Answered step by step

Verified Expert Solution

Question

1 Approved Answer

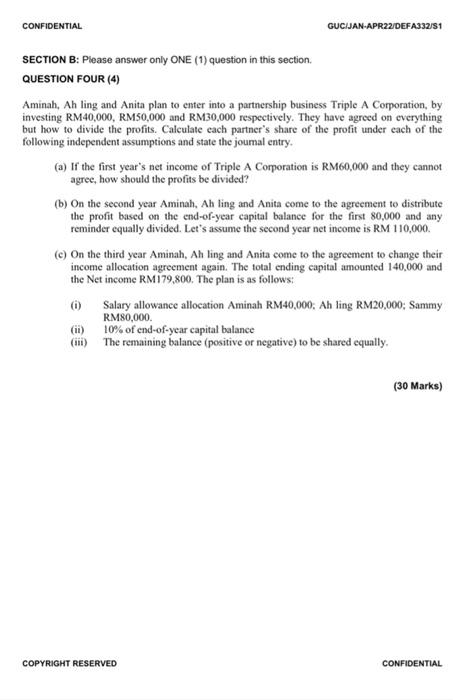

CONFIDENTIAL GUCIJAN-APR22/DEFA332/S1 SECTION B: Please answer only ONE (1) question in this section. QUESTION FOUR (4) Aminah, Ah ling and Anita plan to enter into

CONFIDENTIAL

GUCIJAN-APR22/DEFA332/S1

SECTION B: Please answer only ONE (1) question in this section.

QUESTION FOUR (4)

Aminah, Ah ling and Anita plan to enter into a partnership business Triple A Corporation, by

investing RM40,000, RM50,000 and RM30,000 respectively. They have agreed on everything

but how to divide the profits. Calculate each partner's share of the profit under each of the

following independent assumptions and state the journal entry.

(a) If the first year's net income of Triple A Corporation is RM60,000 and they cannot

agree, how should the profits be divided?

(b) On the second year Aminah, Ah ling and Anita come to the agreement to distribute

the profit based on the end-of-year capital balance for the first 80,000 and any

reminder equally divided. Let's assume the second year net income is RM 110,000.

(c) On the third year Aminah, Ah ling and Anita come to the agreement to change their

income allocation agreement again. The total ending capital amounted 140,000 and

the Net income RM179,800. The plan is as follows:

(i)

Salary allowance allocation Amina RM40,000; Ah ling RM20,000; Sammy

RM80,000.

10% of end-of-year capital balance

The remaining balance (positive or negative) to be shared equally.

(30 Marks)

COPYRIGHT RESERVED

CONFIDENTIAL

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started