Conduct a ratio analysis of the venture Spatial Technologies using the provided income statement and balance sheet. Use any ratios you are familiar with from this course, e.g. Return on Equity or cash conversion ratios. Note any performance strengths and weaknesses and discuss any ratio trends.

Please upload a one page answer as a guideline, it is ok to provide a longer (or shorter) answer.

(If you right click on a figure you should be able to dowload it - save image as - and enlarge it locally if it shows better this way)

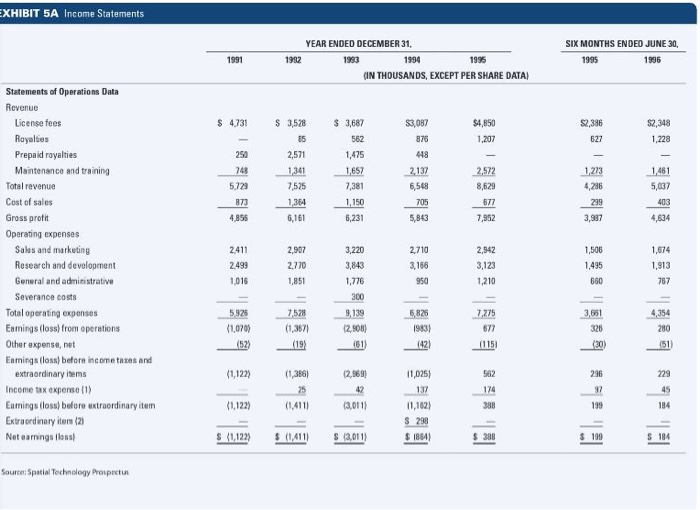

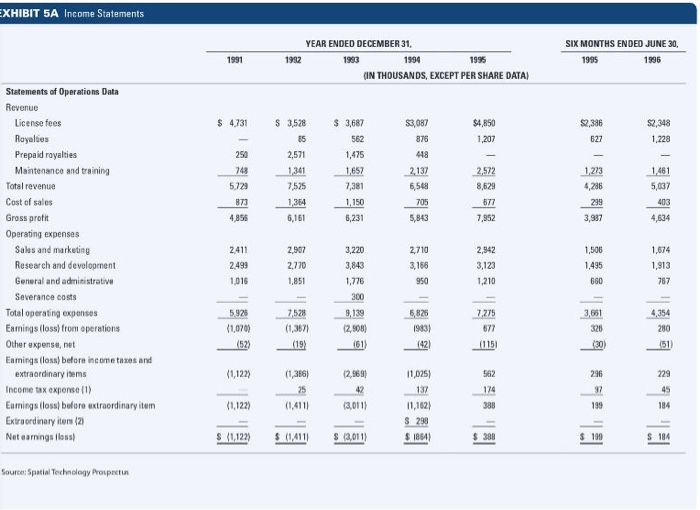

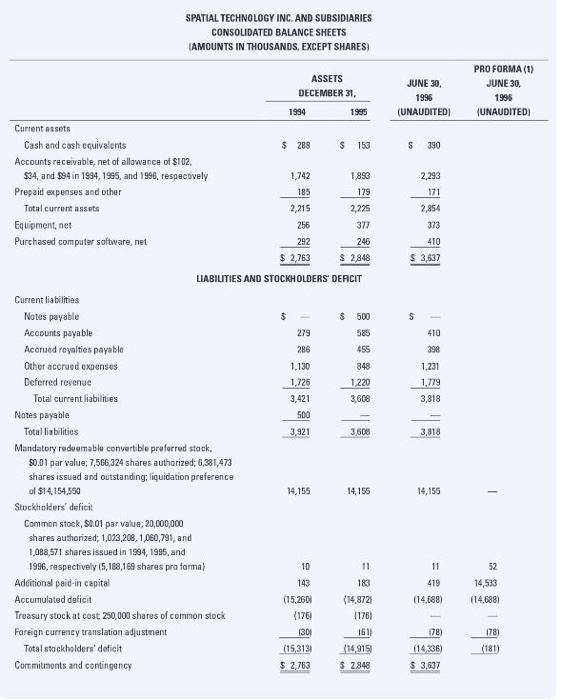

EXHIBIT 5A Income Statements SIX MONTHS ENDED JUNE 30, 1995 1996 1982 YEAR ENDED DECEMBER 31, 1994 199 (IN THOUSANDS, EXCEPT PER SHARE DATA) $ 4,731 $2,386 $4,850 1,207 $2,348 1,228 627 $ 3,528 5 2,571 1,341 250 $3,687 562 1,475 1,657 7,381 1.150 6,231 $3,087 876 418 2,137 6,548 705 5,843 1,461 5728 7.525 5.037 2,572 8,629 877 7,952 1,273 4,286 299 3,987 873 1,364 6,161 4,856 Statements of Operations Data Revenue License fees Royalties Prepaid rayalties Maintenance and training Total revenue Cost of sales Gross profit Operating expenses Sales and marketing Research and development General and administrative Severance costs Total operating expenses Earnings (loss) from operations Other expense, net Earnings floss) before income taxes and extraordinary items Income tax expense (1) Eumings floss) before extraordinary item Extraordinary item (2) Net earnings oss 2,907 2770 1.851 2499 1,016 3,220 3,843 1,776 300 2,710 3,166 950 2,542 3,123 1,210 1,074 1.913 1.506 1,495 660 787 9,179 3,651 5.926 (1,0701 (52) 7,528 (1,3571 (19) 5,826 1983) 7.275 677 (1151 4,354 280 12,908) 1421 (1,122) (1,3561 (2.569 11,025) 229 1. (1,122) (1,4111 (3,011) 11,162) $ 238 $ 1864) $ (1,122) $ 3,011) Source: Spatial Technology Prospect EXHIBIT 5A Income Statements SIX MONTHS ENDED JUNE 30, 1995 1996 1982 YEAR ENDED DECEMBER 31, 1994 199 (IN THOUSANDS, EXCEPT PER SHARE DATA) $ 4,731 $2,386 $4,850 1,207 $2,348 1,228 627 $ 3,528 5 2,571 1,341 250 $3,687 562 1,475 1,657 7,381 1.150 6,231 $3,087 876 418 2,137 6,548 705 5,843 1,461 5728 7.525 5.037 2,572 8,629 877 7,952 1,273 4,286 299 3,987 873 1,364 6,161 4,856 Statements of Operations Data Revenue License fees Royalties Prepaid rayalties Maintenance and training Total revenue Cost of sales Gross profit Operating expenses Sales and marketing Research and development General and administrative Severance costs Total operating expenses Earnings (loss) from operations Other expense, net Earnings floss) before income taxes and extraordinary items Income tax expense (1) Eumings floss) before extraordinary item Extraordinary item (2) Net earnings oss 2,907 2770 1.851 2499 1,016 3,220 3,843 1,776 300 2,710 3,166 950 2,542 3,123 1,210 1,074 1.913 1.506 1,495 660 787 9,179 3,651 5.926 (1,0701 (52) 7,528 (1,3571 (19) 5,826 1983) 7.275 677 (1151 4,354 280 12,908) 1421 (1,122) (1,3561 (2.569 11,025) 229 1. (1,122) (1,4111 (3,011) 11,162) $ 238 $ 1864) $ (1,122) $ 3,011) Source: Spatial Technology Prospect SPATIAL TECHNOLOGY INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS AMOUNTS IN THOUSANDS, EXCEPT SHARES) ASSETS DECEMBER 31, JUNE 30, 1996 (UNAUDITED) PRO FORMA (1) JUNE 30, 1996 (UNAUDITED) 1994 Current Atsets $ 390 2,293 185 171 Cash and cash equivalents $ 288 $ 153 Accounts receivable, net of allowance of $102, $34, and $94 in 1994, 1995, and 1996, respectively 1,742 1,893 Prepaid expenses and other 179 Total current assets 2,215 2,225 Equipment, net 256 Purchased computer software, net 246 $ 2848 LIABILITIES AND STOCKHOLDERS DEFICIT 2,854 373 292 $ 2,763 $ 3,637 $ 500 279 286 1,130 1,726 3,421 848 1.220 3,608 1,231 1,779 3,818 500 3,921 3608 3.818 Current liabilities Notes payable Accounts payable Accrued royalties payable Other accrued expenses Deferred revenue Total current liabilities Notes payable Total liabilities Mandatory redeemable convertible preferred stack, 50.01 par value; 7,566,324 shares authorized: 6,381,473 shares issued and outstanding; liquidation preference of $14,154,550 Stockholders' deficit Common stock, S0.01 par value; 20,000,000 shares authorized: 1,023,208, 1,060,791, and 1,088,571 shares issued in 1994, 1995, and 1996, respectively (5,188,169 shares pra forma) Additional paid-in capital Accumulated deficit Treasury stock at cost 250,000 shares of common stock Foreign currency translation adjustment Total stockholders' deficit Commitments and contingency 14,155 14,155 14,155 11 11 183 143 (15,2601 (176) 52 14,533 (14,688) (14.872 114,688) (176) 1301 78) 1611 (14,915 $ 2.848 178 (181) (15,313 $ 2,763 (14,336) $ 3,637