Answered step by step

Verified Expert Solution

Question

1 Approved Answer

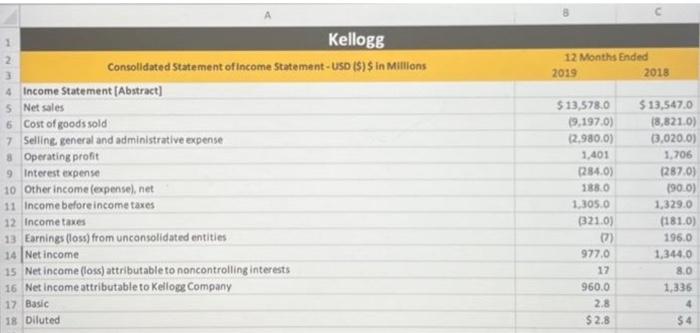

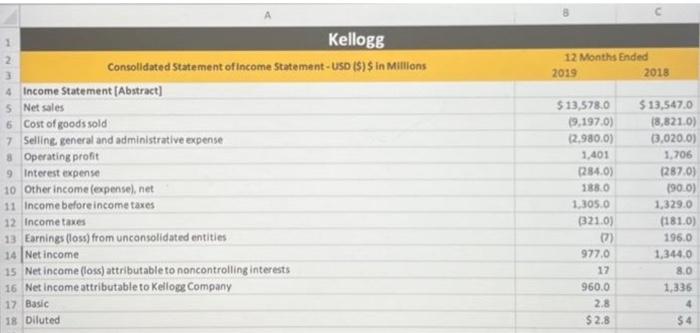

Conduct a cause of change analysis to identify what caused the change in Kellogg's net income from 2018 to 2019. Which line item on Kellogg's

Conduct a cause of change analysis to identify what caused the change in Kellogg's net income from 2018 to 2019. Which line item on Kellogg's income statements caused the largest change in Kellogg's 2019 net income. Do you think this line item will continue to impact Kellogg's net income in 2020? (Note: For full credit, you must explain why you think this item will or will not continue to impact Kellogg's net income.)

\begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|l|}{ Kellogg } \\ \hline \multirow{2}{*}{ Consolidated Statement of income Statement - USO (\$)\$ in Millions } & \multicolumn{2}{|c|}{12 Months Ended } \\ \hline & 2019 & 2018 \\ \hline \multicolumn{3}{|l|}{ Income Statement [Abstract] } \\ \hline Net sales & $13,578.0 & $13,547.0 \\ \hline Cost of goodssold & (9,197.0) & (8,821.0) \\ \hline Selline general and administrative expense & (2,980.0) & (3,020.0) \\ \hline Operating profit & 1,401 & 1,706 \\ \hline Interest expense & [284.0) & (287.0) \\ \hline Other income (oxpense), net & 188.0 & (90.0) \\ \hline Income before income taxes & 1.305 .0 & 1,329.0 \\ \hline Income taxes & (321.0) & (181.0) \\ \hline Earnings (loss) from unconsolidated entities & (n) & 196.0 \\ \hline Net income & 977.0 & 1,344.0 \\ \hline Net income (loss) attributable to noncontrolling interests & 17 & 8.0 \\ \hline Net income attributable to Kellogs Company & 960.0 & 1,336 \\ \hline Basic & 2.8 & 4 \\ \hline Diluted & $2.8 & $4 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started