Cash and bank balances Total assets 5 6 11 11 7 179,413,089 121.670,292 80,115,250 2318219 407 517,273 5.529.691 193.441.500 $2.50 33,455.659 24.340.407 309 357213 110.520.08 3,900,000 358,743,239 3625429 3.900.000 279.903.469 EQUITY AND LIABILITIES EQUITY Share capital Retained coming Total equity LIABILITIES Non-current liabilities Provision for employees' end of service benefits Current liabilities Trade and other payables Due ord party Bank borrowing Totallit Total equity and liabilities 9 355,785 385,285 262.073 252,073 10 11 17 1.123.523 26,729,064 1902,925 4675515 47 231,100 409874,599 6,079,565 20415,435 120,200 26615,266 26. 67.13 310.570,000 2019: a) Current Ratio: CA/CL = 407,517,973/ 46,875,515 = 8.69 b) Acid Test Ratio: CA - Inventories / CL = 407,517,973 - 0 / 46,875,515= 8.69 c) Times Interest Earned Ratio: EBIT / Interest expense = 80,036,547 / 1,097,776 = 72.9 d) Debit Ratio: TL/TA = 47,231,300 / 409,874,539 = 11.5% c) Accounts Receivable Turnover: Sales / acc. Receivable = 976,215,339/ 179,413,089 = 5.3% f) Inventory Turnover: COGS / inf. = 862,141,258 / 0 = error g) Days Sales in Inventory: 365 / inf. = 365 / 0 = error h) Average Collection Period: 365 / acc. receivablet/o: 365 / 5.3 = 68.8 2018: a) Current Ratio: CA/CL = 309,357,213 / 26,615,266 = 11.6 b) Acid Test Ratio: CA - Inventories / CL = 309,357,213-5,529,691 / 26,615,266 = 11.4 c) Times Interest Earned Ratio: EBIT / Interest expense = 67,553,016/ 545,088 = 124.7 d) Debit Ratio: TL/TA = 26,867,339 / 310,570,808 = 8.6% e) Accounts Receivable Turnover: Sales / acc. Receivable = 81,341,889/ 193,441,503 = 4.2 times 1) Inventory Turnover: COGS / INV. = 722,094,232 / 5,529,691= 130.8 g) Days Sales in Inventory: 365 / inv. = 365 / 130.8 = 2.79 days h) Average Collection Period: 365 / acc. receivablet/o: 365 / 4.2 = 86.9 days Based on the ratios calculated above, can you conclude if any bank would easily give a loan to you? Justify your

conclude if any bank would easily give a loan to you? justify your answer.

conclude if any bank would easily give a loan to you? justify your answer.