Answered step by step

Verified Expert Solution

Question

1 Approved Answer

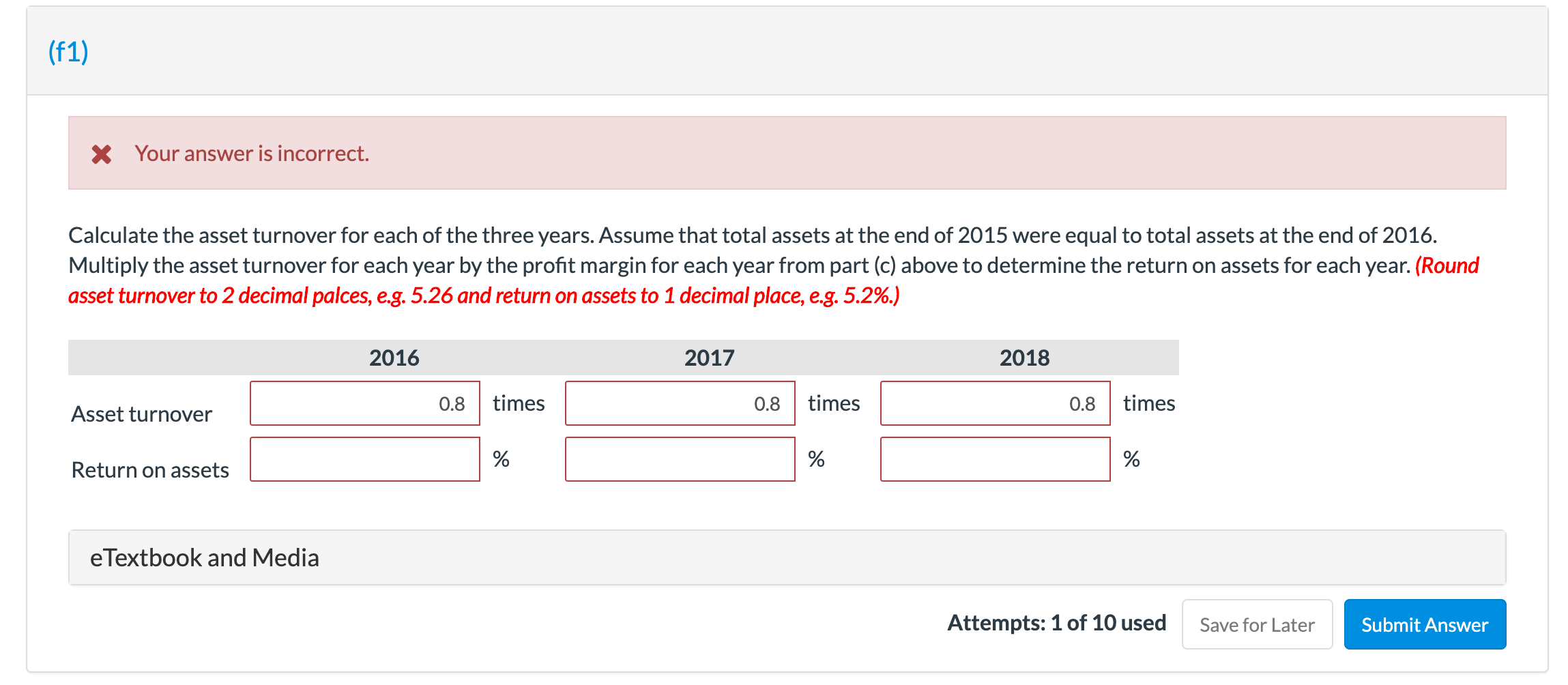

Condensed statement of financial position and income statement data for Elkhardt Ltd. are shown below: ELKHARDT LTD. Statement of Financial Position December 31 (in thousands)

Condensed statement of financial position and income statement data for Elkhardt Ltd. are shown below:

| ELKHARDT LTD. Statement of Financial Position December 31 (in thousands) | |||||||

| 2018 | 2017 | 2016 | |||||

| Assets | |||||||

| Current assets | |||||||

| Cash | $29 | $79 | $199 | ||||

| Accounts receivable | 898 | 706 | 502 | ||||

| Inventory | 1,198 | 798 | 498 | ||||

| Total current assets | 2,125 | 1,583 | 1,199 | ||||

| Property, plant, and equipment (net) | 4,124 | 3,777 | 3,168 | ||||

| Total assets | $6,249 | $5,360 | $4,367 | ||||

| Liabilities and Shareholders Equity | |||||||

| Liabilities | |||||||

| Current liabilities | $600 | $547 | $502 | ||||

| Non-current liabilities | 3,044 | 2,307 | 1,505 | ||||

| Total liabilities | 3,644 | 2,854 | 2,007 | ||||

| Shareholders equity | |||||||

| Common shares | 995 | 995 | 995 | ||||

| Retained earnings | 1,610 | 1,511 | 1,365 | ||||

| Total shareholders equity | 2,605 | 2,506 | 2,360 | ||||

| Total liabilities and shareholders equity | $6,249 | $5,360 | $4,367 | ||||

| ELKHARDT LTD. Income Statement Year Ended December 31 (in thousands) | ||||||

| 2018 | 2017 | 2016 | ||||

| Sales (all on credit) | $4,473 | $4,009 | $3,602 | |||

| Cost of goods sold | 2,503 | 2,113 | 1,812 | |||

| Gross profit | 1,970 | 1,896 | 1,790 | |||

| Operating expenses | 1,436 | 1,475 | 1,498 | |||

| Income from operations | 534 | 421 | 292 | |||

| Interest expense | 191 | 129 | 70 | |||

| Income before income tax | 343 | 292 | 222 | |||

| Income tax expense | 86 | 73 | 56 | |||

| Net income | $257 | $219 | $166 | |||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started