Answered step by step

Verified Expert Solution

Question

1 Approved Answer

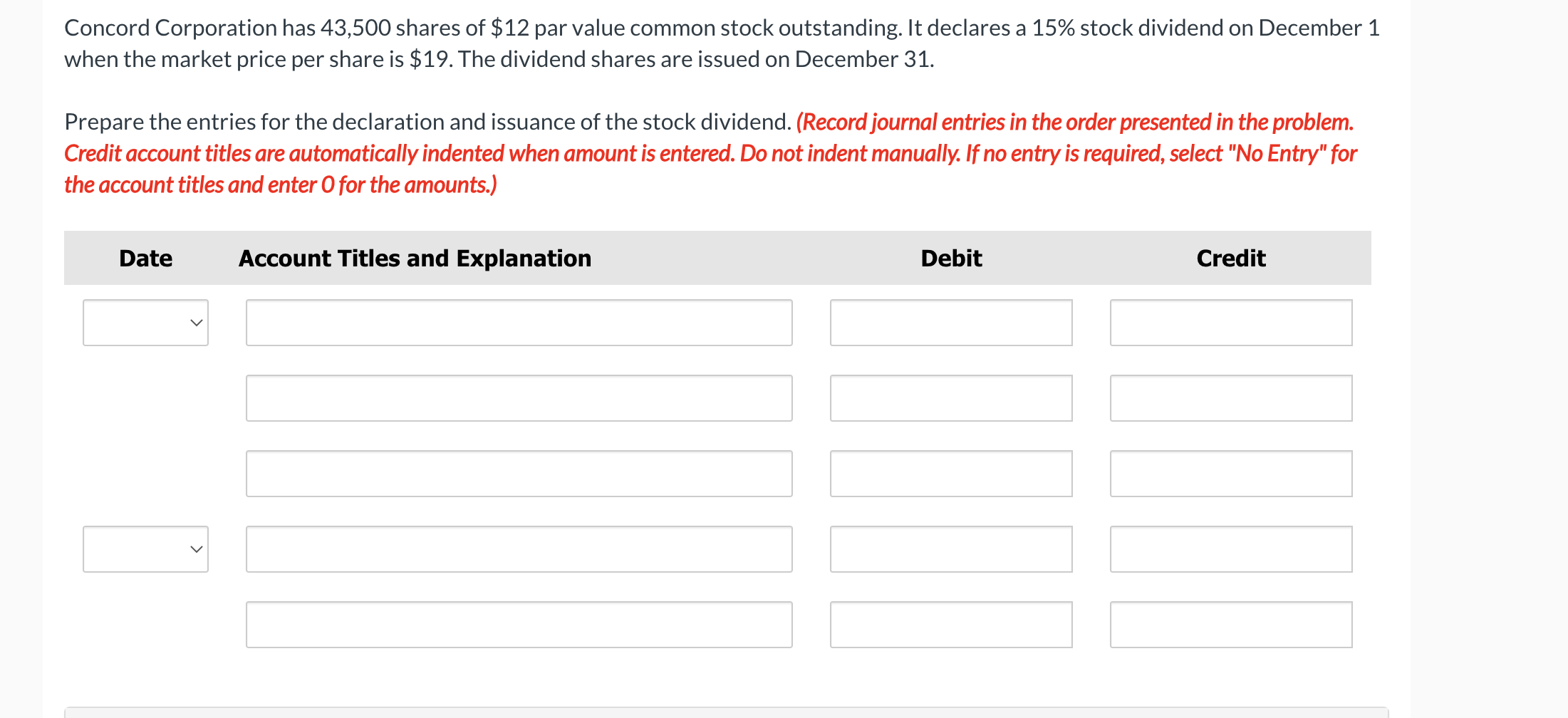

Concord Corporation has 43,500 shares of $12 par value common stock outstanding. It declares a 15% stock dividend on December 1 when the market

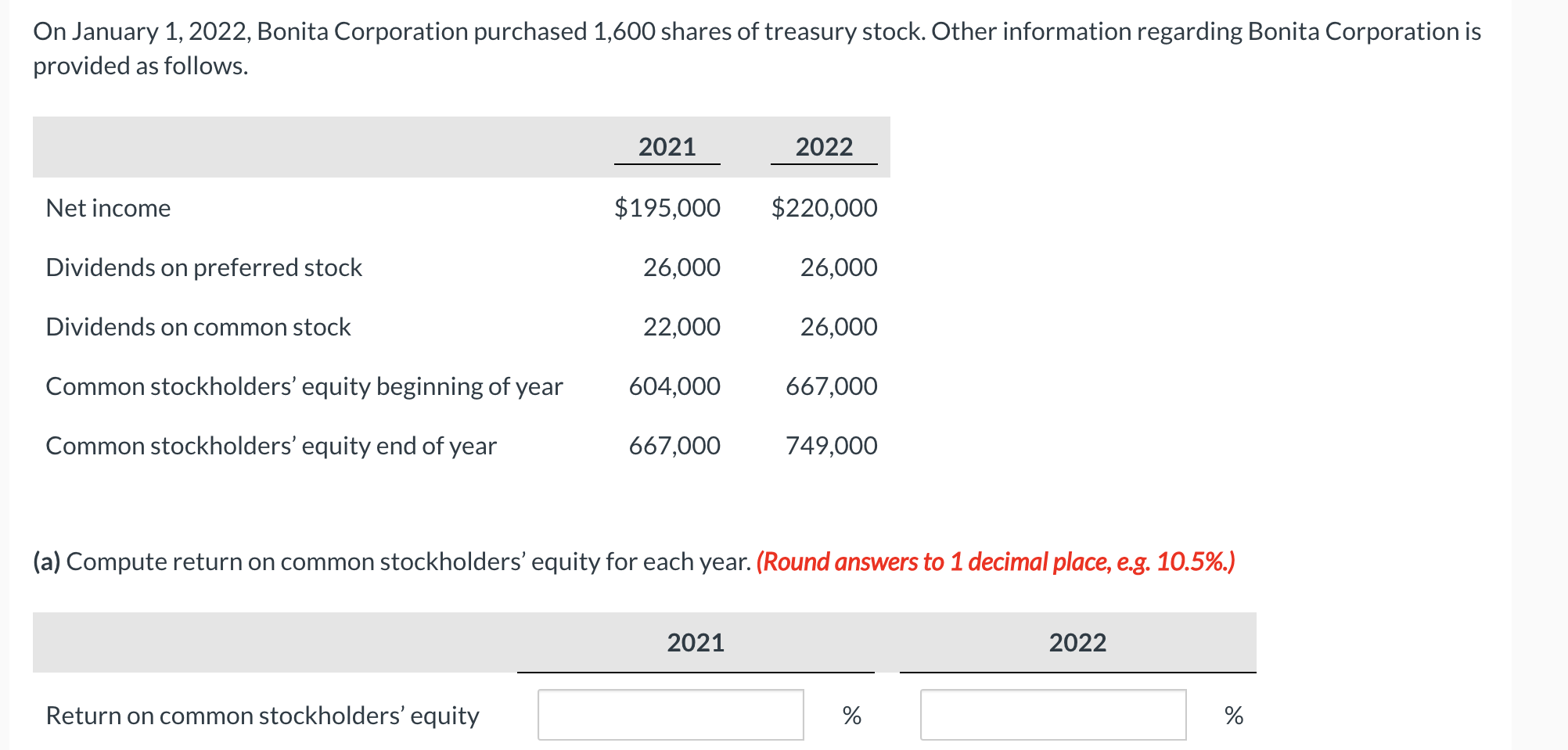

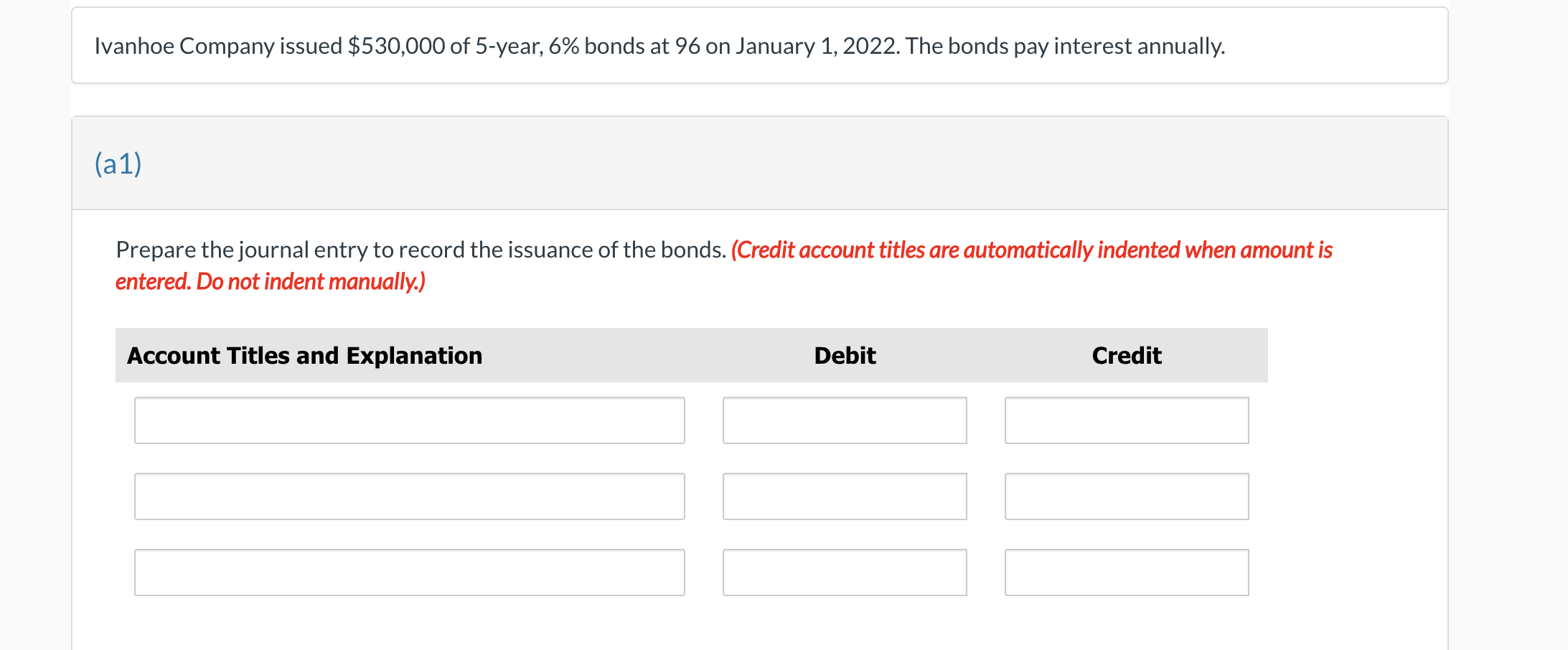

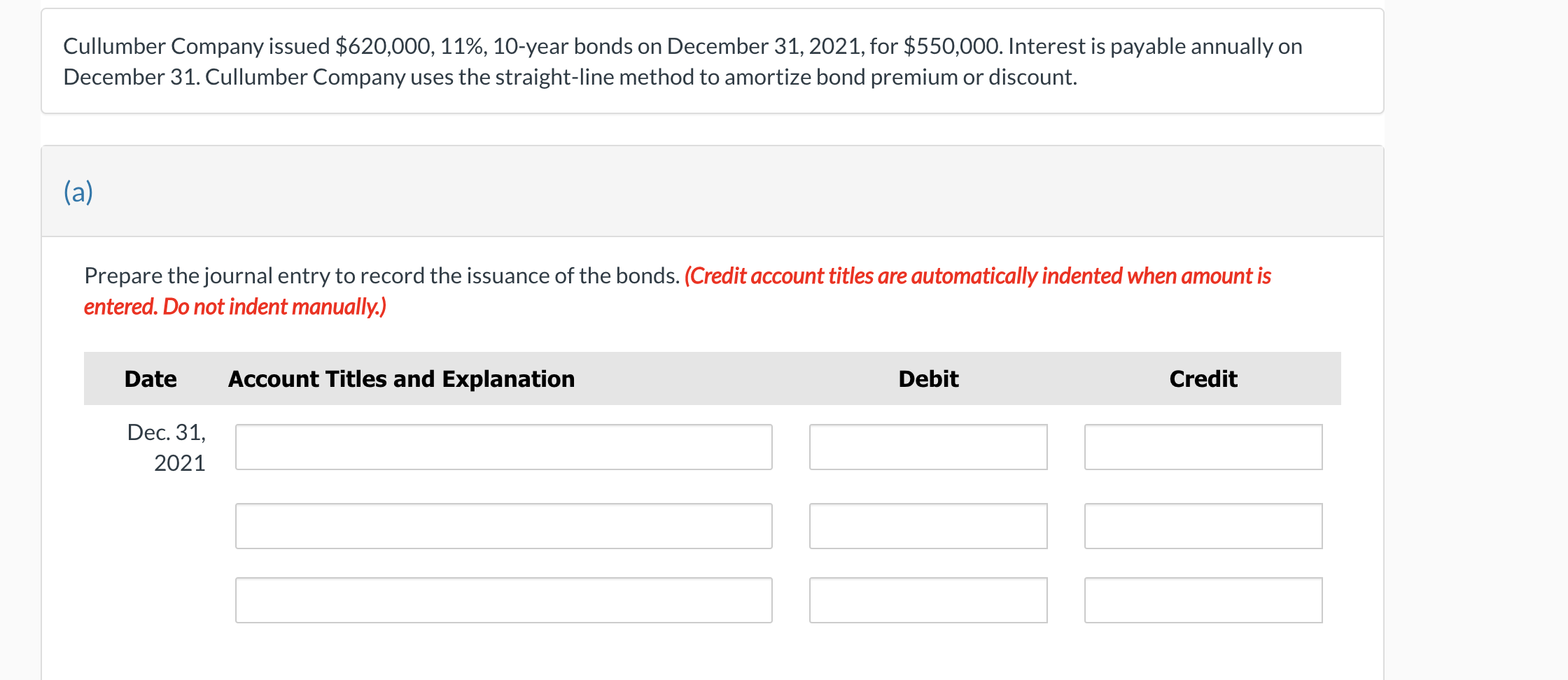

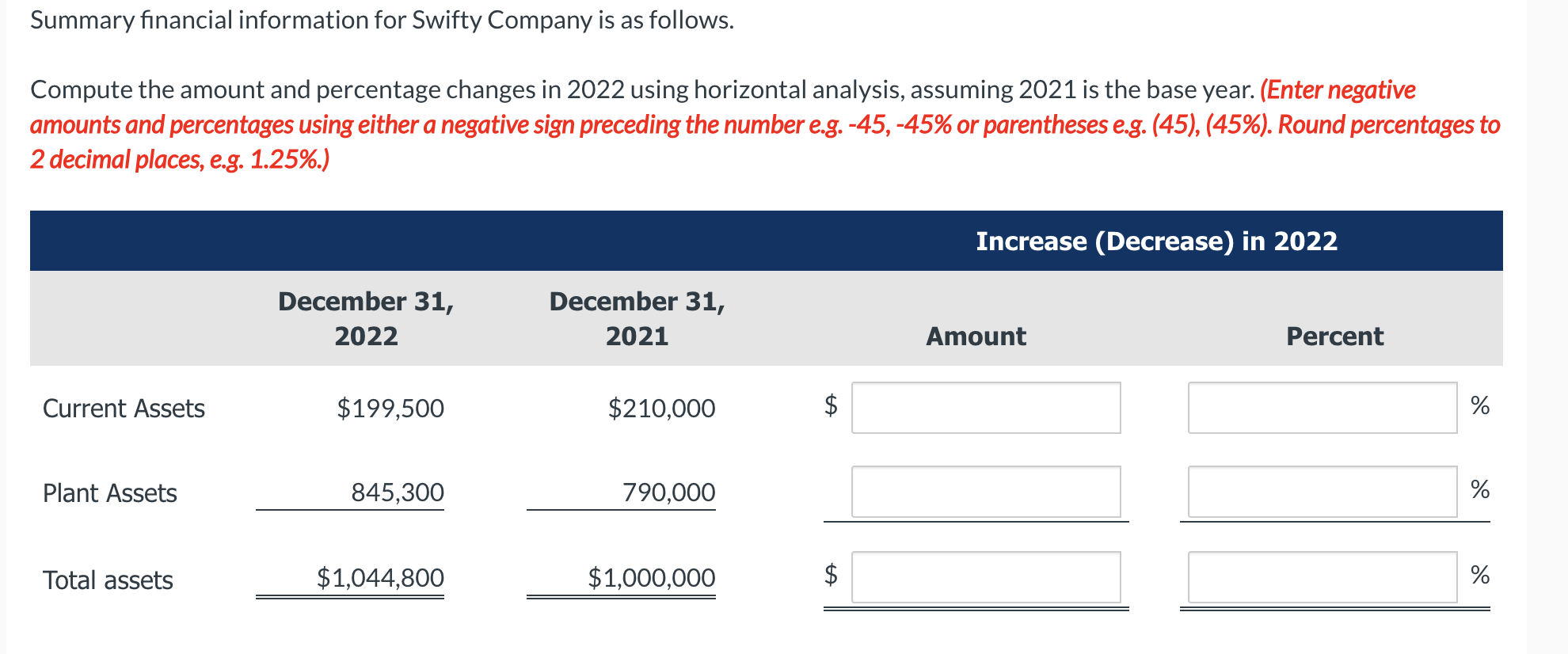

Concord Corporation has 43,500 shares of $12 par value common stock outstanding. It declares a 15% stock dividend on December 1 when the market price per share is $19. The dividend shares are issued on December 31. Prepare the entries for the declaration and issuance of the stock dividend. (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit On January 1, 2022, Bonita Corporation purchased 1,600 shares of treasury stock. Other information regarding Bonita Corporation is provided as follows. 2021 2022 Net income Dividends on preferred stock $195,000 $220,000 26,000 26,000 Dividends on common stock 22,000 26,000 Common stockholders' equity beginning of year 604,000 667,000 Common stockholders' equity end of year 667,000 749,000 (a) Compute return on common stockholders' equity for each year. (Round answers to 1 decimal place, e.g. 10.5%.) Return on common stockholders' equity 2021 % 2022 % Ivanhoe Company issued $530,000 of 5-year, 6% bonds at 96 on January 1, 2022. The bonds pay interest annually. (a1) Prepare the journal entry to record the issuance of the bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Cullumber Company issued $620,000, 11%, 10-year bonds on December 31, 2021, for $550,000. Interest is payable annually on December 31. Cullumber Company uses the straight-line method to amortize bond premium or discount. (a) Prepare the journal entry to record the issuance of the bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Dec. 31, 2021 Account Titles and Explanation Debit Credit Summary financial information for Swifty Company is as follows. Compute the amount and percentage changes in 2022 using horizontal analysis, assuming 2021 is the base year. (Enter negative amounts and percentages using either a negative sign preceding the number e.g. -45, -45% or parentheses e.g. (45), (45%). Round percentages to 2 decimal places, e.g. 1.25%.) December 31, 2022 December 31, 2021 Current Assets $199,500 Plant Assets 845,300 $210,000 790,000 Total assets $1,044,800 $1,000,000 A A Increase (Decrease) in 2022 Amount Percent % % %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started