Answered step by step

Verified Expert Solution

Question

1 Approved Answer

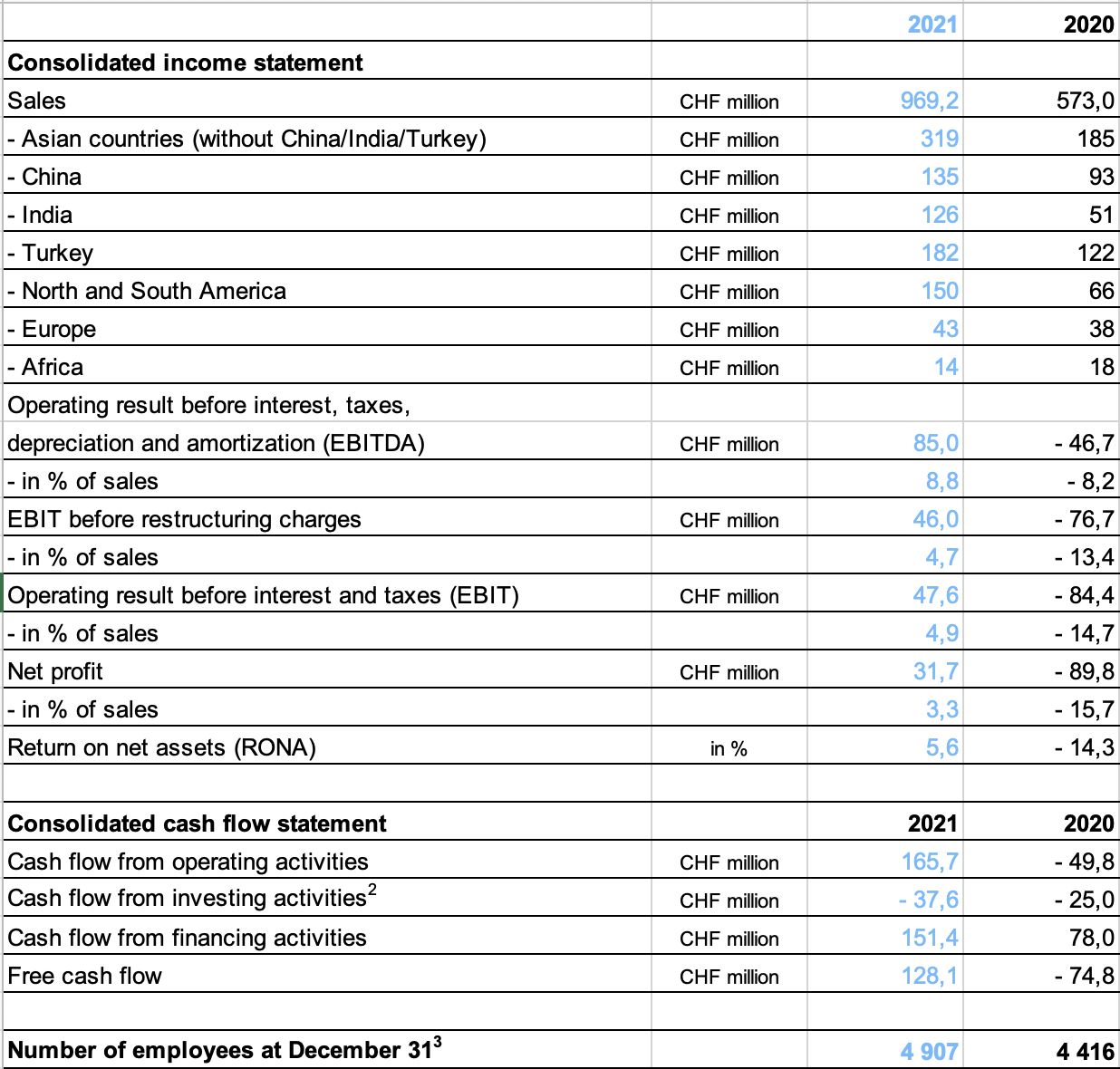

Conduct vertical and horizontal analysis this Income Statement and Cash flow statement in 2020-2021. What are the most significant changes and trends in these statements?

Conduct vertical and horizontal analysis this Income Statement and Cash flow statement in 2020-2021. What are the most significant changes and trends in these statements?

\begin{tabular}{|c|c|c|c|} \hline & & 2021 & 2020 \\ \hline \multicolumn{4}{|l|}{ Consolidated income statement } \\ \hline Sales & CHF million & 969,2 & 573,0 \\ \hline - Asian countries (without China/India/Turkey) & CHF million & 319 & 185 \\ \hline - China & CHF million & 135 & 93 \\ \hline - India & CHF million & 126 & 51 \\ \hline - Turkey & CHF million & 182 & 122 \\ \hline - North and South America & CHF million & 150 & 66 \\ \hline - Europe & CHF million & 43 & 38 \\ \hline - Africa & CHF million & 14 & 18 \\ \hline \multicolumn{4}{|l|}{ Operating result before interest, taxes, } \\ \hline depreciation and amortization (EBITDA) & CHF million & 85,0 & 46,7 \\ \hline - in % of sales & & 8,8 & 8,2 \\ \hline EBIT before restructuring charges & CHF million & 46,0 & 76,7 \\ \hline - in % of sales & & 4,7 & 13,4 \\ \hline Operating result before interest and taxes (EBIT) & CHF million & 47,6 & 84,4 \\ \hline - in % of sales & & 4,9 & 14,7 \\ \hline Net profit & CHF million & 31,7 & 89,8 \\ \hline - in % of sales & & 3,3 & 15,7 \\ \hline Return on net assets (RONA) & in \% & 5,6 & 14,3 \\ \hline Consolidated cash flow statement & & 2021 & 2020 \\ \hline Cash flow from operating activities & CHF million & 165,7 & 49,8 \\ \hline Cash flow from investing activities 2 & CHF million & 37,6 & 25,0 \\ \hline Cash flow from financing activities & CHF million & 151,4 & 78,0 \\ \hline Free cash flow & CHF million & 128,1 & 74,8 \\ \hline Number of employees at December 313 & & 4907 & 4416 \\ \hline \end{tabular}

\begin{tabular}{|c|c|c|c|} \hline & & 2021 & 2020 \\ \hline \multicolumn{4}{|l|}{ Consolidated income statement } \\ \hline Sales & CHF million & 969,2 & 573,0 \\ \hline - Asian countries (without China/India/Turkey) & CHF million & 319 & 185 \\ \hline - China & CHF million & 135 & 93 \\ \hline - India & CHF million & 126 & 51 \\ \hline - Turkey & CHF million & 182 & 122 \\ \hline - North and South America & CHF million & 150 & 66 \\ \hline - Europe & CHF million & 43 & 38 \\ \hline - Africa & CHF million & 14 & 18 \\ \hline \multicolumn{4}{|l|}{ Operating result before interest, taxes, } \\ \hline depreciation and amortization (EBITDA) & CHF million & 85,0 & 46,7 \\ \hline - in % of sales & & 8,8 & 8,2 \\ \hline EBIT before restructuring charges & CHF million & 46,0 & 76,7 \\ \hline - in % of sales & & 4,7 & 13,4 \\ \hline Operating result before interest and taxes (EBIT) & CHF million & 47,6 & 84,4 \\ \hline - in % of sales & & 4,9 & 14,7 \\ \hline Net profit & CHF million & 31,7 & 89,8 \\ \hline - in % of sales & & 3,3 & 15,7 \\ \hline Return on net assets (RONA) & in \% & 5,6 & 14,3 \\ \hline Consolidated cash flow statement & & 2021 & 2020 \\ \hline Cash flow from operating activities & CHF million & 165,7 & 49,8 \\ \hline Cash flow from investing activities 2 & CHF million & 37,6 & 25,0 \\ \hline Cash flow from financing activities & CHF million & 151,4 & 78,0 \\ \hline Free cash flow & CHF million & 128,1 & 74,8 \\ \hline Number of employees at December 313 & & 4907 & 4416 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started