Answered step by step

Verified Expert Solution

Question

1 Approved Answer

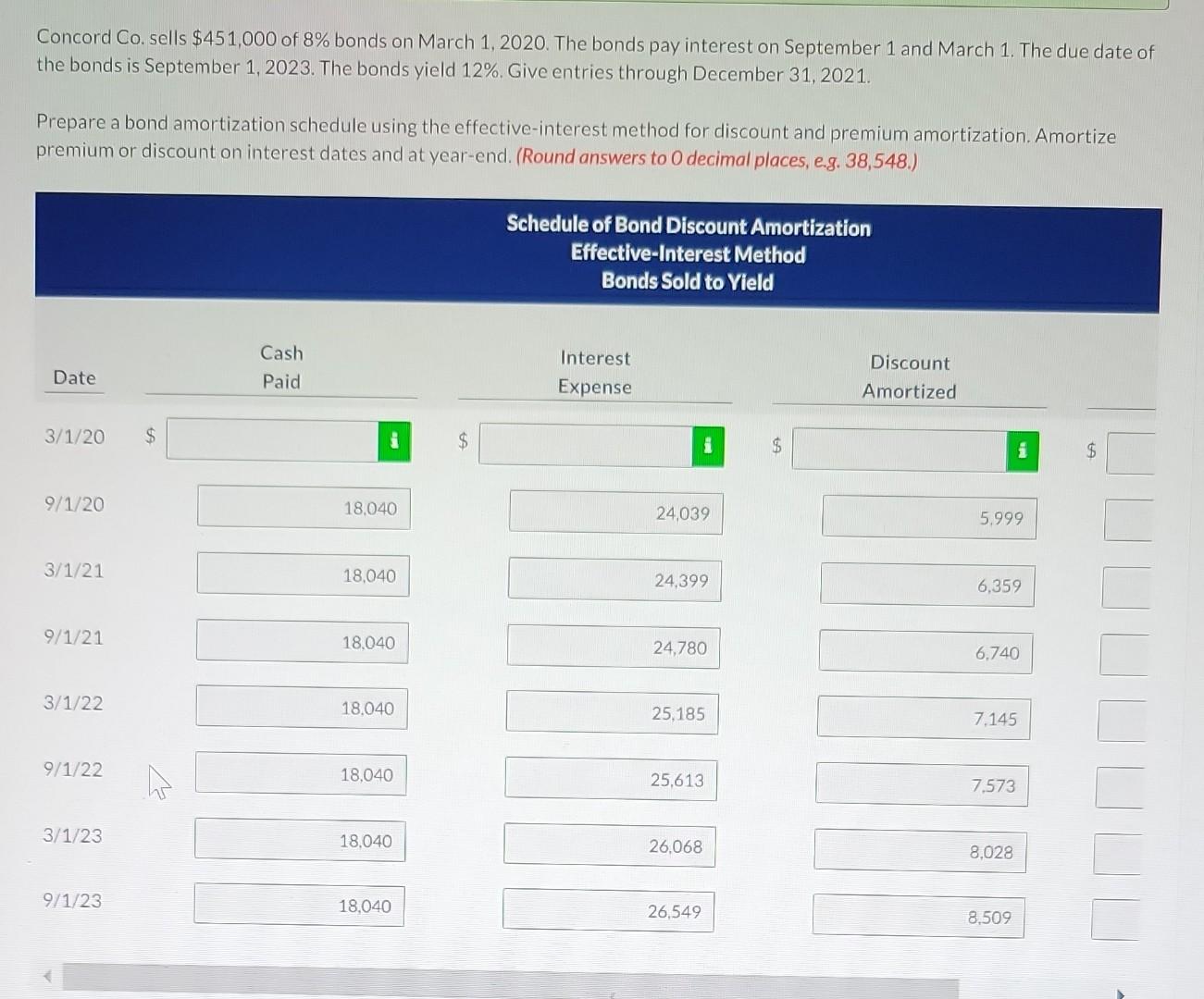

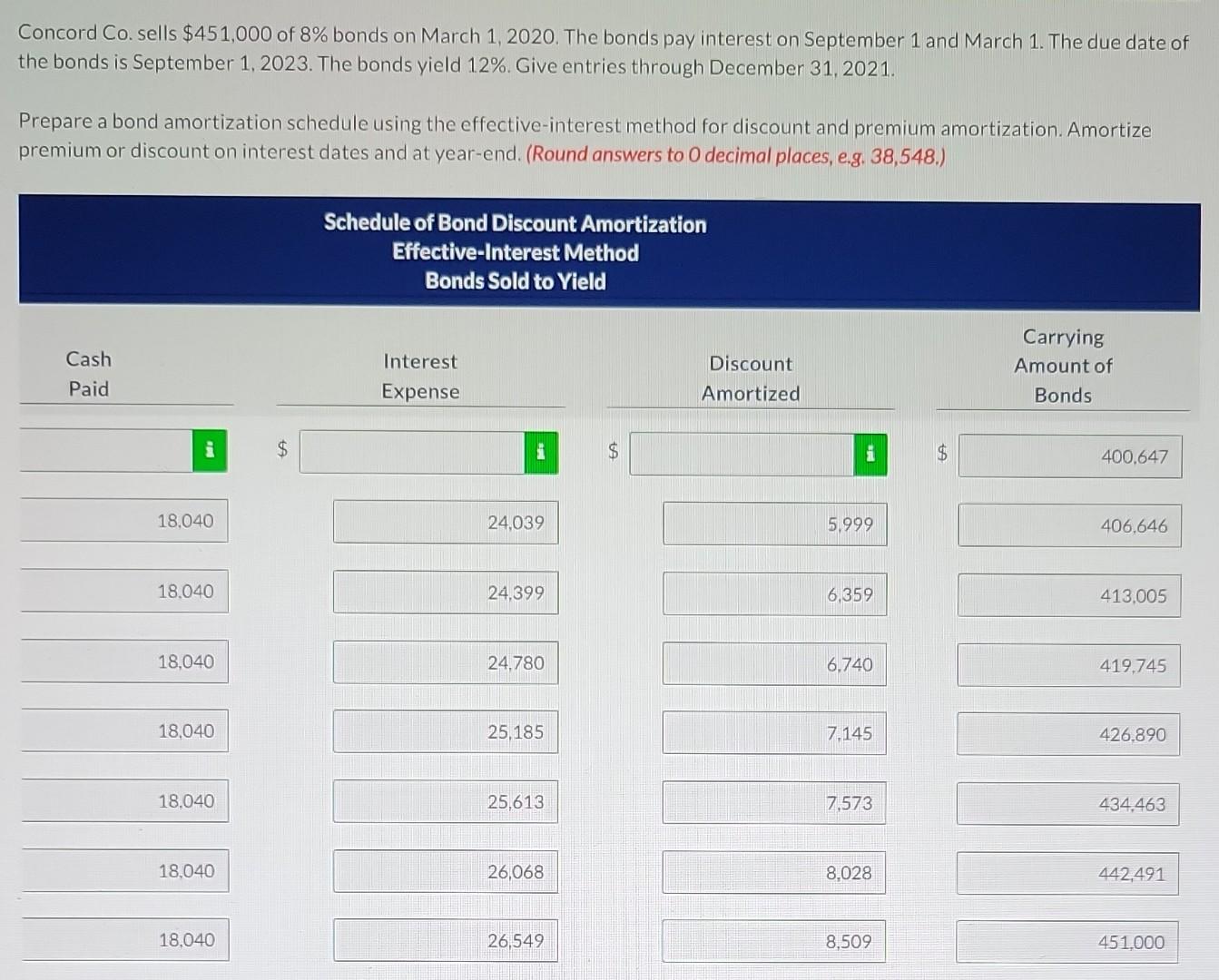

Concord Co. sells $451,000 of 8% bonds on March 1, 2020. The bonds pay interest on September 1 and March 1. The due date of

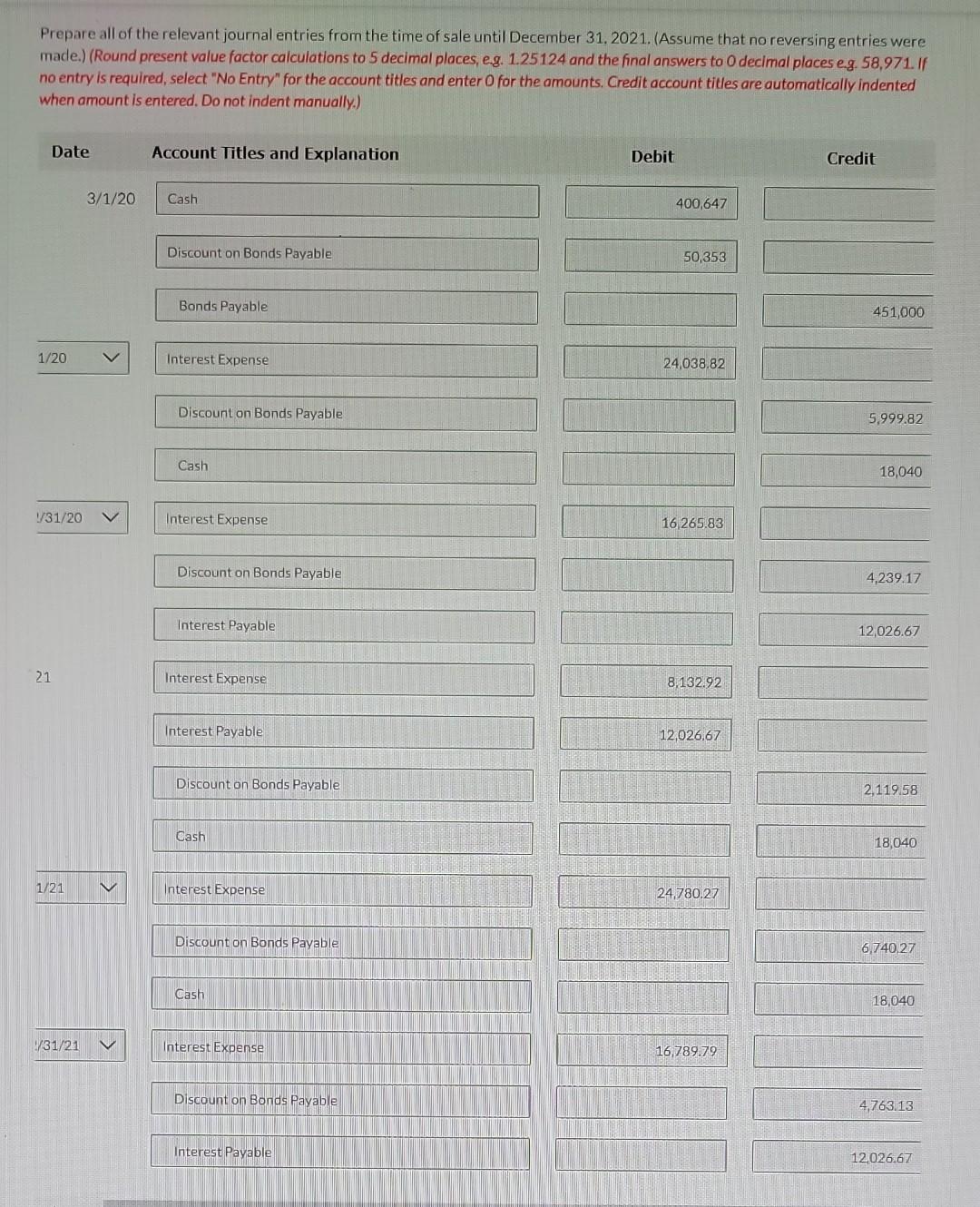

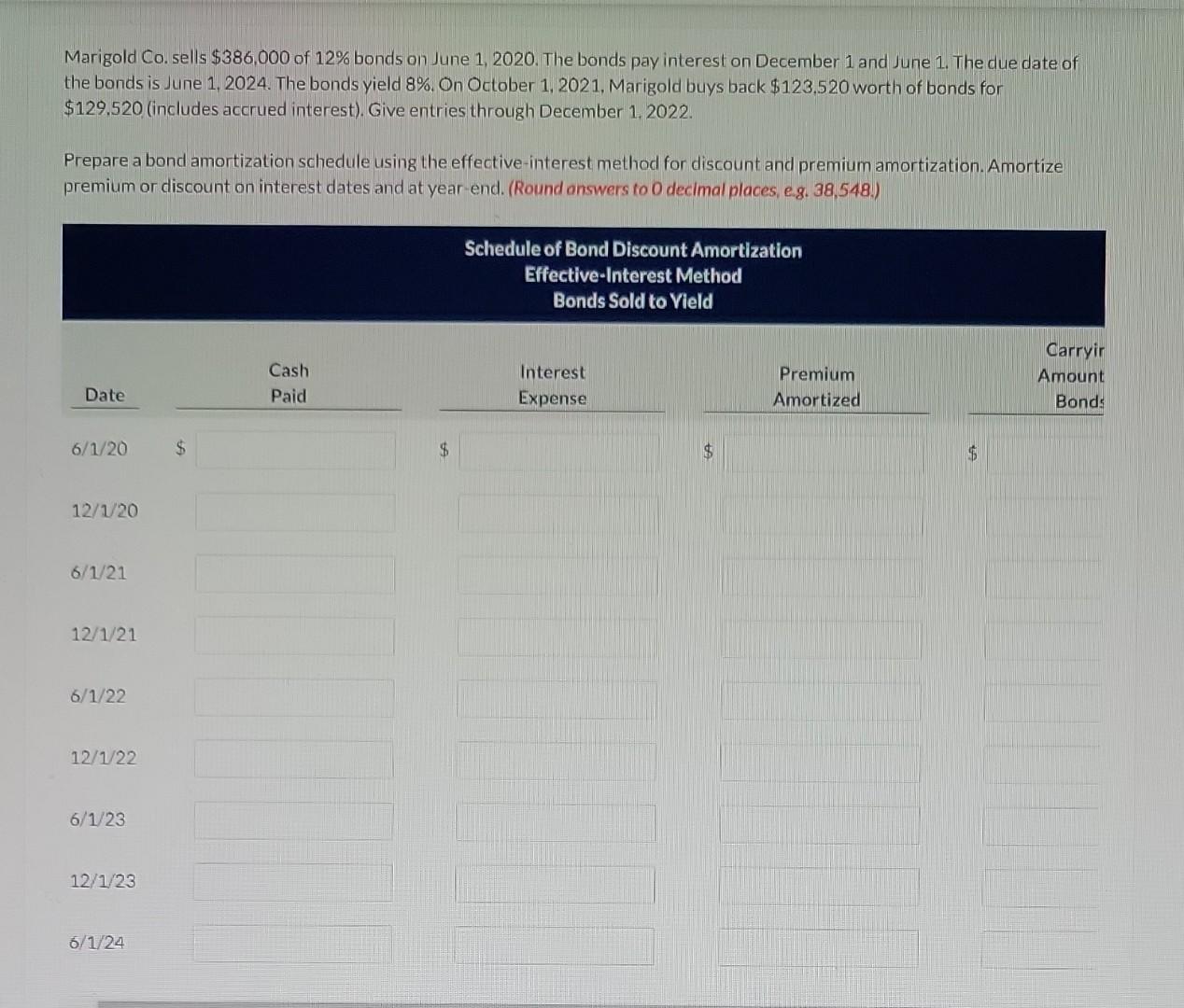

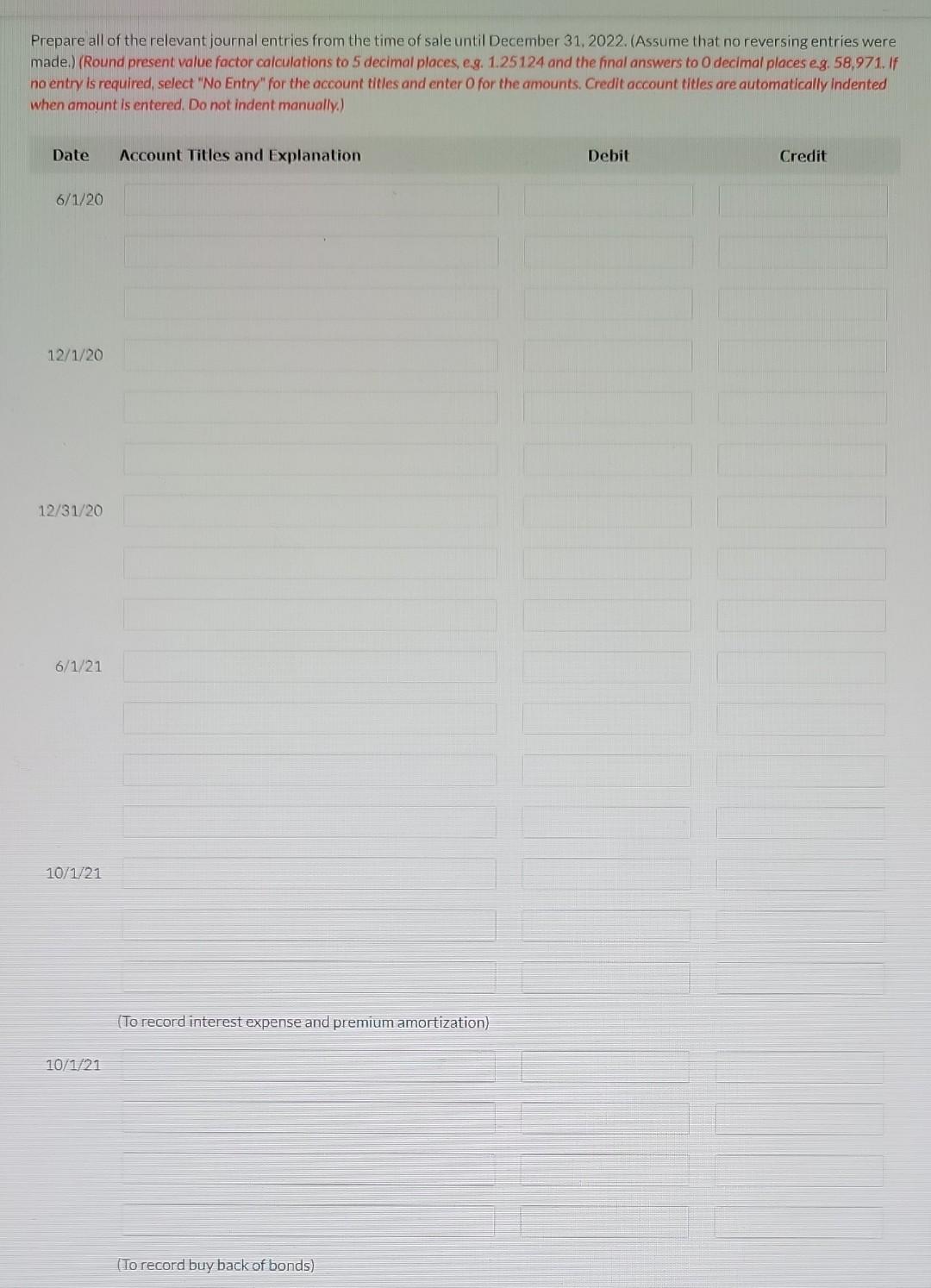

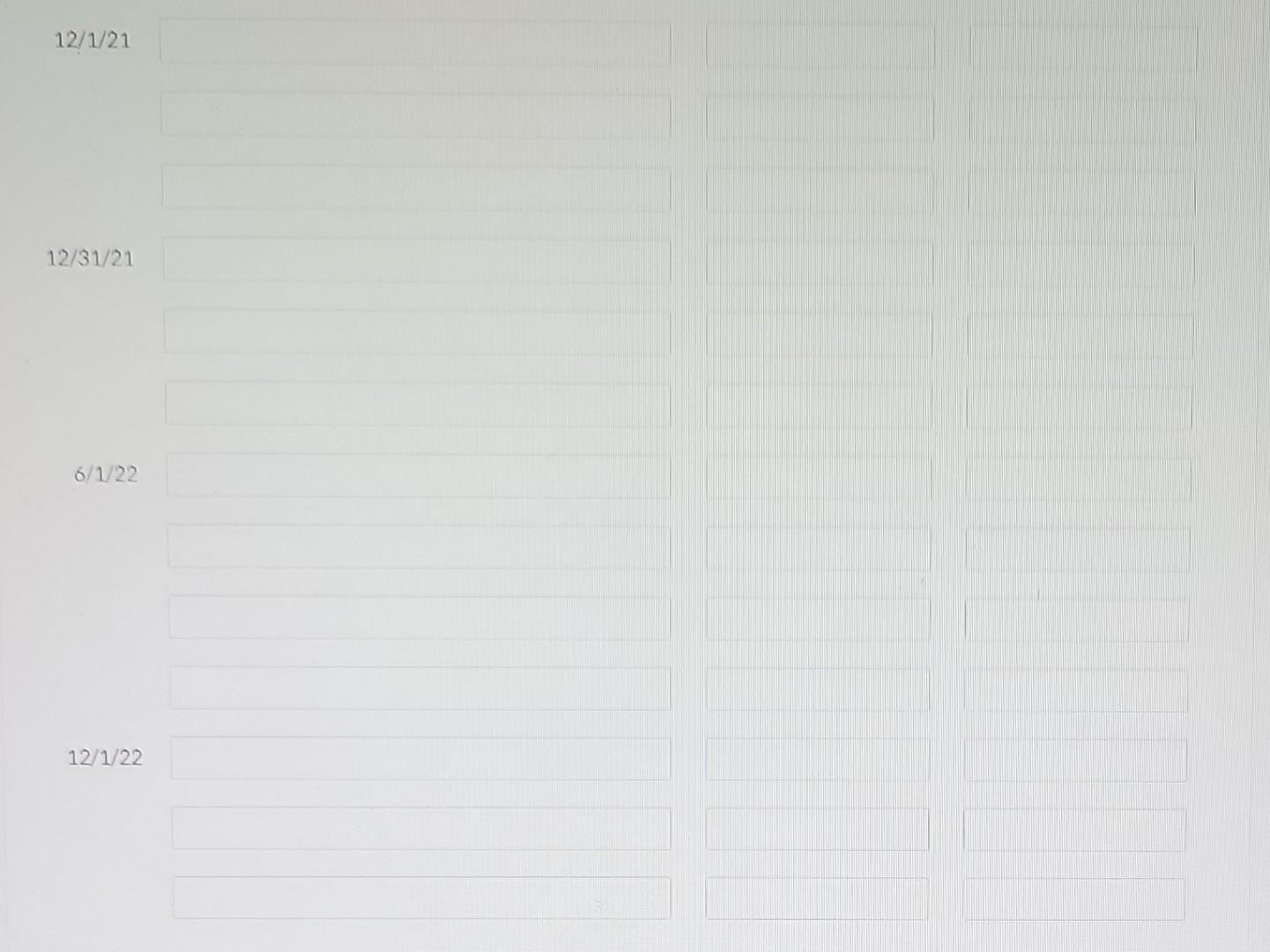

Concord Co. sells $451,000 of 8% bonds on March 1, 2020. The bonds pay interest on September 1 and March 1. The due date of the bonds is September 1, 2023. The bonds yield 12\%. Give entries through December 31,2021. Prepare a bond amortization schedule using the effective-interest method for discount and premium amortization. Amortize premium or discount on interest dates and at year-end. (Round answers to 0 decimal places, e.g. 38,548. ) Concord Co. sells $451,000 of 8% bonds on March 1, 2020. The bonds pay interest on September 1 and March 1 . The due date of the bonds is September 1, 2023. The bonds yield 12\%. Give entries through December 31, 2021. Prepare a bond amortization schedule using the effective-interest method for discount and premium amortization. Amortize premium or discount on interest dates and at year-end. (Round answers to 0 decimal places, e.g. 38,548. ) Prepare all of the relevant journal entries from the time of sale until December 31. 2021. (Assume that no reversing entries were made.) (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answers to 0 decimal places e.g. 58,971 . If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Marigold Co. sells $386,000 of 12% bonds on June 1, 2020. The bonds pay interest on December 1 and June 1 . The due date of the bonds is June 1, 2024. The bonds yield 8%. On October 1, 2021, Marigold buys back $123,520 worth of bonds for $129,520 (includes accrued interest). Give entries through December 1, 2022. Prepare a bond amortization schedule using the effective-interest method for discount and premium amortization. Amortize premium or discount on interest dates and at year-end. (Round onswers to 0 decimal places, e. . 38,548.) Prepare all of the relevant journal entries from the time of sale until December 31, 2022. (Assume that no reversing entries were made.) (Round present value foctor calculations to 5 decimal ploces, e. . 1.25124 and the final answers to 0 decimal places eg. 58,971 . If no entry is required, select "No Entry" for the occount titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) 12/1/21 12/31/21 6/1/22 12/1/22

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started