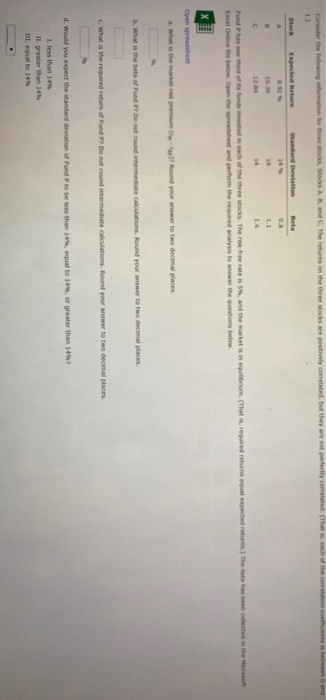

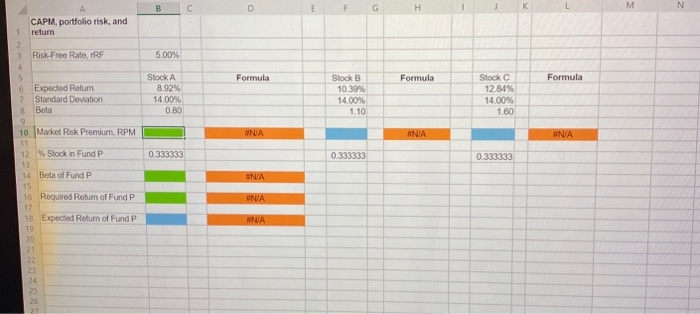

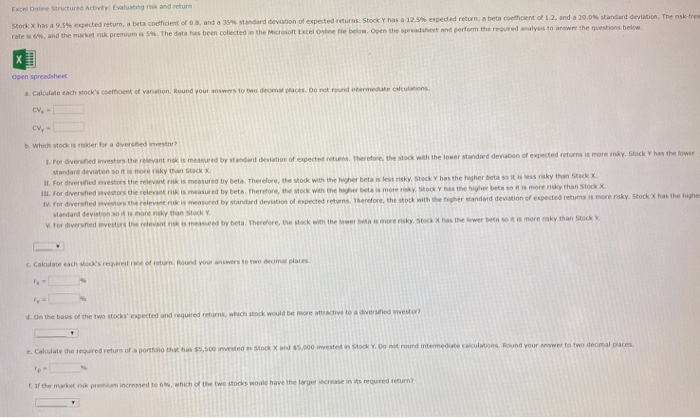

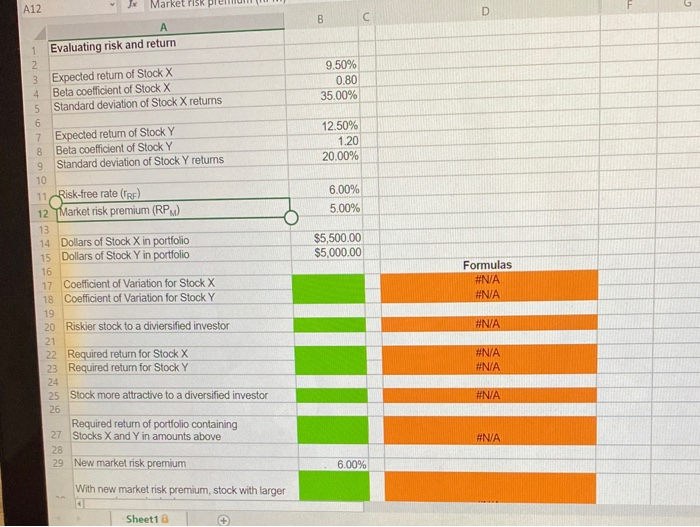

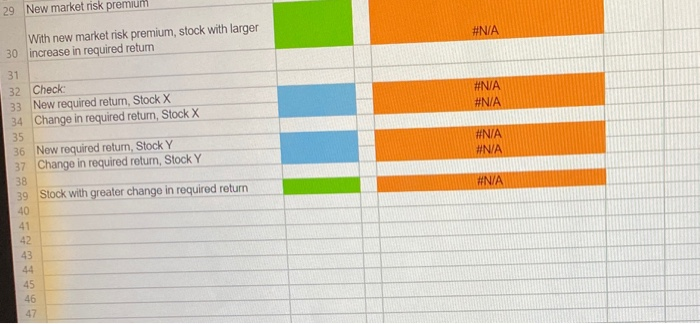

Conder the following to the west and the returns on the the stocks are pouvely correlated, but they went Stock Expected Return Standard deviation required returns al expected returns the data han ded in the Microso Fund Phasone trad e m ach of the the The free rates and the market in quorum. (That Excel Online below. Open the present and perform the required analysis to answer the questions below Open spreadsheet What is the market pre Round your answer to two decimal places. b. What is the bea of Fund P7 De not round i mmediate calculations. Round your answer to two decimal places. What is the required return of Fund P? Do not round intermediate calculations. Round your answer to two decimal places d. Would you expect the standard deviation of Fund P to be less than 149, equal to 14. or greater than 1497 1. less than 14% II. greater than 14 TEL. equal to 144 B CAPM, portfolio risk, and return 1 3 Risk-Free Rate, IRF 5.00 Formula Formula Formula 6 7 B Expected Retur Standard Deviation Bata Stock A 8.92% 1400% 0.80 Slock B 10.39% 14.00% Stock C 12.84% 14.00% 1.10 1.80 10 Market Risk Premium, RPM WNIA DNIA % Stock in Fund P 0.333333 0.333333 0.333333 12 13 14 Beta of Fund P #NA 16 Required Return of Fund P UNA Expected Return of Fund P INA Excel Online structured Activity Evaluating and return Stock Xhosa 9.5% expected retum, a beta coefficient of 0.8, and a standard deviation of expected returns Stock Y has a 12. expected return, beta coefficient of 1.2. and a 20.0 standard deviation. The risk-free rates and the market nik premium is 5%. The data has been collected the Microsoft Excel Online below. Open the spreadsheet and perform the required analysis tow er the questions below. Open spreadsheet 3. Calculate each stock's comment of antion Round your answers to two places. Do CV- which stock is sker for a dvered investor 1. For dvered investors the relevantnisk is measured by stand deviation of expected returns. Therefore, the stock with the lower standard deviation of expected returns is morensky stock Y has the lower standard deviation so it is more sky transack IL For diversified westors the relevant rok is measured by beta Therefore, the stock with the higher beta is less risky Stock has the herbeta so it is less risky than stock III. For divenhed vestors the relevant is measured by beta Therefore, the Mock with the bes more , has the higher bets so is morensky than stock x TV For diverted vestors the relevant is measured by standard deviation of expected returns. Therefore, the stock with the higher standard deviation of expected retumst more risky. Stock x has the highes Handard deviations is more sky than stock For diverted investors the relevantnis m e d try beta Therefore, the stock with the barbeta is morensky stock x has the lower beta so it is morensky than Stock Calculate each s regu your awers to two decimal places , which stock would b e On the bus of the two stockspected and required attractive Calculate the required return of a t o the $5,500 invested Stock X and 55.000 inwested y. Do not found intermediate calculations, Round your answer to two dermal places If the market risk premium increased to which of the two stocks would have the larger increase in its recured return A12 T Market PSR premium 1 Evaluating risk and return 9.50% 0.80 3 4 5 Expected return of Stock X Beta coefficient of Stock X Standard deviation of Stock X returns 35.00% 7 8 9 Expected return of Stock Y Beta coefficient of Stock Y Standard deviation of Stock y returns 12.50% 1.20 20.00% 11 Risk-free rate (TRF) 12 TMarket risk premium (RP) 6.00% 5.00% 14 15 Dollars of Stock X in portfolio Dollars of Stock Y in portfolio $5,500.00 $5,000.00 Formulas #NA 17 18 Coefficient of Variation for Stock X Coefficient of Variation for Stock Y #N/A 20 Riskier stock to a diviersified investor #N/A 22 23 Required return for Stock X Required return for Stock Y #N/A #N/A 25 Stock more attractive to a diversified investor #NA Required return of portfolio containing 27 Stocks X and Y in amounts above #NA 29 New market risk premium 6.00% With new market risk premium, stock with larger Sheet1 a + 29 New market risk premium #N/A With new market risk premium, stock with larger 30 increase in required retum 31 32 Check 33 New required retum, Stock X 34 Change in required return, Stock X #NA #N/A #N/A #N/A 36 New required return, Stock Y Change in required return, Stock Y #N/A 39 Stock with greater change in required return