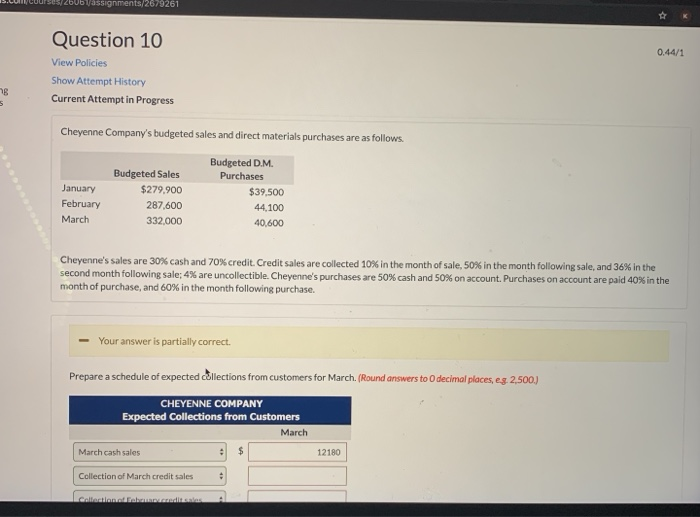

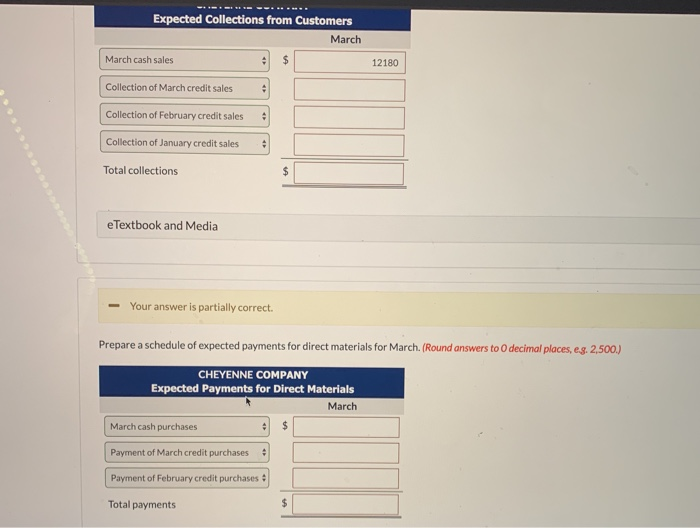

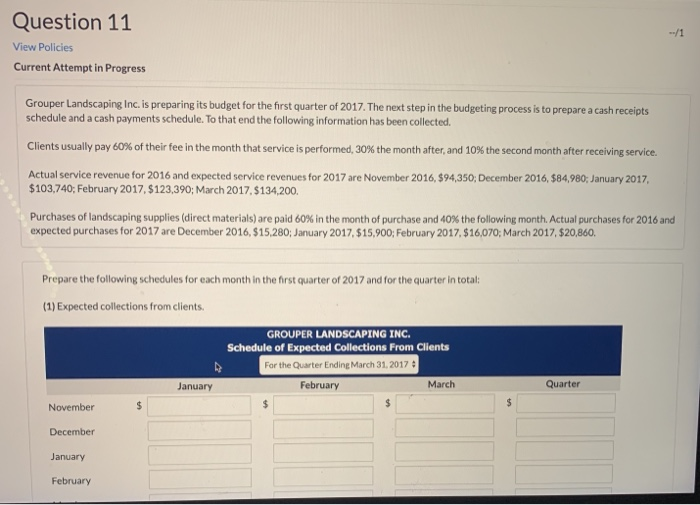

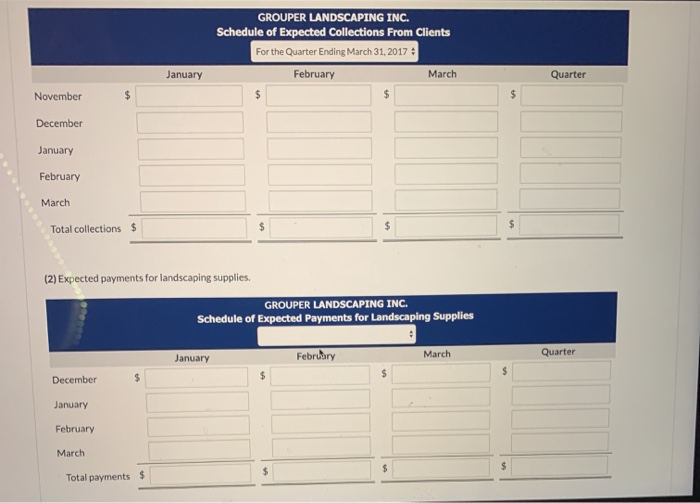

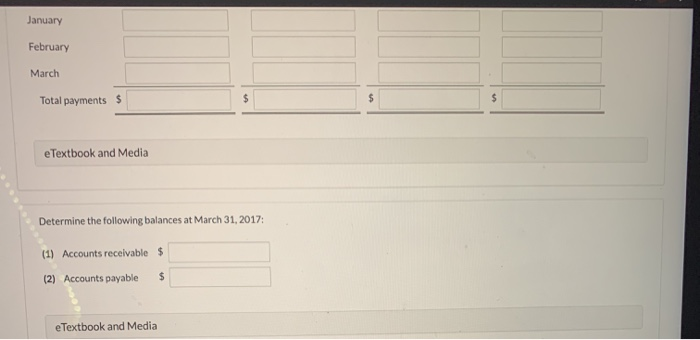

CONCURSOS CUVsign 0.44/1 Question 10 View Policies Show Attempt History Current Attempt in Progress Cheyenne Company's budgeted sales and direct materials purchases are as follows. January February March Budgeted Sales $279.900 287,600 332,000 Budgeted D.M. Purchases $39,500 44.100 40.600 Cheyenne's sales are 30% cash and 70% credit. Credit sales are collected 10% in the month of sale, 50% in the month following sale, and 36% in the second month following sale; 4% are uncollectible. Cheyenne's purchases are 50% cash and 50% on account. Purchases on account are paid 40% in the month of purchase, and 60% in the month following purchase. - Your answer is partially correct. Prepare a schedule of expected cllections from customers for March (Round answers to decimal places, eg 2,500.) CHEYENNE COMPANY Expected Collections from Customers March March cash sales : $ Collection of March credit sales collection mondia l Expected Collections from Customers March March cash sales 12180 Collection of March credit sales Collection of February credit sales - Collection of January credit sales Total collections e Textbook and Media - Your answer is partially correct. Prepare a schedule of expected payments for direct materials for March (Round answers to decimal places, e.g. 2,500) CHEYENNE COMPANY Expected Payments for Direct Materials March March cash purchases $ Payment of March credit purchases Payment of February credit purchases Total payments Question 11 View Policies Current Attempt in Progress Grouper Landscaping Inc. is preparing its budget for the first quarter of 2017. The next step in the budgeting process is to prepare a cash receipts schedule and a cash payments schedule. To that end the following information has been collected. Clients usually pay 60% of their fee in the month that service is performed, 30% the month after, and 10% the second month after receiving service. Actual service revenue for 2016 and expected service revenues for 2017 are November 2016.594,350: December 2016, $84,980: January 2017 $103.740; February 2017. $123,390; March 2017. $134,200. Purchases of landscaping supplies (direct materials) are paid 60% in the month of purchase and 40% the following month. Actual purchases for 2016 and expected purchases for 2017 are December 2016, $15,280, January 2017 $15,900; February 2017. $16,070; March 2017, $20,860. Prepare the following schedules for each month in the first quarter of 2017 and for the quarter in total; (1) Expected collections from clients, GROUPER LANDSCAPING INC. Schedule of Expected Collections From Clients For the Quarter Ending March 31, 2017 : January February March Quarter November December January February GROUPER LANDSCAPING INC. Schedule of Expected Collections From Clients For the Quarter Ending March 31, 2017 : January February March Quarter November December January February March Total collections $ (2) Expected payments for landscaping supplies. GROUPER LANDSCAPING INC. Schedule of Expected Payments for Landscaping Supplies caping Supplies February January March Quarter December January February March Total payments January February March Total payments $ eTextbook and Media Determine the following balances at March 31, 2017: (1) Accounts receivable $ (2) Accounts payable eTextbook and Media