Question

Concrete Creations manufactures concrete bird baths that are sold through retail outlets nationwide. The bird baths are made in a two-stage process. In the Forming

Concrete Creations manufactures concrete bird baths that are sold through retail outlets nationwide. The bird baths are made in a two-stage process. In the Forming Department, the concrete is poured into silicone molds where it is allowed to cure and set. Once set, the birdbaths are removed from the mold and sent to the Finishing Department where any imperfections are removed and the birdbaths are sprayed with a special sealant.

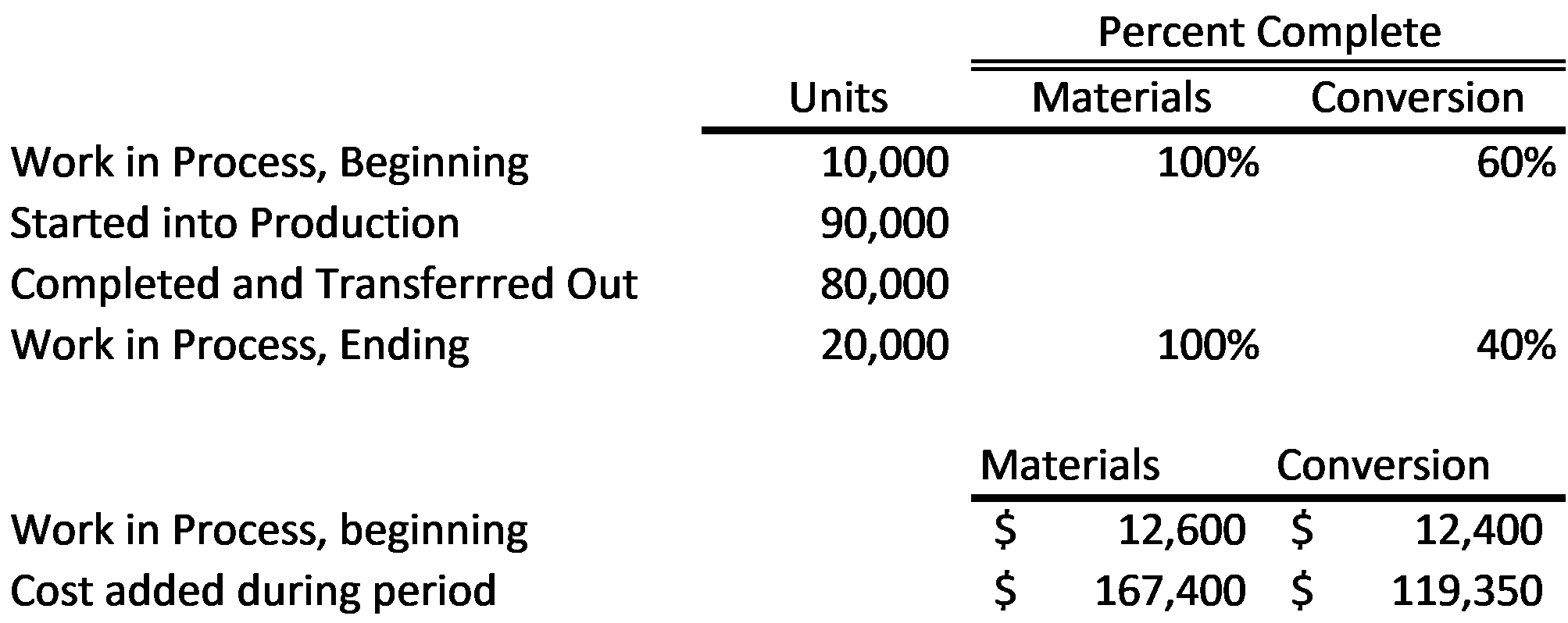

Information for the Forming Department for the month of May is provided below.

Questions

- Assume that Concrete Creations uses the weighted-average method for cost allocation.

Determine the equivalent units of production for the Forming Department for the month of May.

- Assume that Concrete Creations uses the weighted-average method for cost allocation. Compute the cost per equivalent units of production for the Forming Department

- Assume that Concrete Creations uses the weighted-average method for cost allocation.

Calculate the total cost of ending work in process inventory as well as total cost of units transferred out for May.

- Assume that Concrete Creations uses the weighted-average method for cost allocation. Prepare a cost reconciliation report for the Forming Department for May.

- Assume that Concrete Creations used the FIFO method rather than the weighted-average method in its process costing system. Determine the equivalent units of production for the Forming Department for the month of May.

- Assume that Concrete Creations used the FIFO method rather than the weighted-average method in its process costing system. Compute the cost per equivalent units of production for the Forming Department.

- Assume that Concrete Creations used the FIFO method rather than the weighted-average method in its process costing system. Calculate the total cost of ending work in process inventory as well as total cost of units transferred out for May.

- Assume that Concrete Creations used the FIFO method rather than the weighted-average method in its process costing system. Prepare a cost reconciliation report for the Forming Department for May.

- Compare the two cost reconciliation reports (weighted average and FIFO). Identify and comment on any significant differences between the two reports. If you were a manager at Concrete Creations, which approach would you recommend and why? Be sure to identify the advantages and disadvantages to both approaches when making your analysis.

Work in Process, Beginning Started into Production Completed and Transferrred Out Work in Process, Ending Work in Process, beginning Cost added during period Units 10,000 90,000 80,000 20,000 Percent Complete Materials 100% 100% Materials $ $ Conversion 60% 40% Conversion 12,600 $ 12,400 167,400 $ 119,350

Step by Step Solution

3.40 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Assume that Concrete Creations uses the weightedaverage method for cost allocation Determine the equivalent units of production for the Forming Department for the month of May Materials Equiv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started