Answered step by step

Verified Expert Solution

Question

1 Approved Answer

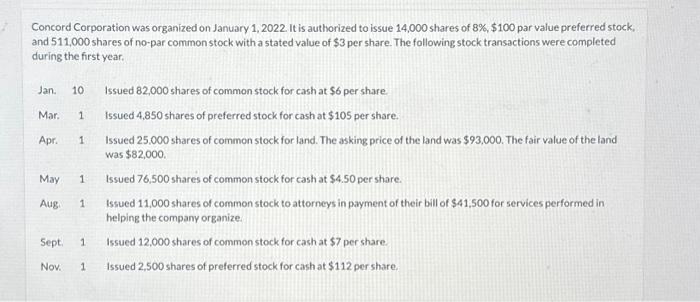

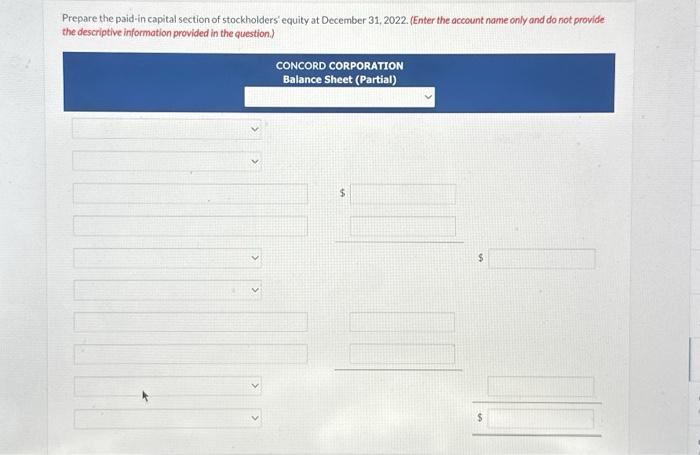

Concord Corporation was organized on January 1, 2022. It is authorized to issue 14,000 shares of 8%, $100 par value preferred stock, and 511,000 shares

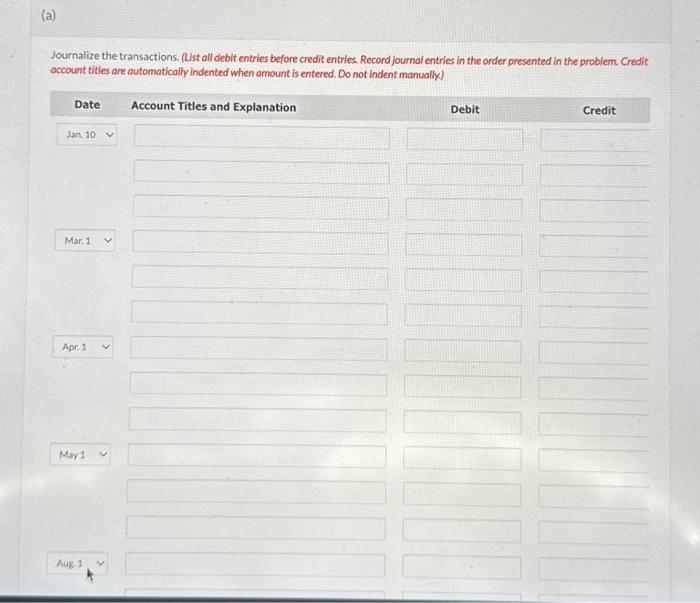

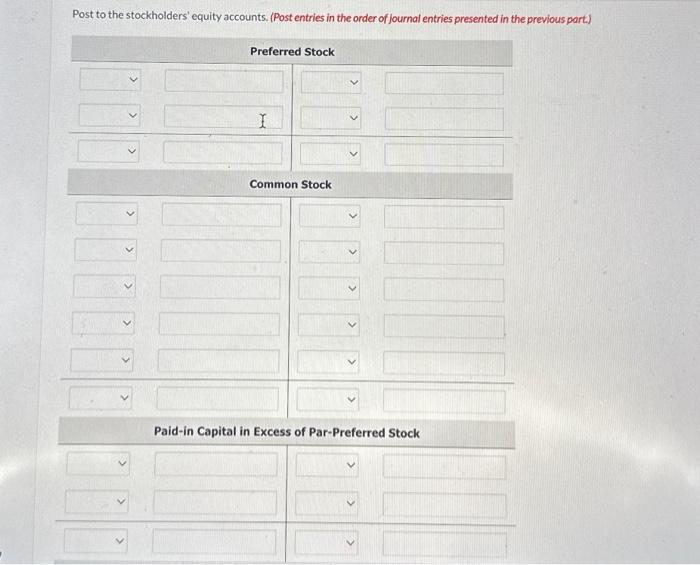

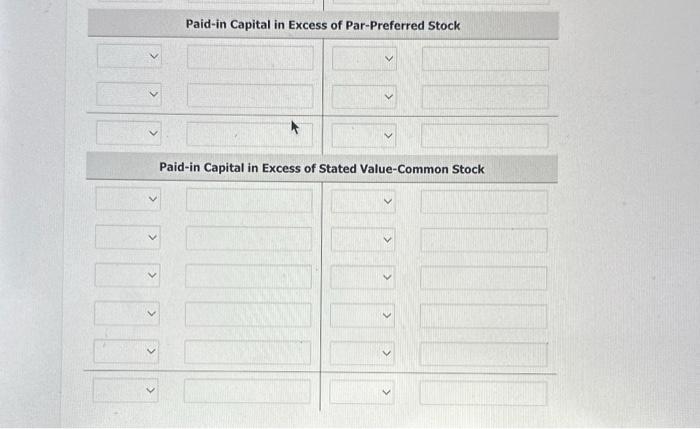

Concord Corporation was organized on January 1, 2022. It is authorized to issue 14,000 shares of 8%, $100 par value preferred stock, and 511,000 shares of no-par common stock with a stated value of $3 per share. The following stock transactions were completed during the first year. Jan. 10 Mar. Apr. Sept. 1 May 1 Aug. 1 Nov. 1 1 1 Issued 82,000 shares of common stock for cash at $6 per share. Issued 4,850 shares of preferred stock for cash at $105 per share. Issued 25,000 shares of common stock for land. The asking price of the land was $93,000. The fair value of the land was $82,000. Issued 76,500 shares of common stock for cash at $4.50 per share. Issued 11,000 shares of common stock to attorneys in payment of their bill of $41,500 for services performed in helping the company organize. Issued 12,000 shares of common stock for cash at $7 per share. Issued 2,500 shares of preferred stock for cash at $112 per share.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started