Question

Conduct a thorough financial analysis for Ford based on its revenue, profit and key financial ratios. (horizontal and vertical analysis including CAGR) Evaluate the financial

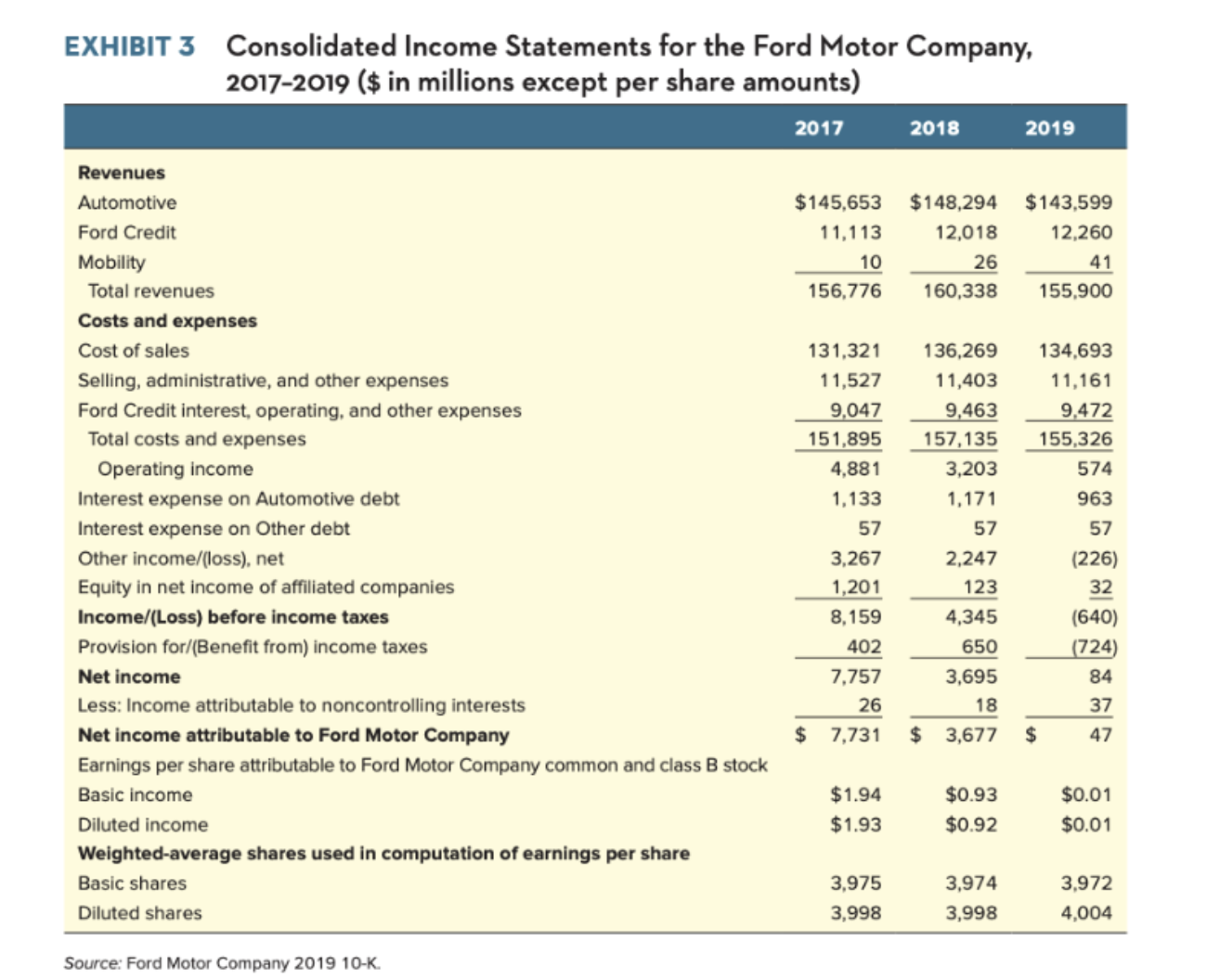

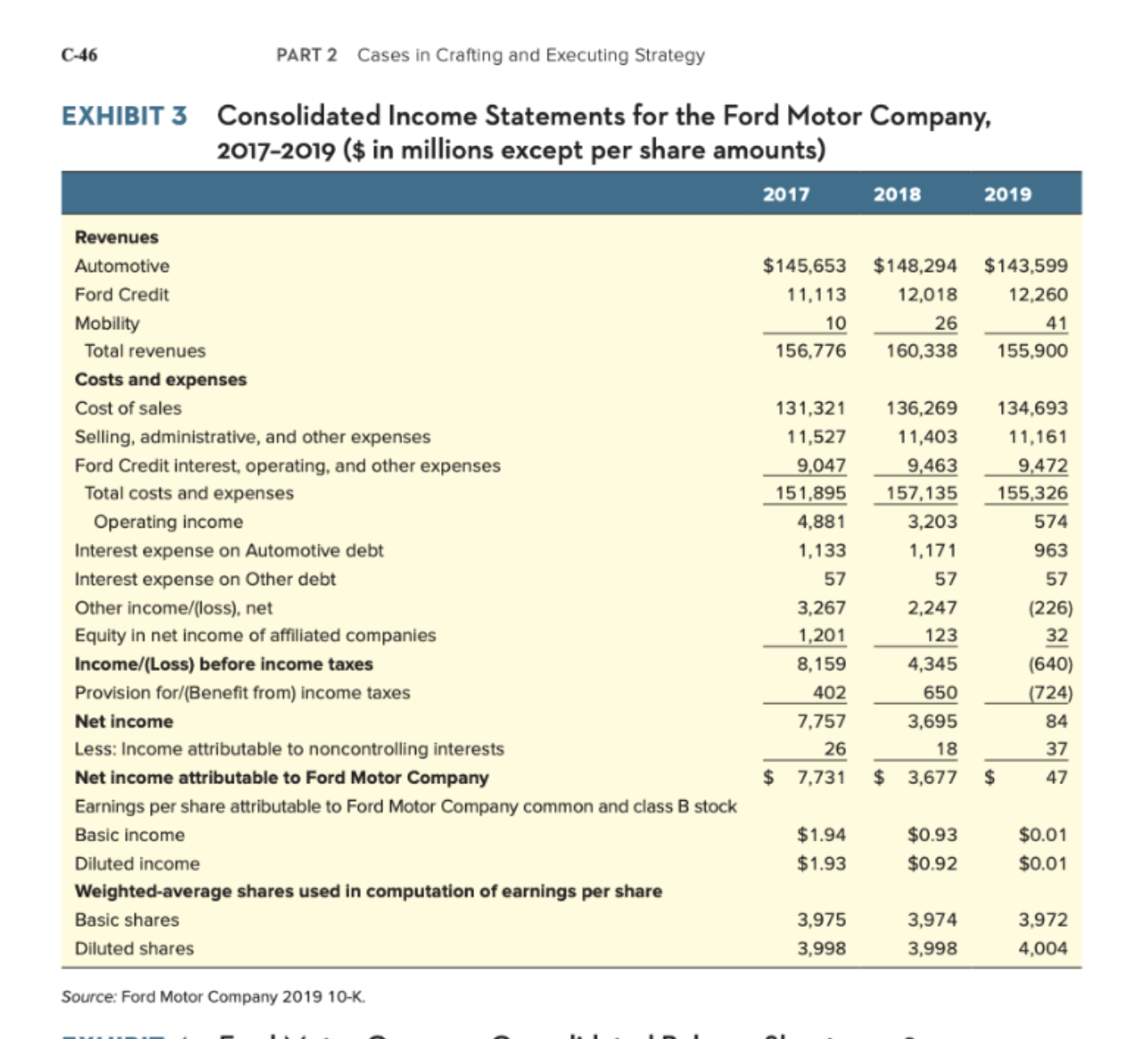

Conduct a thorough financial analysis for Ford based on its revenue, profit and key financial ratios. (horizontal and vertical analysis including CAGR) Evaluate the financial performance of Ford using:

Revenue (based on the years provided in the case) -- and its trend using CAGR calculation and what the trend implies 5.2. Net income [or Net loss] (based on the years provided in the case) -- and its trend using CAGR calculation and what the trend implies

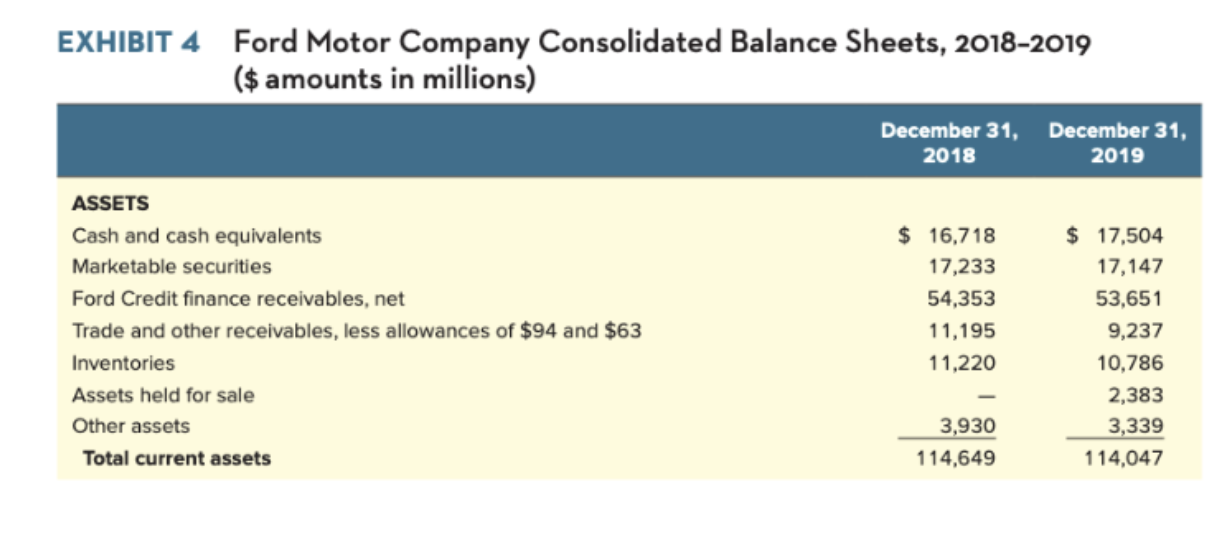

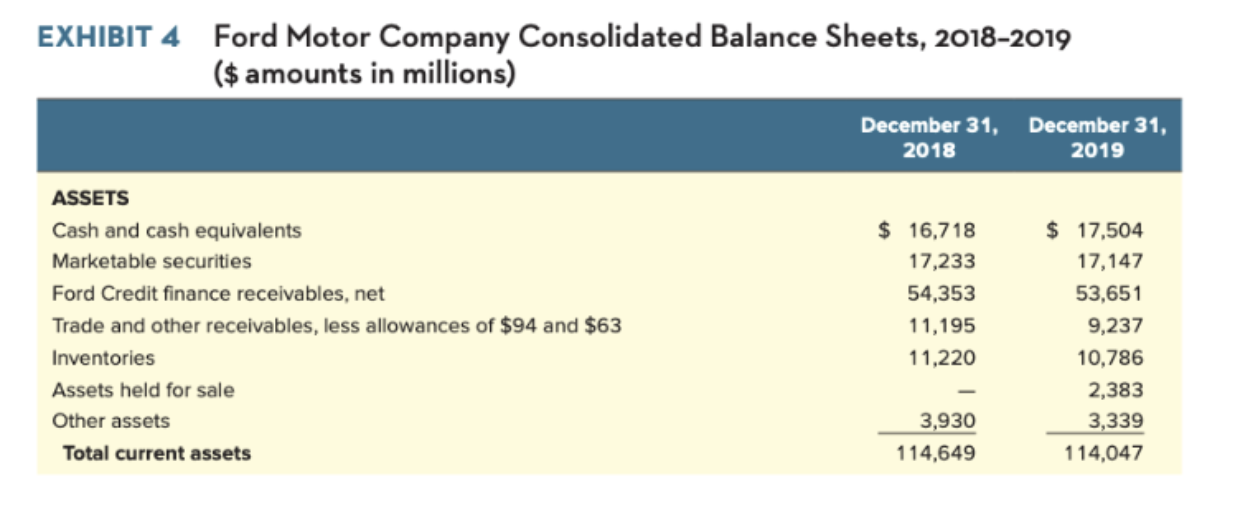

Key financial ratios (include at least 3 key financial ratios, such as D/E ratio (i.e. Total liabilities / Total stockholders' equity), ROE (i.e. Net income (or Net loss)/Total stockholder's Equity), Current Ratio etc.) -- and their trends and what they imply

What is your conclusion on Ford's overall financial performance?

EXHIBIT 3 Consolidated Income Statements for the Ford Motor Company, 2017-2019 ($ in millions except per share amounts) Revenues Automotive Ford Credit Mobility Total revenues Costs and expenses 2017 2018 2019 $145,653 11,113 $148,294 10 12,018 26 $143,599 12,260 41 156,776 160,338 155,900 Cost of sales 131,321 136,269 134,693 Selling, administrative, and other expenses 11,527 11,403 11,161 Ford Credit interest, operating, and other expenses 9,047 9,463 9,472 Total costs and expenses 151,895 157,135 155,326 Operating income 4,881 3,203 574 Interest expense on Automotive debt 1,133 1,171 963 Interest expense on Other debt 57 57 57 Other income/(loss), net Equity in net income of affiliated companies Income/(Loss) before income taxes Provision for/(Benefit from) income taxes Net income 3,267 2,247 (226) 1,201 123 32 8,159 4,345 (640) 402 650 (724) 7,757 3,695 84 Less: Income attributable to noncontrolling interests 26 18 37 Net income attributable to Ford Motor Company $ 7,731 $ 3,677 $ 47 Earnings per share attributable to Ford Motor Company common and class B stock Basic income $1.94 $0.93 $0.01 Diluted income $1.93 $0.92 $0.01 Weighted-average shares used in computation of earnings per share Basic shares 3,975 3,974 3,972 Diluted shares 3,998 3,998 4,004 Source: Ford Motor Company 2019 10-K.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Ford Motor Company had revenue of 17749B in the twelve m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started