Answered step by step

Verified Expert Solution

Question

1 Approved Answer

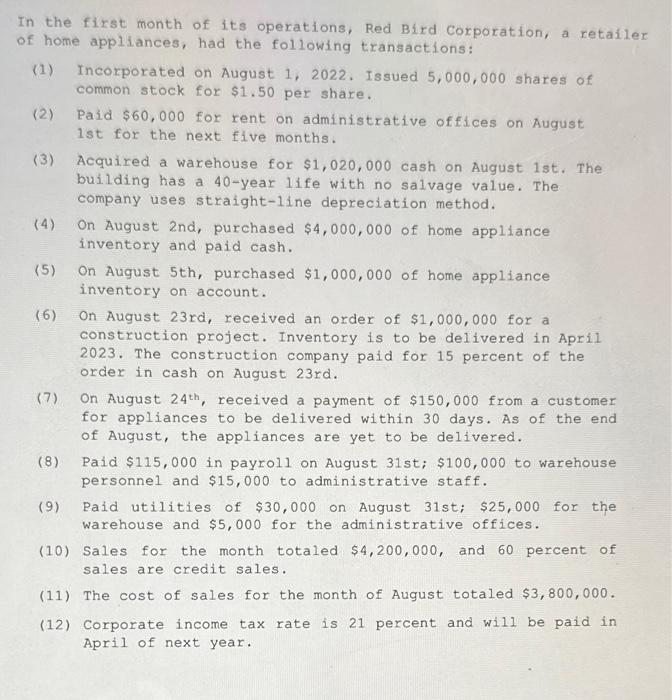

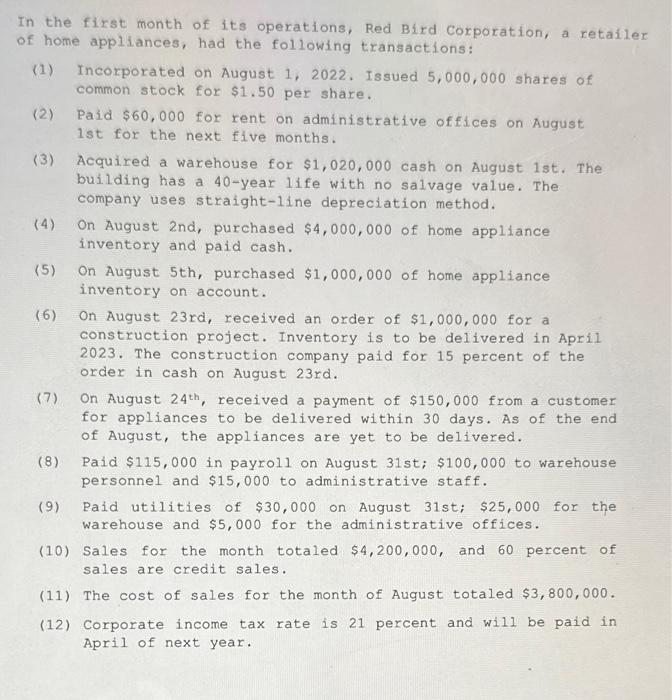

Confused on how to do the t-accounts to this question. In the first month of its operations, Red Bird Corporation, a retaile of home appliances,

Confused on how to do the t-accounts to this question.

In the first month of its operations, Red Bird Corporation, a retaile of home appliances, had the following transactions: (1) Incorporated on August 1, 2022. Issued 5,000,000 shares of common stock for $1.50 per share. (2) Paid $60,000 for rent on administrative offices on August 1st for the next five months. (3) Acquired a warehouse for $1,020,000 cash on August 1st. The building has a 40 -year 1 ife with no salvage value. The company uses straight-1ine depreciation method. (4) On August 2nd, purchased $4,000,000 of home appliance inventory and paid cash. (5) On August 5th, purchased $1,000,000 of home appliance inventory on account. (6) On August 23rd, received an order of $1,000,000 for a construction project. Inventory is to be delivered in April 2023. The construction company paid for 15 percent of the order in cash on August 23rd. (7) On August 24th, received a payment of $150,000 from a customer for appliances to be delivered within 30 days. As of the end of August, the appliances are yet to be delivered. (8) Paid $115,000 in payroll on August 31 st; $100,000 to warehouse personnel and $15,000 to administrative staff. (9) Paid utilities of $30,000 on August 31st; $25,000 for the warehouse and $5,000 for the administrative offices. (10) Sales for the month totaled $4,200,000, and 60 percent of sales are credit sales. (11) The cost of sales for the month of August totaled $3,800,000. (12) Corporate income tax rate is 21 percent and will be paid in April of next year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started