Answered step by step

Verified Expert Solution

Question

1 Approved Answer

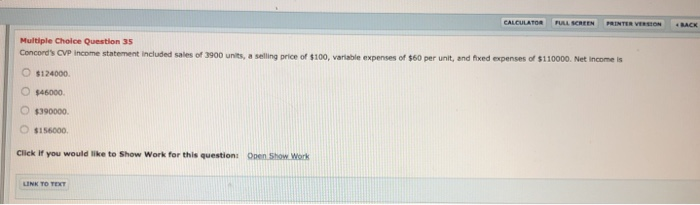

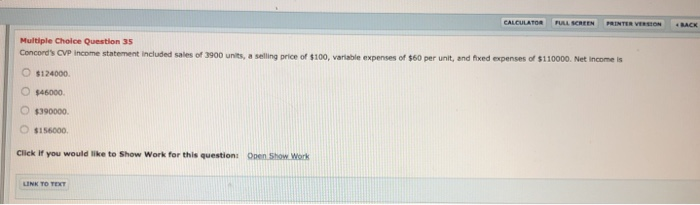

Concords CVP income statement included sales of 3900 units, a selling price of $100, variable expenses of $60 per unit, and fixed expenses of $110000.

Concords CVP income statement included sales of 3900 units, a selling price of $100, variable expenses of $60 per unit, and fixed expenses of $110000. Net income is______

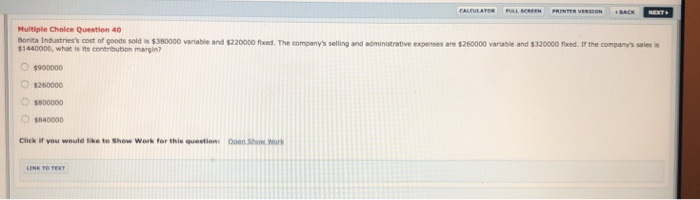

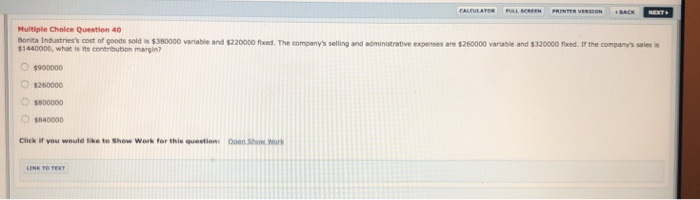

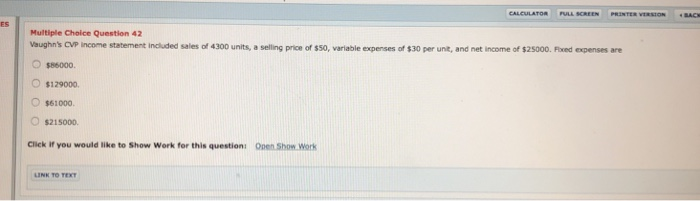

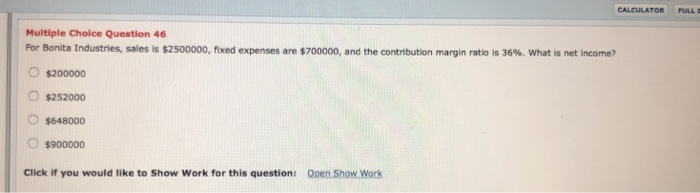

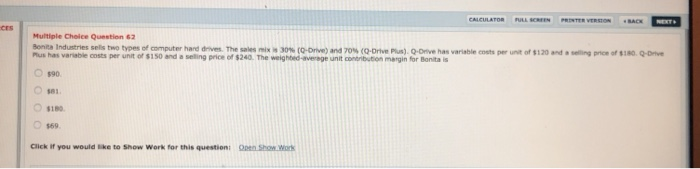

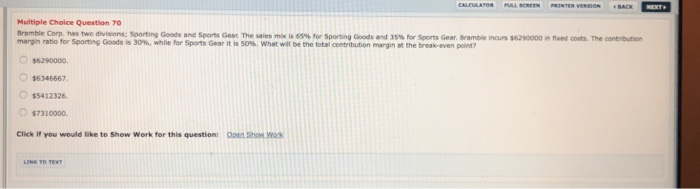

CALCULATOR FULL SCREEN PRINTER VER53 BACK Multiple Choice Question 35 Concord's CVP income statement included sales O $124000. O$46000. O $390000 o $156000. sales of 3900 units, a selling price of $100, variable expenses of $60 per unit, and fixed expenses of $110000. Net income is units, a Click If you would like to Show Work for this question: Open Show Work K TO TEXT Multiple Choice Question 40 Bonita Industries's cost of goods sold is $380000 variable and $220000 fixed. The company's selling and administrative expenses are $260000 variable and $320000 fixed. If the company's sales is $1440000, what is its contribution margin O $900000 O$ 260000 O $800000 Click if you would like to Show Work for this question Ooen Show k ES Multiple Choice Question 42 Vaughn's CVP income statement included sales of 4 00 units, a selling price of s50, variable expenses of $30 per unit, and net income of $25000. Flixed expenses are $86000. o $129000. $61000. O s215000. Click if you would like to Show Work for this questioni Open Show.work INK TO TEXT CALCULATOR FULL Multiple Choice Question 46 For Bonita Industries, sales is $2500000, fixed expenses are $700000, and the contribution margin ratio is 36%, what is net income? O $200000 o $252000 O $648000 O $900000 Click if you would like to Show Work for this question: Open Show Work Multiple Choice Question 62 enna Industries sels two types of mmputrr hard dve. The sales mix-30% ( Pus has variable costs per unit of $150 and a selling price of $240. The weighbed-averege unit conbribution margin for Bonita is onve) and 70% (QDn ems). One has varable costs per ntof$120. rarasoare o$90 $180 $69 Click if you would ike to Show Work for this question Qen Show Work Multiple Choice Question 70 Bramble orp. has twee tions soort ng Goods and Sperts Gea. The sales mix iser + 'o S ringekods ad Sfor Sports Gear en oe nas sooooo n n s margin ratio for Sport ng Goods is 30%, while for Sports Gear it is 50%, what wel be the total ontribut on margin at the treakeven port, . The uonntion O $6290000. 6346567 5412326 $7310000 Click if you would like to Show Work for this question: O ShowWack Bonita Industries cost of goods sold is $380000 variable and $220000 fixed. The companys selling and administrative expenses are $260000 variable and $320000 fixed. if the companys sales is $1440000, what is its controbution margin? _____

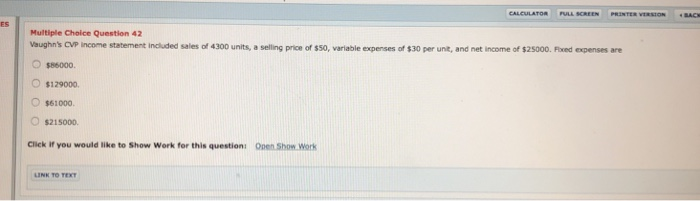

Vaughns CVP income statement included sales of 4300 units, a selling price of $50, variable expenses of $30 per unit, net income of $25000. Fixed expenses are______

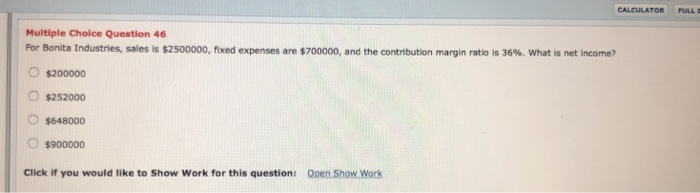

For Bonita Industries, sales is $2,500,000 fixed expenses are $700,000, and the contribution margin ratio is 36%. What is net income?____

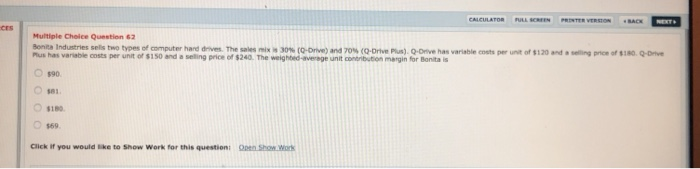

Bonita Industries sells two types of computer hard drives. The sales mix is 30% (Q-Drive) and 70% (Q-Drive Plus). Q-drive has variable costs per unit of $120 and a selling price of $180. Q-drive Plus has variable costs per unit of $150 and a selling price of $240. The weighted average unit contribution margin for Bonita is_____

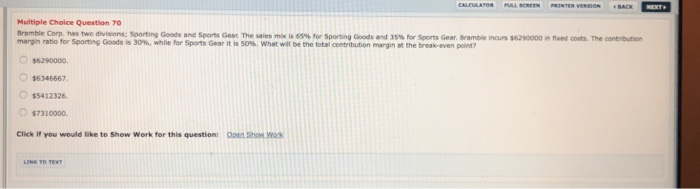

Bramble Corp. had two divisions; Sporting Goods and Sports Gear. The sales mix is 65% for sporting goods and 35% for Sports Gear. Bramble incurs $6290000 in fixed costs. The contribution margin ratio for Sporting Goods is 30%, while for Sports Gear it is 50%. What will be the total contribution margin at the break-even point? _____

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started