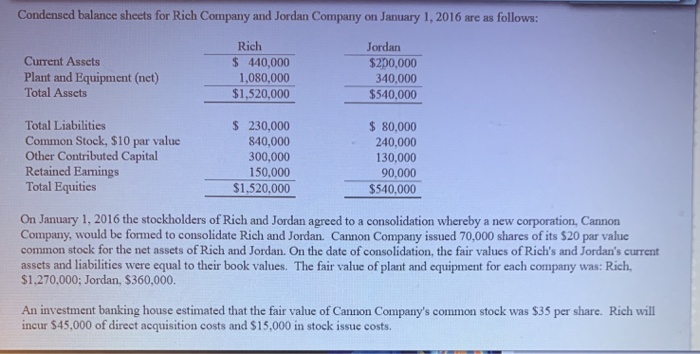

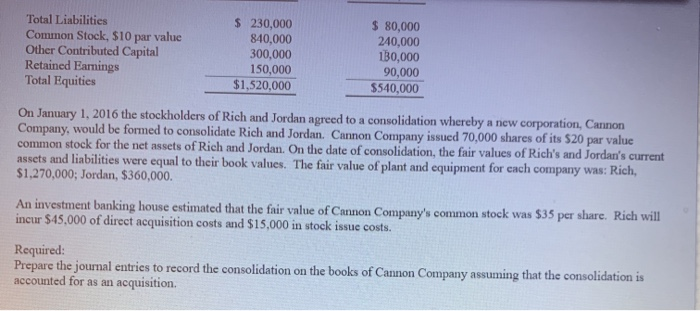

Condensed balance sheets for Rich Company and Jordan Company on January 1, 2016 are as follows: Current Assets Plant and Equipment (nct) Total Assets Rich $ 440,000 1,080,000 $1,520,000 Jordan $200,000 340,000 $540,000 Total Liabilities Common Stock, $10 par value Other Contributed Capital Retained Earings Total Equities $ 230,000 840,000 300,000 150,000 $1,520,000 $ 80,000 240,000 130,000 90,000 $540,000 On January 1, 2016 the stockholders of Rich and Jordan agreed to a consolidation whereby a new corporation, Cannon Company, would be formed to consolidate Rich and Jordan. Cannon Company issued 70,000 shares of its 520 par value common stock for the net assets of Rich and Jordan. On the date of consolidation, the fair values of Rich's and Jordan's current assets and liabilities were equal to their book values. The fair value of plant and equipment for each company was: Rich, $1,270,000; Jordan, $360,000. An investment banking house estimated that the fair value of Cannon Company's common stock was $35 per share. Rich will incur $45,000 of direct acquisition costs and $15,000 in stock issuc costs. Total Liabilities Common Stock, $10 par value Other Contributed Capital Retained Earnings Total Equities $ 230,000 840,000 300,000 150,000 $1,520,000 $ 80,000 240,000 130,000 90,000 $540,000 On January 1, 2016 the stockholders of Rich and Jordan agreed to a consolidation whereby a new corporation, Cannon Company, would be formed to consolidate Rich and Jordan. Cannon Company issued 70,000 shares of its 520 par value common stock for the net assets of Rich and Jordan. On the date of consolidation, the fair values of Rich's and Jordan's current assets and liabilities were equal to their book values. The fair value of plant and equipment for each company was: Rich, $1,270,000; Jordan, $360,000. An investment banking house estimated that the fair value of Cannon Company's common stock was $35 per share. Rich will incur $45,000 of direct acquisition costs and $15,000 in stock issue costs. Required: Prepare the journal entries to record the consolidation on the books of Cannon Company assuming that the consolidation is accounted for as an acquisition