Answered step by step

Verified Expert Solution

Question

1 Approved Answer

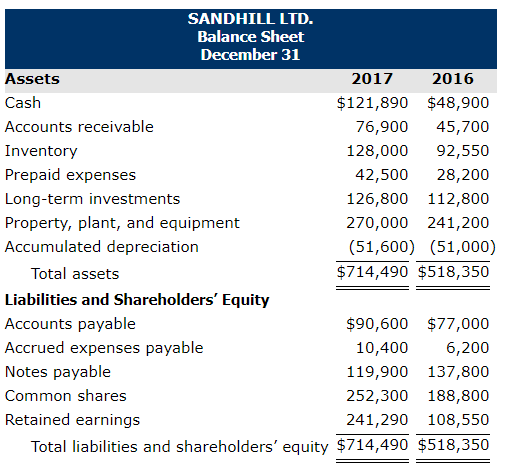

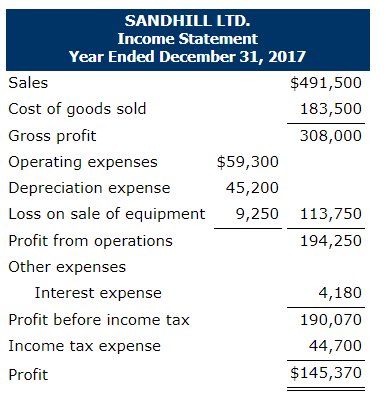

Condensed financial data follow for Sandhill Ltd. E- Perform reports under ASPE. Additional information: 1. New equipment costing $85,900 was purchased for $28,500 cash and

Condensed financial data follow for Sandhill Ltd. E- Perform reports under ASPE.

| Additional information: | ||

| 1. | New equipment costing $85,900 was purchased for $28,500 cash and a $57,400 note payable. | |

| 2. | Equipment with an original cost of $57,100 was sold at a loss of $9,250. | |

| 3. | Notes payable matured during the year and were repaid. | |

| 4. | A long-term investment was acquired for cash. | |

| 5. | Accounts payable relate only to merchandise creditors. | |

| 6. | Accrued expenses payable and prepaid expenses relate to operating expenses. | |

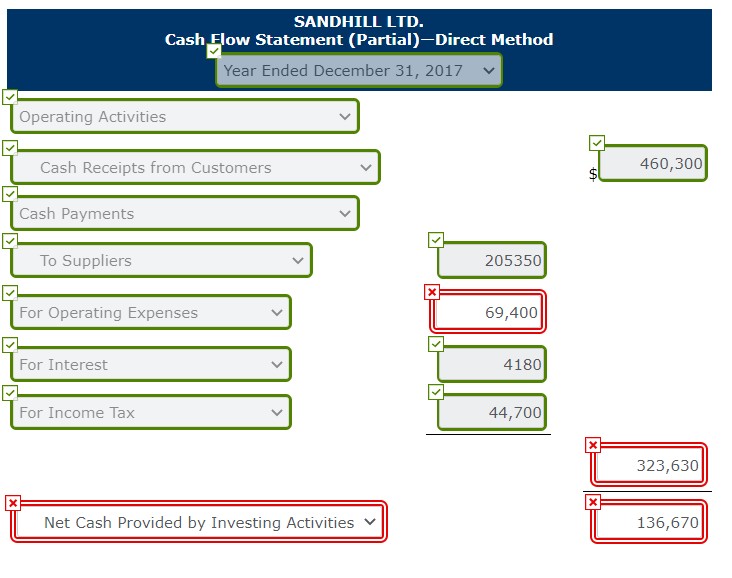

Prepare the operating section of the cash flow statement using the direct method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started