Answered step by step

Verified Expert Solution

Question

1 Approved Answer

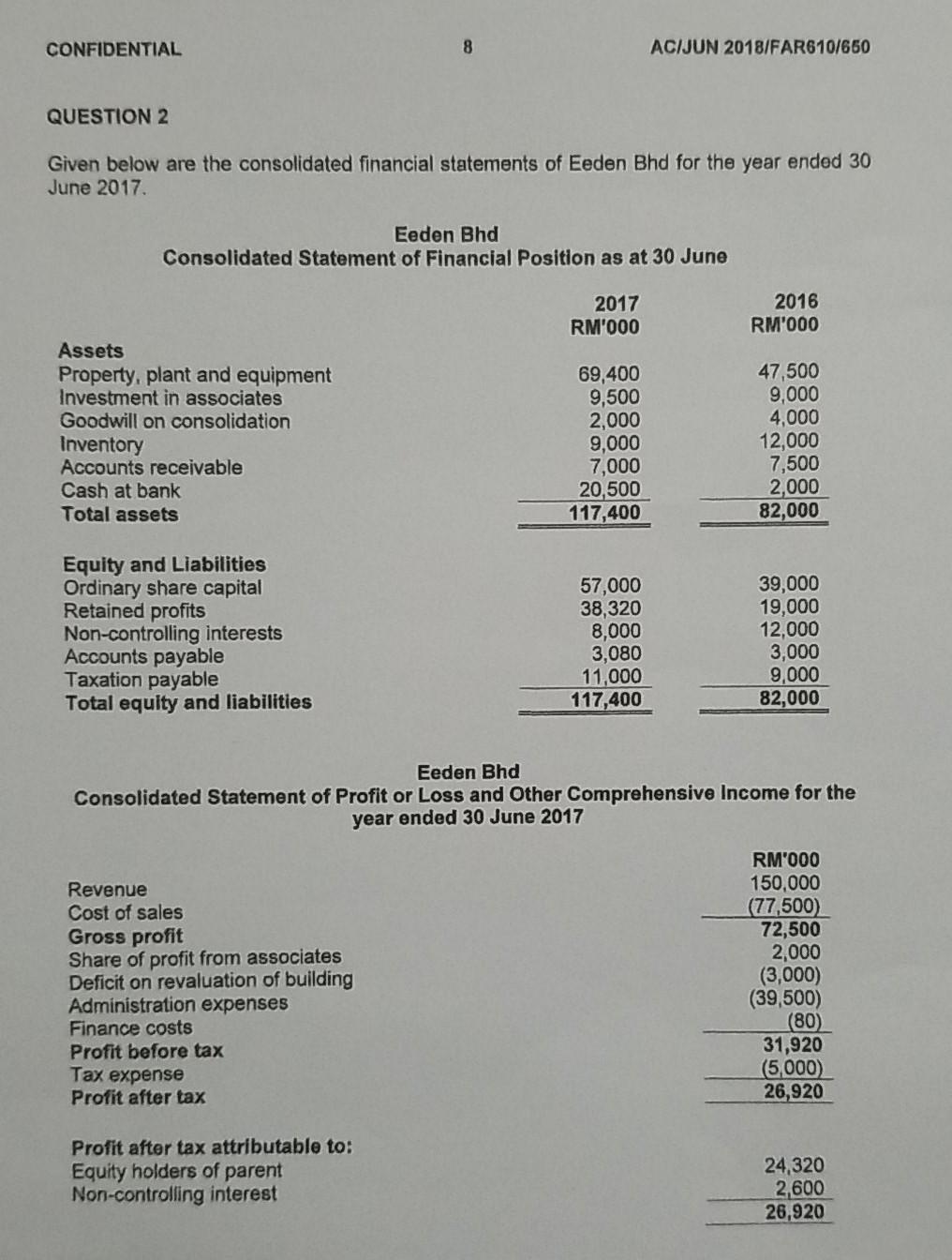

CONFIDENTIAL 8 ACIJUN 2018/FAR610/660 QUESTION 2 Given below are the consolidated financial statements of Eeden Bhd for the year ended 30 June 2017 Eeden Bhd

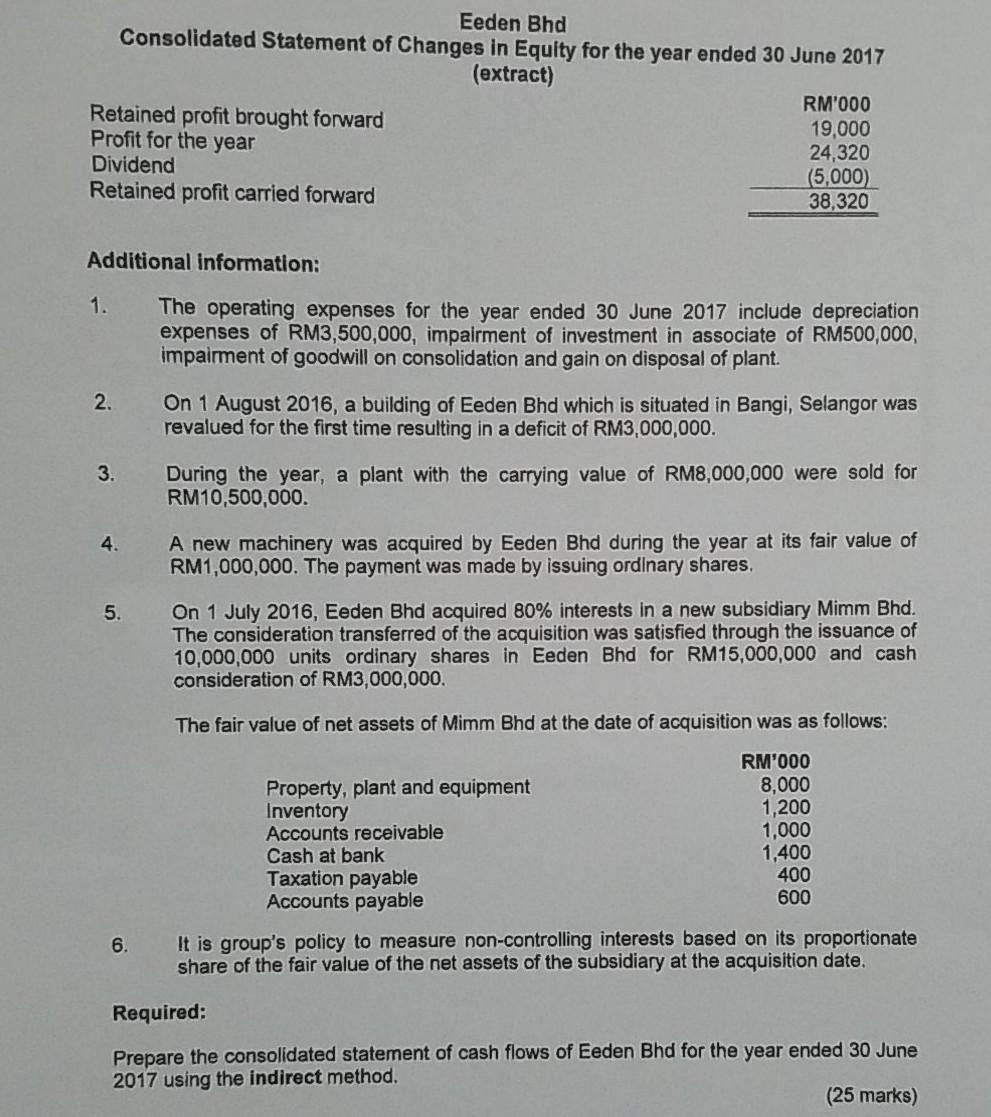

CONFIDENTIAL 8 ACIJUN 2018/FAR610/660 QUESTION 2 Given below are the consolidated financial statements of Eeden Bhd for the year ended 30 June 2017 Eeden Bhd Consolidated Statement of Financial Position as at 30 June 2017 RM'000 2016 RM'000 Assets Property, plant and equipment Investment in associates Goodwill on consolidation Inventory Accounts receivable Cash at bank Total assets 69,400 9,500 2,000 9,000 7,000 20,500 117,400 47,500 9,000 4,000 12,000 7,500 2,000 82,000 Equity and Liabilities Ordinary share capital Retained profits Non-controlling interests Accounts payable Taxation payable Total equity and liabilities 57,000 38,320 8,000 3,080 11,000 117,400 39,000 19,000 12,000 3,000 9,000 82,000 Eeden Bhd Consolidated Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2017 Revenue Cost of sales Gross profit Share of profit from associates Deficit on revaluation of building Administration expenses Finance costs Profit before tax Tax expense Profit after tax RM'000 150,000 (77,500 72,500 2,000 (3,000) (39,500) (80) 31,920 (5,000) 26,920 Profit after tax attributable to: Equity holders of parent Non-controlling interest 24,320 2,600 26,920 Eeden Bhd Consolidated Statement of Changes in Equity for the year ended 30 June 2017 (extract) RM'000 Retained profit brought forward 19,000 Profit for the year 24,320 Dividend (5,000) Retained profit carried forward 38,320 Additional information: 1. 2. The operating expenses for the year ended 30 June 2017 include depreciation expenses of RM3,500,000, impairment of investment in associate of RM500,000, impairment of goodwill on consolidation and gain on disposal of plant. On 1 August 2016, a building of Eeden Bhd which is situated in Bangi, Selangor was revalued for the first time resulting in a deficit of RM3,000,000. During the year, a plant with the carrying value of RM8,000,000 were sold for RM10,500,000 3. 4. A new machinery was acquired by Eeden Bhd during the year at its fair value of RM1,000,000. The payment was made by issuing ordinary shares. 5. On 1 July 2016, Eeden Bhd acquired 80% interests in a new subsidiary Mimm Bhd. The consideration transferred of the acquisition was satisfied through the issuance of 10,000,000 units ordinary shares in Eeden Bhd for RM15,000,000 and cash consideration of RM3,000,000. The fair value of net assets of Mimm Bhd at the date of acquisition was as follows: Property, plant and equipment Inventory Accounts receivable Cash at bank Taxation payable Accounts payable RM'000 8,000 1,200 1,000 1,400 400 600 6. It is group's policy to measure non-controlling interests based on its proportionate share of the fair value of the net assets of the subsidiary at the acquisition date. Required: Prepare the consolidated statement of cash flows of Eeden Bhd for the year ended 30 June 2017 using the indirect method. (25 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started