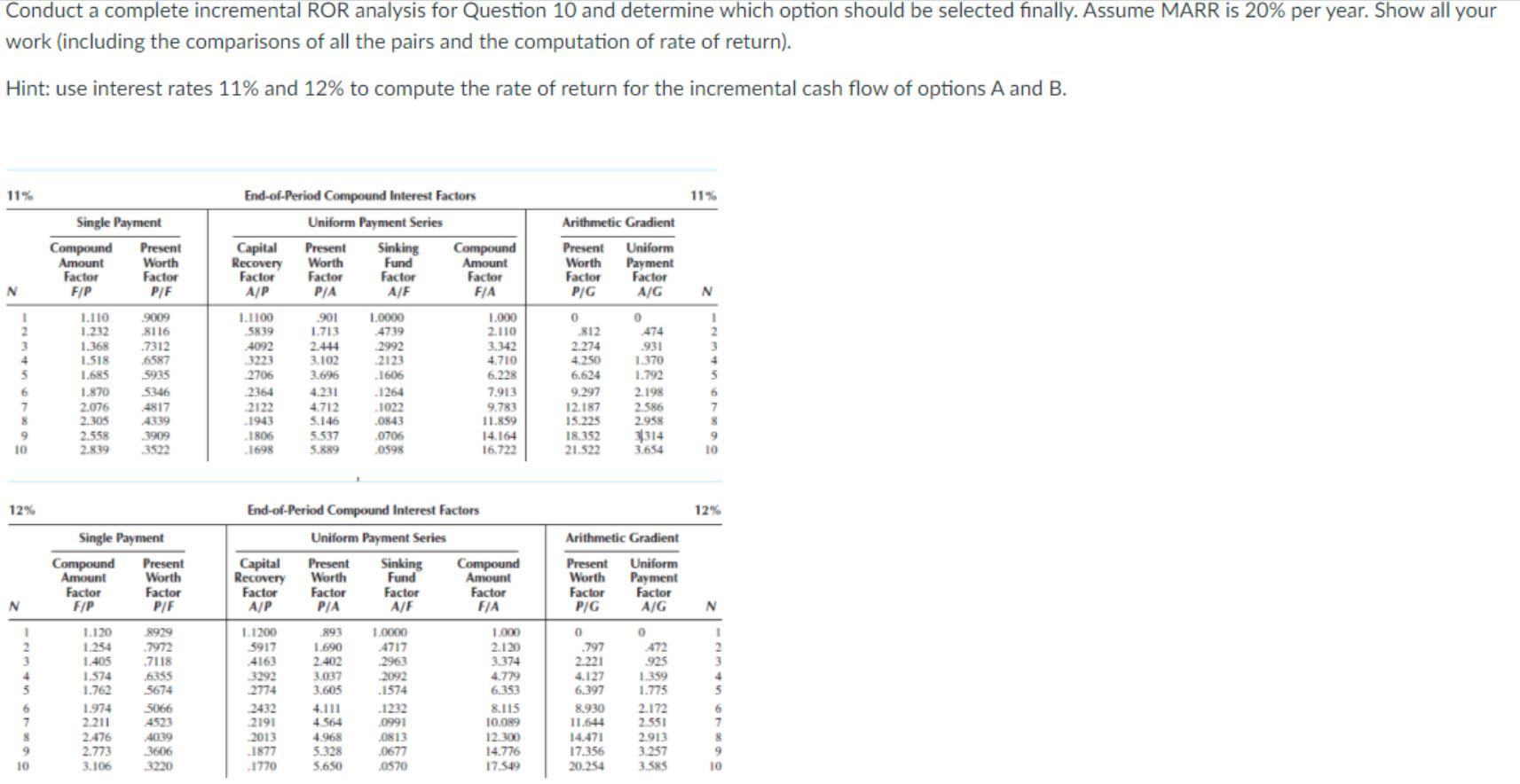

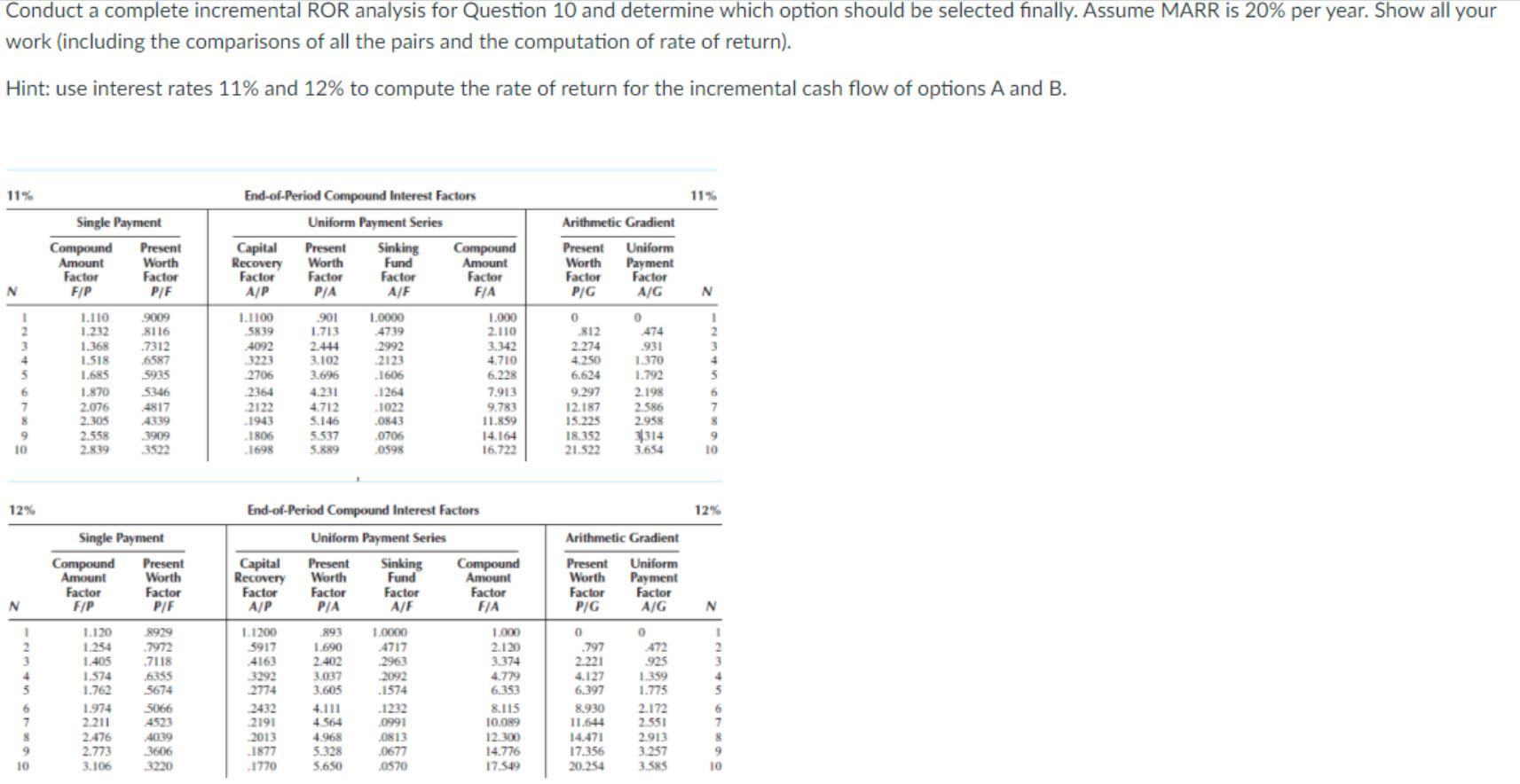

Conduct a complete incremental ROR analysis for Question 10 and determine which option should be selected finally. Assume MARR is 20% per year. Show all your work (including the comparisons of all the pairs and the computation of rate of return). Hint: use interest rates 11% and 12% to compute the rate of return for the incremental cash flow of options A and B. 11% 11% Single Payment Compound Present Amount Worth Factor Factor End-of-Period Compound Interest Factors Uniform Payment Series Capital Present Sinking Compound Recovery Worth Fund Amount Factor Factor Factor Factor A/F Arithmetic Gradient Present Uniform Worth Payment Factor Factor P/G N FIP P/E A/P P/A F/A A/G N 1 2 3 4 3 6 7 8 9 10 1.110 1.232 1.368 1.518 1.683 1.870 2.076 2.305 2.558 2.839 9009 8116 .7312 6587 3935 5346 4817 4339 .3909 3522 1.1100 5839 4092 3223 2706 2364 2122 1943 1806 1698 .901 1.713 2.444 3.102 3.696 4.231 4.712 5.146 5.537 5.889 1.0000 4739 2992 2123 1606 .1264 1022 .0843 0705 0598 1000 2.110 3.342 4.710 6.228 7.913 9.783 11.859 14.164 16.722 0 .812 2.274 4.250 6.624 9.297 12.187 15.225 18.352 21.522 0 474 .931 1.370 1.792 2.198 2.586 2.958 3314 3.654 4 5 6 7 8 9 10 12% 12% Arithmetic Gradient Single Payment Compound Present Amount Worth Factor Factor F/P P/F End-of-Period Compound Interest Factors Uniform Payment Series Capital Present Sinking Compound Recovery Worth Fund Amount Factor Factor Factor A/P P/A A/F Present Worth Uniform Payment Factor Factor Factor N F/A P/G A/G N 1 2 3 4 5 5 1.120 1.254 1.405 1.574 1.762 1.974 2.211 2.476 2.773 3.106 8929 .7972 .7118 6355 5674 5066 4523 4039 3606 3220 1.1200 3917 4163 3292 2774 2432 2191 2013 .1877 .1770 893 1.690 2.402 3.037 3.605 4.111 4.564 4.968 5.328 5,650 1.0000 4717 2963 2092 .1574 .1232 0991 0813 .0677 0570 1.000 2.120) 3.374 4.779 6.353 8.115 10.089 12.300 14.776 17.549 0 .797 2.221 4.127 6.397 8.930 11.644 14.471 17.356 20.254 0 .472 925 1.359 1.775 2.172 2551 2.913 3.257 3.585 6 7 8 6 7 8 9 10 10 Conduct a complete incremental ROR analysis for Question 10 and determine which option should be selected finally. Assume MARR is 20% per year. Show all your work (including the comparisons of all the pairs and the computation of rate of return). Hint: use interest rates 11% and 12% to compute the rate of return for the incremental cash flow of options A and B. 11% 11% Single Payment Compound Present Amount Worth Factor Factor End-of-Period Compound Interest Factors Uniform Payment Series Capital Present Sinking Compound Recovery Worth Fund Amount Factor Factor Factor Factor A/F Arithmetic Gradient Present Uniform Worth Payment Factor Factor P/G N FIP P/E A/P P/A F/A A/G N 1 2 3 4 3 6 7 8 9 10 1.110 1.232 1.368 1.518 1.683 1.870 2.076 2.305 2.558 2.839 9009 8116 .7312 6587 3935 5346 4817 4339 .3909 3522 1.1100 5839 4092 3223 2706 2364 2122 1943 1806 1698 .901 1.713 2.444 3.102 3.696 4.231 4.712 5.146 5.537 5.889 1.0000 4739 2992 2123 1606 .1264 1022 .0843 0705 0598 1000 2.110 3.342 4.710 6.228 7.913 9.783 11.859 14.164 16.722 0 .812 2.274 4.250 6.624 9.297 12.187 15.225 18.352 21.522 0 474 .931 1.370 1.792 2.198 2.586 2.958 3314 3.654 4 5 6 7 8 9 10 12% 12% Arithmetic Gradient Single Payment Compound Present Amount Worth Factor Factor F/P P/F End-of-Period Compound Interest Factors Uniform Payment Series Capital Present Sinking Compound Recovery Worth Fund Amount Factor Factor Factor A/P P/A A/F Present Worth Uniform Payment Factor Factor Factor N F/A P/G A/G N 1 2 3 4 5 5 1.120 1.254 1.405 1.574 1.762 1.974 2.211 2.476 2.773 3.106 8929 .7972 .7118 6355 5674 5066 4523 4039 3606 3220 1.1200 3917 4163 3292 2774 2432 2191 2013 .1877 .1770 893 1.690 2.402 3.037 3.605 4.111 4.564 4.968 5.328 5,650 1.0000 4717 2963 2092 .1574 .1232 0991 0813 .0677 0570 1.000 2.120) 3.374 4.779 6.353 8.115 10.089 12.300 14.776 17.549 0 .797 2.221 4.127 6.397 8.930 11.644 14.471 17.356 20.254 0 .472 925 1.359 1.775 2.172 2551 2.913 3.257 3.585 6 7 8 6 7 8 9 10 10