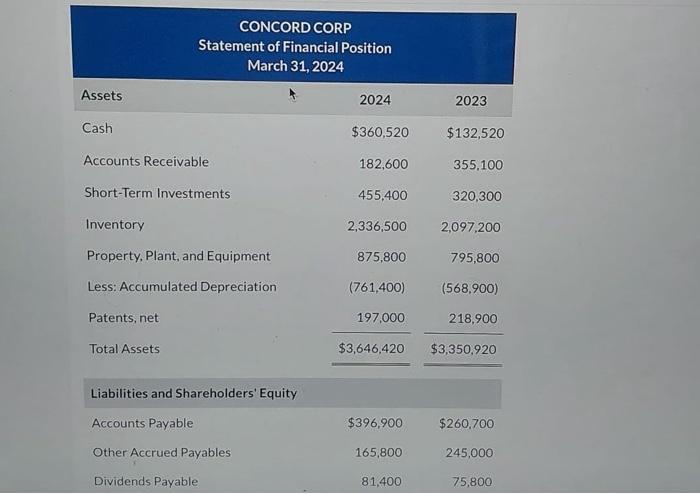

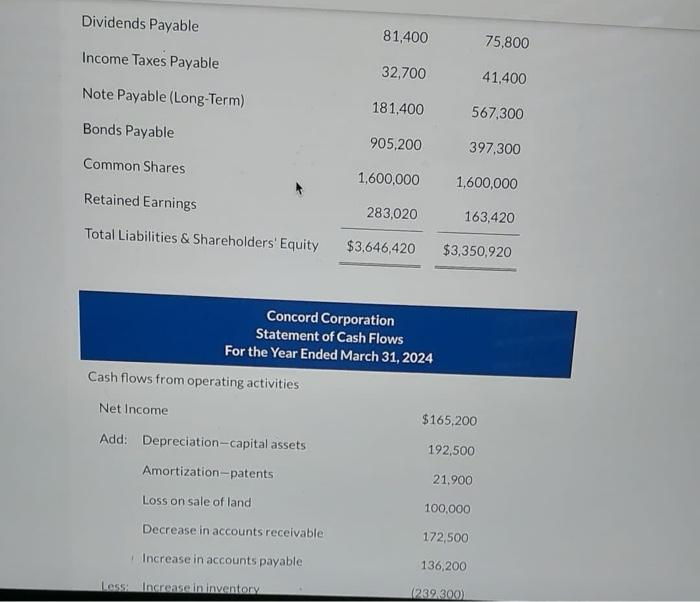

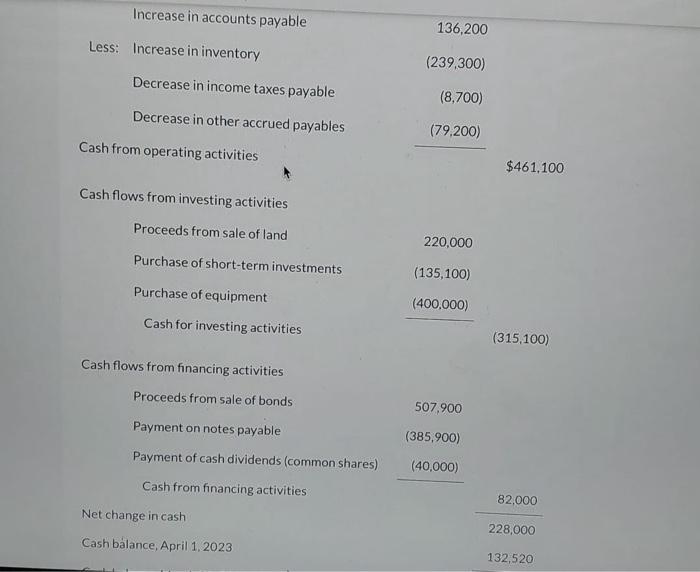

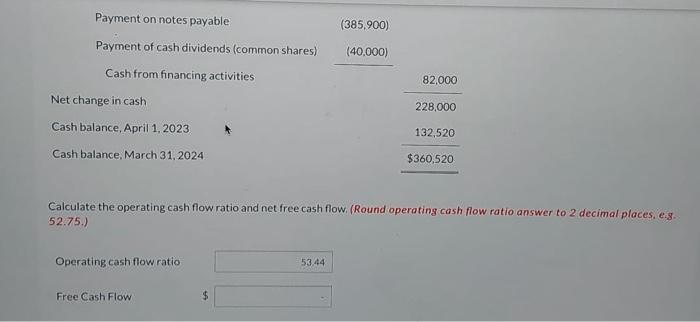

CONCORD CORP Statement of Financial Position March 31, 2024 \begin{tabular}{|c|c|c|} \hline Assets & 2024 & 2023 \\ \hline Cash & $360,520 & $132,520 \\ \hline Accounts Receivable & 182,600 & 355,100 \\ \hline Short-Term Investments & 455,400 & 320,300 \\ \hline Inventory & 2,336,500 & 2,097,200 \\ \hline Property, Plant, and Equipment & 875,800 & 795,800 \\ \hline Less: Accumulated Depreciation & (761,400) & (568,900) \\ \hline Patents, net & 197.000 & 218,900 \\ \hline Total Assets & $3,646,420 & $3,350,920 \\ \hline \end{tabular} \begin{tabular}{lrr|} \hline Liabilities and Shareholders' Equity & \\ \hline Accounts Payable & $396,900 & $260,700 \\ \hline Other Accrued Payables & 165,800 & 245,000 \\ \hline Dividends Payable & 81,400 & 75,800 \end{tabular} \begin{tabular}{lrr} Dividends Payable & 81,400 & 75,800 \\ Income Taxes Payable & 32,700 & 41,400 \\ Note Payable (Long-Term) & 181,400 & 567,300 \\ Bonds Payable & 905,200 & 397,300 \\ Common Shares & 1,600,000 & 1,600,000 \\ Retained Earnings & 283,020 & 163,420 \\ Total Liabilities \& Shareholders' Equity & $3,646,420 & $3,350,920 \\ \hline \end{tabular} Concord Corporation Statement of Cash Flows For the Year Ended March 31, 2024 Cash flows from operating activities Net Income Add: Depreciation-capital assets Amortization-patents Loss on sale of land $165,200 192,500 21,900 100,000 172,500 136,200 Les5:- Increasein inventory (239.300) Increase in accounts payable Less: Increase in inventory 136,200 (239,300) Decrease in income taxes payable (8,700) Decrease in other accrued payables (79,200) Cash from operating activities $461,100 Cash flows from investing activities Proceeds from sale of land 220,000 Purchase of short-term investments (135,100) Purchase of equipment (400,000) Cash for investing activities (315,100) Cash flows from financing activities Proceeds from sale of bonds 507,900 Payment on notes payable (385,900) Payment of cash dividends (common shares) (40,000) Cash from financing activities Net change in cash Cash blance, April 1, 2023 82,000 228,000 132,520 Calculate the operating cash flow ratio and net free cash flow. (Round operating cash flow ratio answer to 2 decimal places, e.g. 52.75.) Operating cash flow ratio Free Cash Flow