Answered step by step

Verified Expert Solution

Question

1 Approved Answer

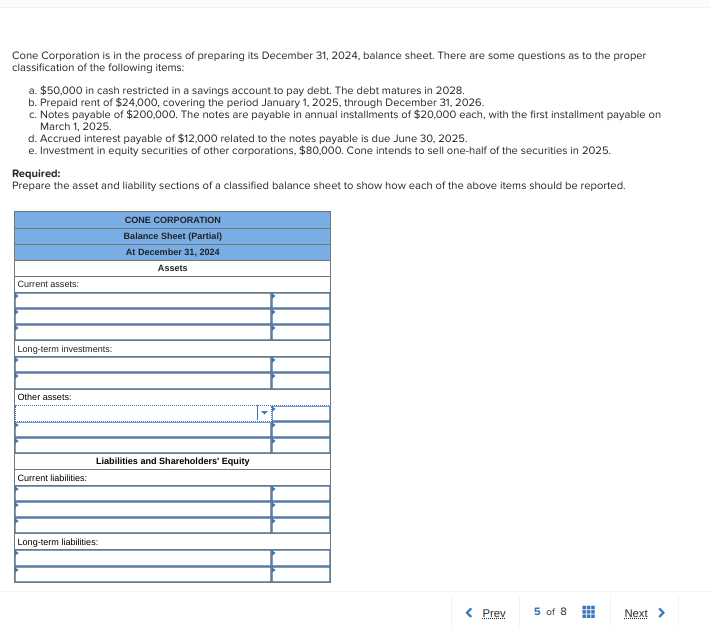

Cone Corporation is in the process of preparing its December 31,2024 , balance sheet. There are some questions as to the proper classification of the

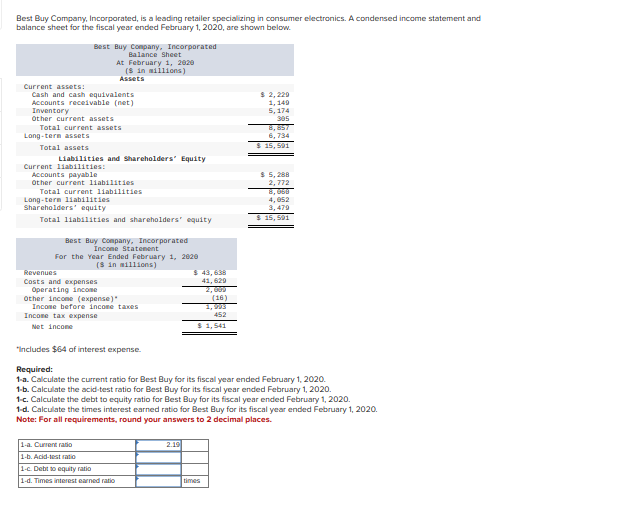

Cone Corporation is in the process of preparing its December 31,2024 , balance sheet. There are some questions as to the proper classification of the following items: a. $50,000 in cash restricted in a savings account to pay debt. The debt matures in 2028 . b. Prepaid rent of $24,000, covering the period January 1,2025 , through December 31,2026 . c. Notes payable of $200,000. The notes are payable in annual installments of $20,000 each, with the first installment payable on March 1, 2025. d. Accrued interest payable of $12,000 related to the notes payable is due June 30,2025 . e. Investment in equity securities of other corporations, $80,000. Cone intends to sell one-half of the securities in 2025. Required: Prepare the asset and liability sections of a classified balance sheet to show how each of the above items should be reported. Best Buy Company, Incorporated, is a leading retailer specializing in consumer electronics. A condensed income statement and balance sheet for the fiscal year ended February 1,2020 , are shown below. 'Includes $64 of interest expense. Required: 1-a. Calculate the current ratio for Best Buy for its fiscal year ended February 1, 2020. 1-b. Calculate the acid test ratio for Best Buy for its fiscal year ended February 1, 2020. 1-c. Calculate the debt to equity ratio for Best Buy for its fiscal year ended February 1, 2020 . 1-d. Calculate the times interest earned ratio for Best Buy for its fiscal year ended February 1, 2020. Note: For all requirements, round your answers to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started