Conduct a financial analysis for Costco, using both common-sized statements and ratios over each year provided in Exhibit 1. Then use the data in Exhibits 5 and 6 to do as much of a cross-sectional analysis as possible.

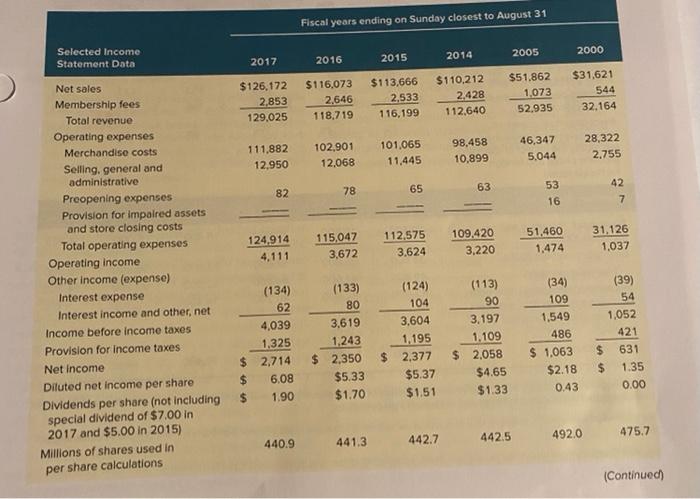

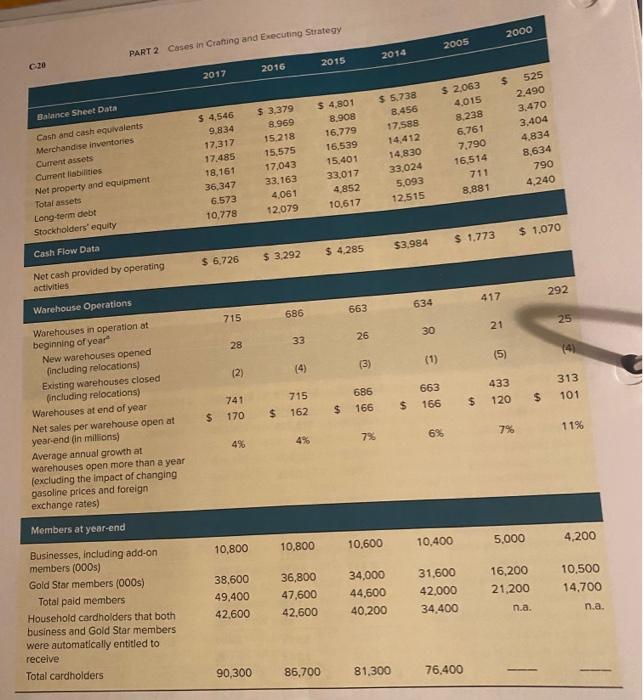

Fiscal years ending on Sunday closest to August 31 2005 2014 2000 2016 2017 2015 $126,172 2,853 129,025 $116,073 2,646 118,719 $113,666 2,533 116,199 $110.212 2,428 112,640 $51.862 1,073 52.935 $31,621 544 32,164 111.882 12,950 102,901 12,068 101,065 11.445 98,458 10,899 46,347 5.044 28,322 2.755 82 78 63 65 53 16 42 7 124,914 4,111 115,047 3,672 112,575 3.624 109,420 3,220 51,460 1,474 Selected Income Statement Data Net sales Membership fees Total revenue Operating expenses Merchandise costs Selling, general and administrative Preopening expenses Provision for impaired assets and store closing costs Total operating expenses Operating income Other income (expense) Interest expense Interest income and other, net Income before income taxes Provision for Income taxes Net Income Diluted net income per share Dividends per share (not including special dividend of $7.00 in 2017 and $5.00 in 2015) Millions of shares used in per share calculations 31,126 1,037 (124) 104 (134) 62 4,039 1,325 $ 2,714 $ 6.08 $ 1.90 (133) 80 3,619 1,243 $ 2,350 $5.33 $1.70 (113) 90 3,197 1,109 $ 2,058 $4.65 $1.33 3,604 1,195 2,377 $5.37 $1.51 (34) 109 1,549 486 $ 1,063 $2.18 (39) 54 1,052 421 631 $ 1.35 0.00 $ 0.43 440.9 441.3 442.7 442.5 492.0 475.7 (Continued) 2000 2005 PART 2 Cases in Crafting and Executing Strategy 2014 2015 C20 2016 2017 Balance Sheet Data Cash and cash equivalents Merchandise inventores Current assets Current Mobilities Net property and equipment Total assets Long term debt Stockholders' equity $4,546 9.834 17,317 17,485 18,161 36,347 6 573 10,778 $ 525 2,490 3.470 3,404 4.834 8,634 $ 4,801 8.908 16,779 16,539 15,401 33,017 4,852 10.617 $ 3,379 8.969 15.218 15,575 17,043 33.163 4,061 12,079 $ 5.738 8,456 17,588 14,412 14,830 33,024 5,093 12,515 $ 2,063 4,015 8.238 6,761 7,790 16,514 711 8.881 790 4,240 $ 1.070 $3,984 $ 1.773 Cash Flow Data $ 6,726 $ 3.292 $ 4,285 Net cash provided by operating activities 292 417 663 634 Warehouse Operations 715 686 25 30 21 33 26 28 (1) (5) (3) (4) 686 166 313 101 433 $ 120 663 $ 166 715 162 741 170 $ $ Warehouses in operation at beginning of year New warehouses opened (including relocations) Exsting warehouses closed including relocations) Warehouses at end of year Net sales per warehouse open at year-end (in milions Average annual growth at warehouses open more than a year (excluding the impact of changing gasoline prices and foreign exchange rates) $ $ 7% 11% 6% 796 4% 10,400 5.000 4,200 10.800 10.800 10.600 Members at year-end Businesses, including add-on members (000s) Gold Star members (000) Total paid members Household cardholders that both business and Gold Star members were automatically entitled to receive Total cardholders 10.500 14,700 36,800 47,600 42.600 38.600 49,400 42.600 16,200 21,200 34,000 44,600 40.200 31,600 42.000 34,400 n.a. n.a. 90,300 86,700 81,300 76.400 Fiscal years ending on Sunday closest to August 31 2005 2014 2000 2016 2017 2015 $126,172 2,853 129,025 $116,073 2,646 118,719 $113,666 2,533 116,199 $110.212 2,428 112,640 $51.862 1,073 52.935 $31,621 544 32,164 111.882 12,950 102,901 12,068 101,065 11.445 98,458 10,899 46,347 5.044 28,322 2.755 82 78 63 65 53 16 42 7 124,914 4,111 115,047 3,672 112,575 3.624 109,420 3,220 51,460 1,474 Selected Income Statement Data Net sales Membership fees Total revenue Operating expenses Merchandise costs Selling, general and administrative Preopening expenses Provision for impaired assets and store closing costs Total operating expenses Operating income Other income (expense) Interest expense Interest income and other, net Income before income taxes Provision for Income taxes Net Income Diluted net income per share Dividends per share (not including special dividend of $7.00 in 2017 and $5.00 in 2015) Millions of shares used in per share calculations 31,126 1,037 (124) 104 (134) 62 4,039 1,325 $ 2,714 $ 6.08 $ 1.90 (133) 80 3,619 1,243 $ 2,350 $5.33 $1.70 (113) 90 3,197 1,109 $ 2,058 $4.65 $1.33 3,604 1,195 2,377 $5.37 $1.51 (34) 109 1,549 486 $ 1,063 $2.18 (39) 54 1,052 421 631 $ 1.35 0.00 $ 0.43 440.9 441.3 442.7 442.5 492.0 475.7 (Continued) 2000 2005 PART 2 Cases in Crafting and Executing Strategy 2014 2015 C20 2016 2017 Balance Sheet Data Cash and cash equivalents Merchandise inventores Current assets Current Mobilities Net property and equipment Total assets Long term debt Stockholders' equity $4,546 9.834 17,317 17,485 18,161 36,347 6 573 10,778 $ 525 2,490 3.470 3,404 4.834 8,634 $ 4,801 8.908 16,779 16,539 15,401 33,017 4,852 10.617 $ 3,379 8.969 15.218 15,575 17,043 33.163 4,061 12,079 $ 5.738 8,456 17,588 14,412 14,830 33,024 5,093 12,515 $ 2,063 4,015 8.238 6,761 7,790 16,514 711 8.881 790 4,240 $ 1.070 $3,984 $ 1.773 Cash Flow Data $ 6,726 $ 3.292 $ 4,285 Net cash provided by operating activities 292 417 663 634 Warehouse Operations 715 686 25 30 21 33 26 28 (1) (5) (3) (4) 686 166 313 101 433 $ 120 663 $ 166 715 162 741 170 $ $ Warehouses in operation at beginning of year New warehouses opened (including relocations) Exsting warehouses closed including relocations) Warehouses at end of year Net sales per warehouse open at year-end (in milions Average annual growth at warehouses open more than a year (excluding the impact of changing gasoline prices and foreign exchange rates) $ $ 7% 11% 6% 796 4% 10,400 5.000 4,200 10.800 10.800 10.600 Members at year-end Businesses, including add-on members (000s) Gold Star members (000) Total paid members Household cardholders that both business and Gold Star members were automatically entitled to receive Total cardholders 10.500 14,700 36,800 47,600 42.600 38.600 49,400 42.600 16,200 21,200 34,000 44,600 40.200 31,600 42.000 34,400 n.a. n.a. 90,300 86,700 81,300 76.400