Answered step by step

Verified Expert Solution

Question

1 Approved Answer

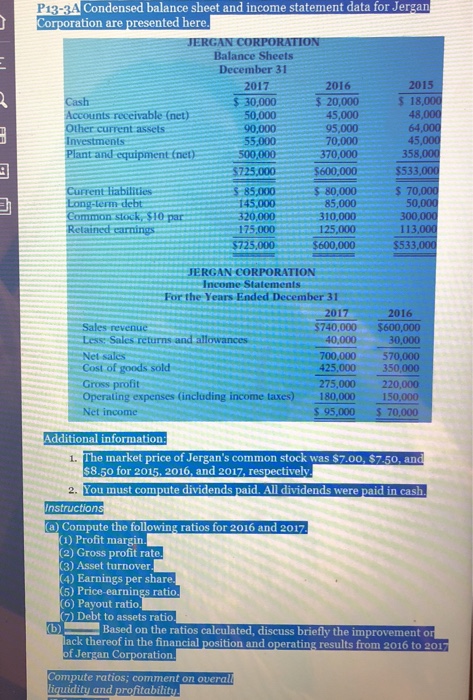

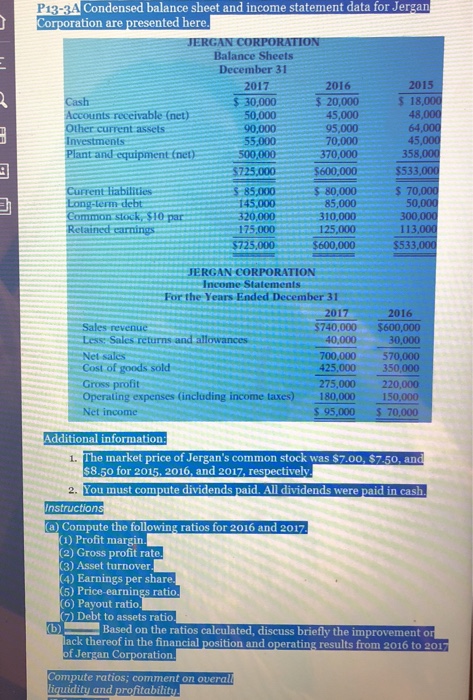

Condensed balance sheet and income statement data forJeran orporation are presented here Balance Sheets December 31 2017 30,000 50,000 90,000 55,000 500 000 $725,000 2016

Condensed balance sheet and income statement data forJeran orporation are presented here Balance Sheets December 31 2017 30,000 50,000 90,000 55,000 500 000 $725,000 2016 2015 S 18,000 20,000 45,000 95,000 70,000 370,000 $600,000 Accounts receivable (net) Other current assets 48,000 64,000 45,000 358,000 $533,000 nvestments Plantand equipment tnep Current liabilities Long-term debt Common stock, S10 Retained carnings $ 80,000 145,00085,000 310,000 175,000 125,000 725,000$600,000 s 70,000 50,000 300,000 113,000 20,000 $533,000 JERGAN CORPORATION Income Statements r the Years Ended December 31 2017 2016 $740,000 $600,000 30,000 700,000570,000 425,000350,000 275,000 220,000 Operaling expenses (including income laxes)180,000150,000 $ 95,000 $ 70,000 les revenue Sales returns and 40,000 Nel sales- Cost of goods sold Gross profit Net income dditional information The market price of Jergan's common stock was $7.00, $7.50, an $8.50 for 2015. 2016, and 2017, respectively 1. 2. You must compute dividends paid. All dividends were paid in cash nstruction a) Compute the following ratios for 2016 and 201 ) Profit margin 2) Gross profit rate 3) Asset turnover 1) Earnings per share 5) Price-earnings ratio 6) Payout ratio 7) Debt to assets ratio Based on the ratios calculated, discuss briefly the improvement o ck thereof in the financial position and operating results from 2016 to 201 f Jergan Corporation ompute ratios; comment on overo uidity and profitabilit

Condensed balance sheet and income statement data forJeran orporation are presented here Balance Sheets December 31 2017 30,000 50,000 90,000 55,000 500 000 $725,000 2016 2015 S 18,000 20,000 45,000 95,000 70,000 370,000 $600,000 Accounts receivable (net) Other current assets 48,000 64,000 45,000 358,000 $533,000 nvestments Plantand equipment tnep Current liabilities Long-term debt Common stock, S10 Retained carnings $ 80,000 145,00085,000 310,000 175,000 125,000 725,000$600,000 s 70,000 50,000 300,000 113,000 20,000 $533,000 JERGAN CORPORATION Income Statements r the Years Ended December 31 2017 2016 $740,000 $600,000 30,000 700,000570,000 425,000350,000 275,000 220,000 Operaling expenses (including income laxes)180,000150,000 $ 95,000 $ 70,000 les revenue Sales returns and 40,000 Nel sales- Cost of goods sold Gross profit Net income dditional information The market price of Jergan's common stock was $7.00, $7.50, an $8.50 for 2015. 2016, and 2017, respectively 1. 2. You must compute dividends paid. All dividends were paid in cash nstruction a) Compute the following ratios for 2016 and 201 ) Profit margin 2) Gross profit rate 3) Asset turnover 1) Earnings per share 5) Price-earnings ratio 6) Payout ratio 7) Debt to assets ratio Based on the ratios calculated, discuss briefly the improvement o ck thereof in the financial position and operating results from 2016 to 201 f Jergan Corporation ompute ratios; comment on overo uidity and profitabilit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started