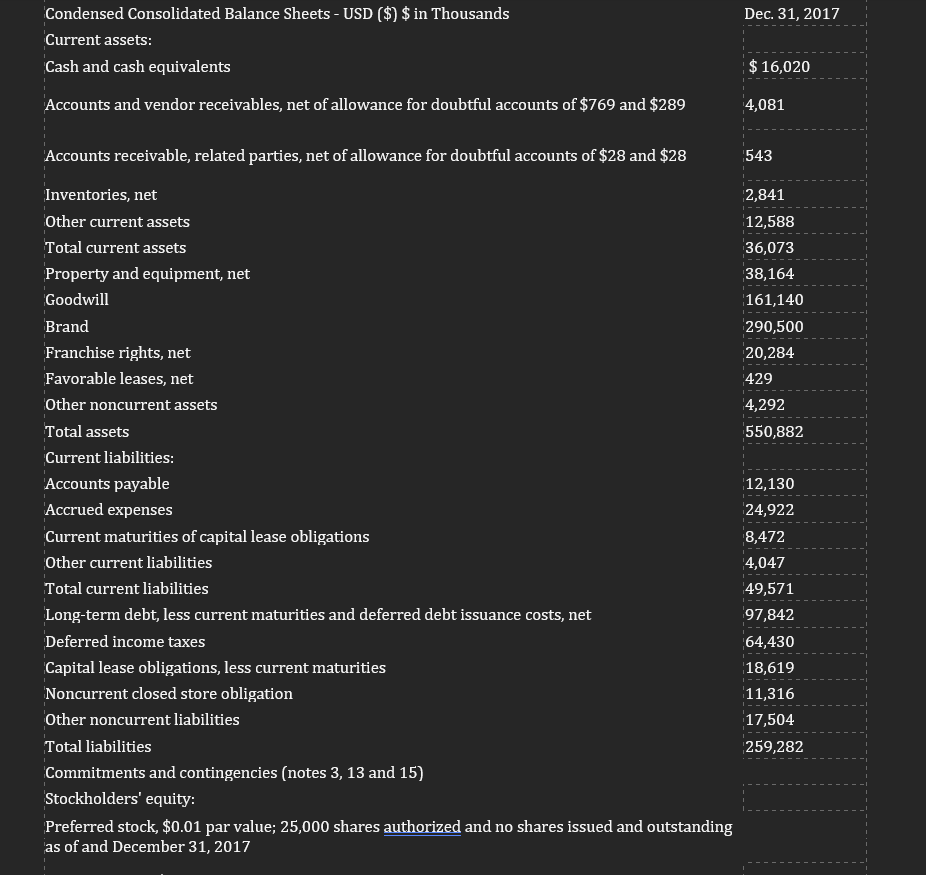

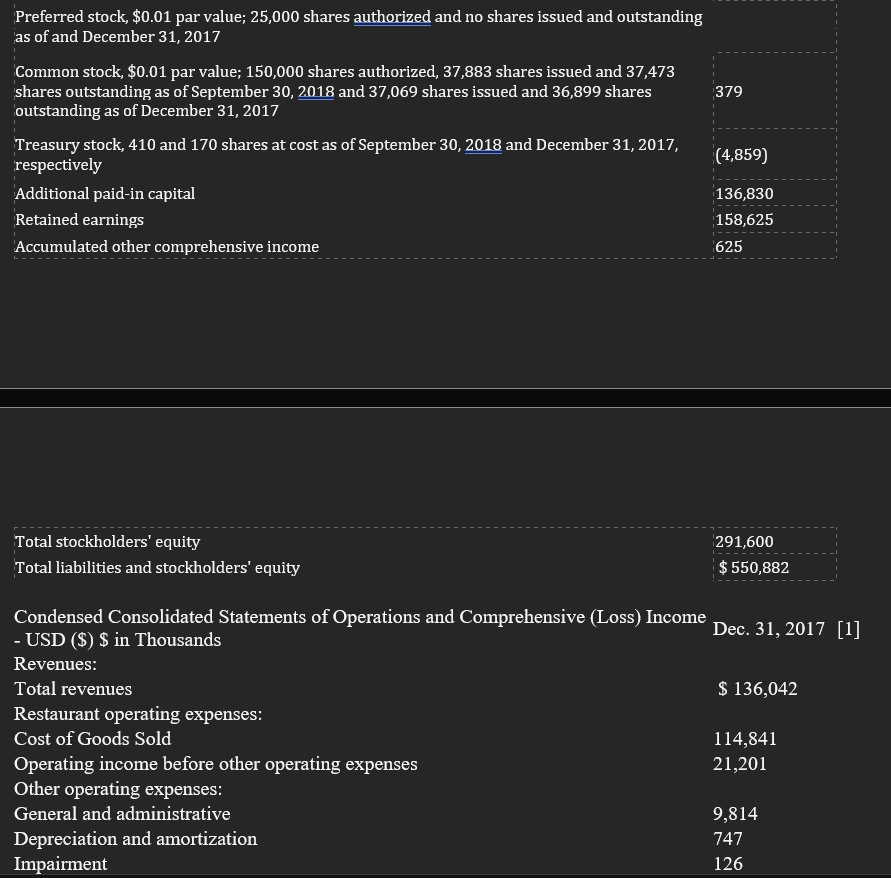

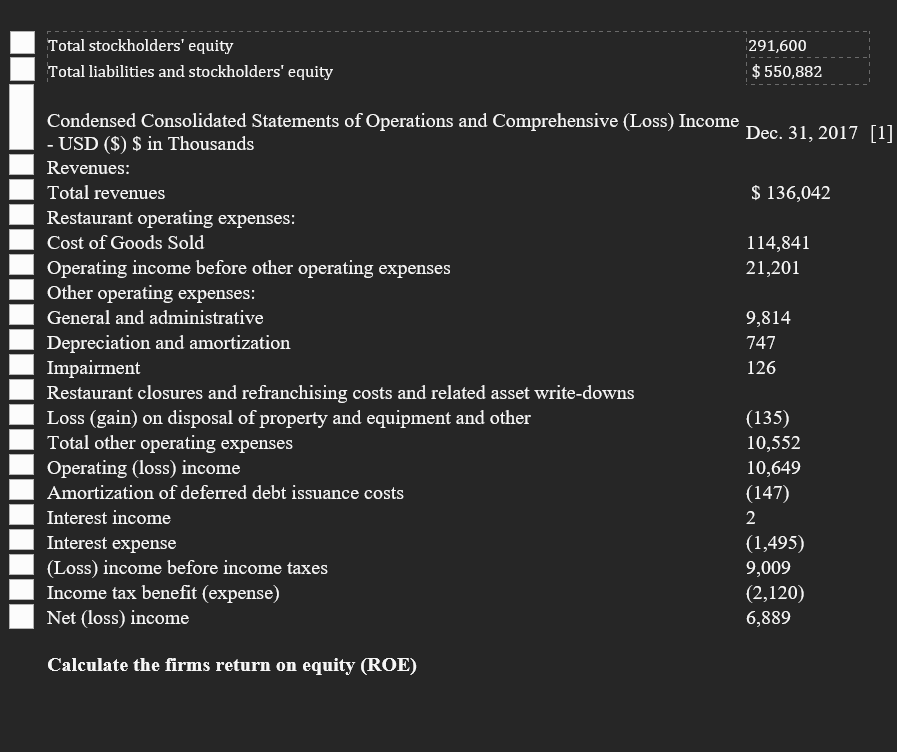

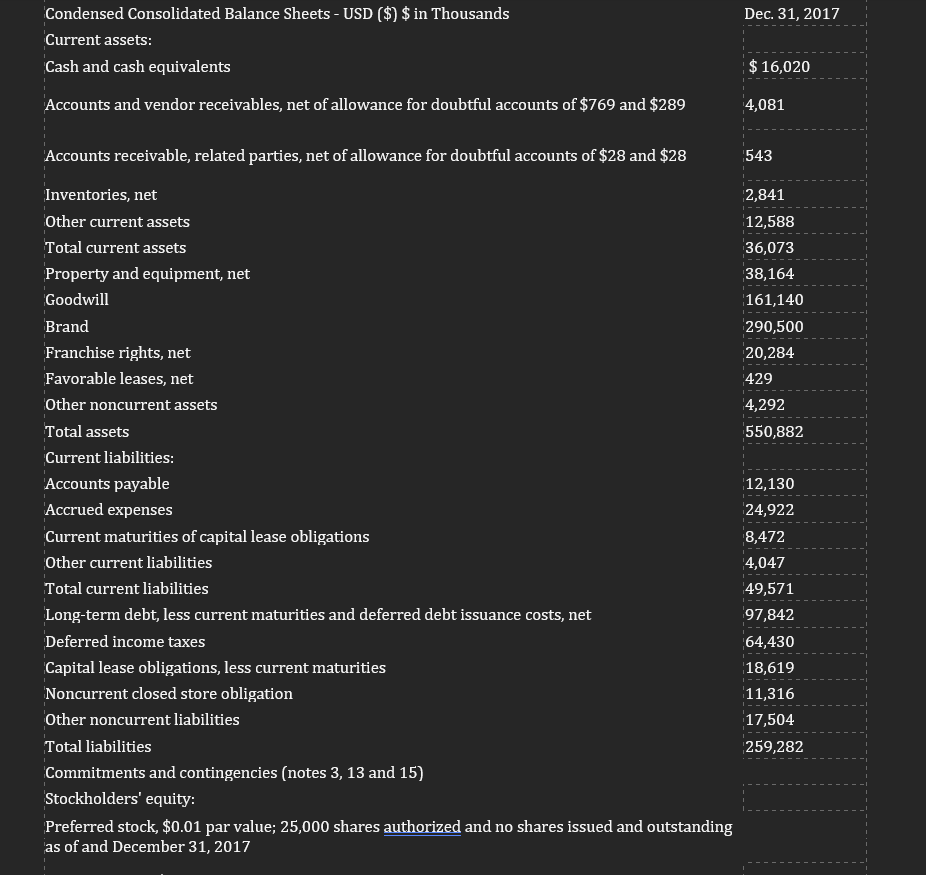

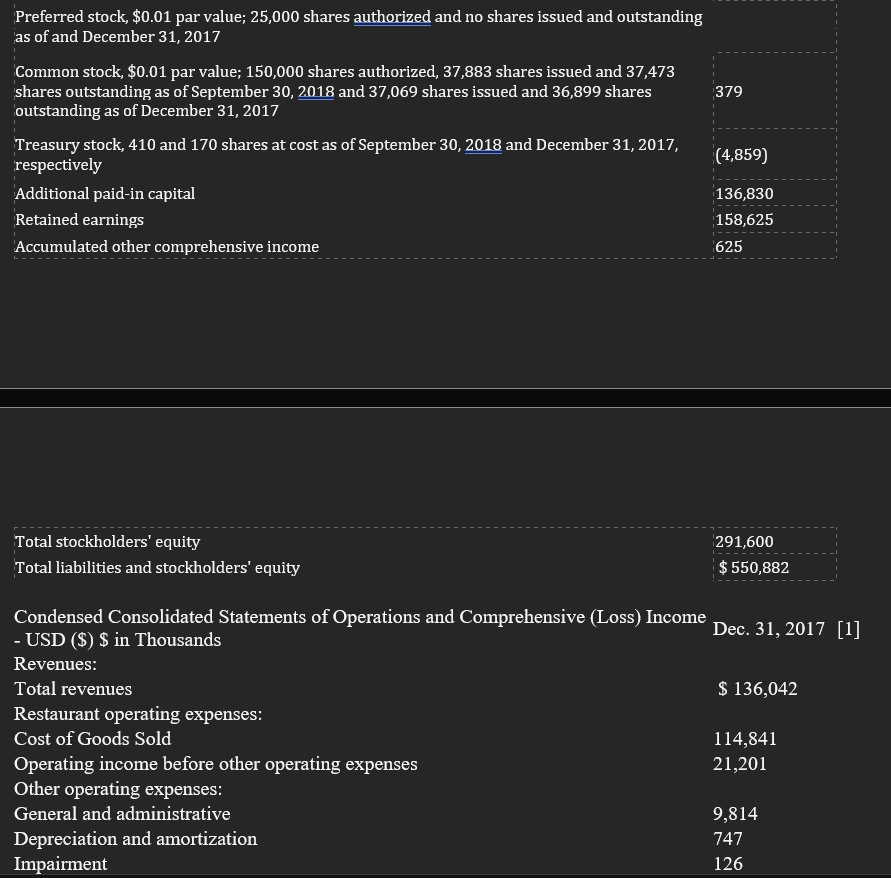

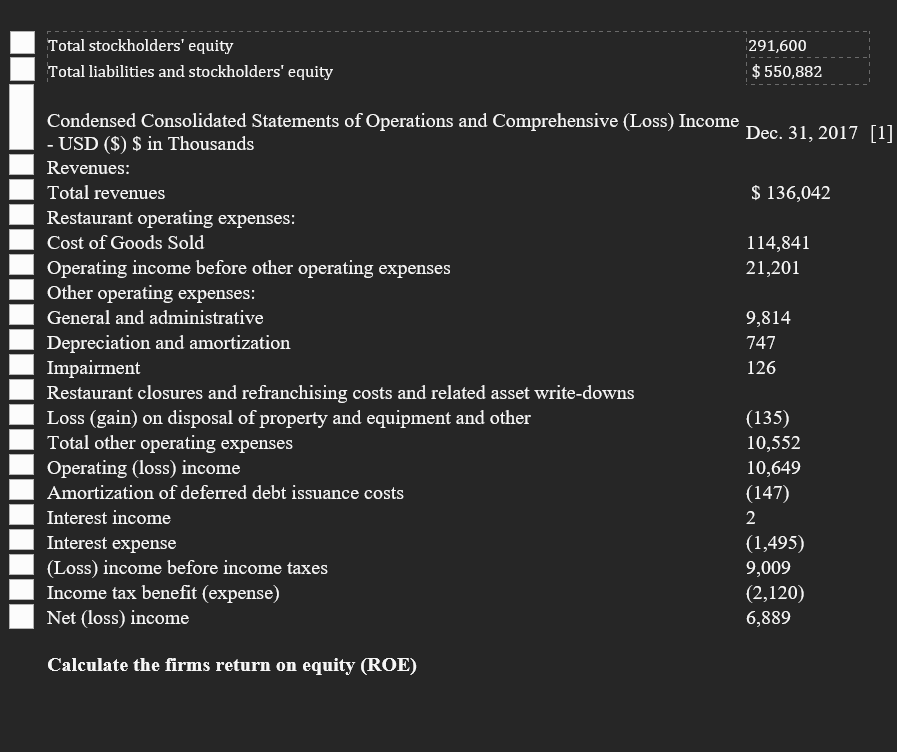

Condensed Consolidated Balance Sheets - USD (\$) \$ in Thousands Current assets: Cash and cash equivalents Accounts and vendor receivables, net of allowance for doubtful accounts of $769 and $289 Accounts receivable, related parties, net of allowance for doubtful accounts of $28 and $28 Inventories, net Other current assets Total current assets Property and equipment, net Goodwill Brand Franchise rights, net Favorable leases, net Other noncurrent assets Total assets Current liabilities: Accounts payable Accrued expenses Current maturities of capital lease obligations Other current liabilities Total current liabilities Long-term debt, less current maturities and deferred debt issuance costs, net Deferred income taxes Capital lease obligations, less current maturities Noncurrent closed store obligation Other noncurrent liabilities Total liabilities Commitments and contingencies (notes 3,13 and 15) Stockholders' equity: Preferred stock, $0.01 par value; 25,000 shares authorized and no shares issued and outstan as of and December 31, 2017 Preferred stock, $0.01 par value; 25,000 shares authorized and no shares issued and outstanding as of and December 31,2017 Common stock, $0.01 par value; 150,000 shares authorized, 37,883 shares issued and 37,473 shares outstanding as of September 30, 2018 and 37,069 shares issued and 36,899 shares loutstanding as of December 31, 2017 Treasury stock, 410 and 170 shares at cost as of September 30, 2018 and December 31, 2017, respectively (4,859) Additional paid-in capital 136,830 Retained earnings 158,625 Accumulated other comprehensive income 625 Total stockholders' equity 291,600 $550,882 Total liabilities and stockholders' equity Condensed Consolidated Statements of Operations and Comprehensive (Loss) Income - USD (\$) \$ in Thousands Revenues: Total revenues Restaurant operating expenses: Cost of Goods Sold Operating income before other operating expenses Other operating expenses: General and administrative Depreciation and amortization Impairment Restaurant closures and refranchising costs and related asset write-downs Loss (gain) on disposal of property and equipment and other Dec. 31, 2017 [1] Total other operating expenses Operating (loss) income $136,042 Amortization of deferred debt issuance costs Interest income (135) Interest expense 114,841 21,201 (Loss) income before income taxes (1,495) Income tax benefit (expense) 9,009 (2,120) Net (loss) income 6,889 Calculate the firms return on equity (ROE)