Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Confused on these! increases assets, increases stockholders' equity. increases assets, decreases stockholders' equity. Question 2 ( 2 points) Saved Stork Corporation's common stock is $55,000,

Confused on these!

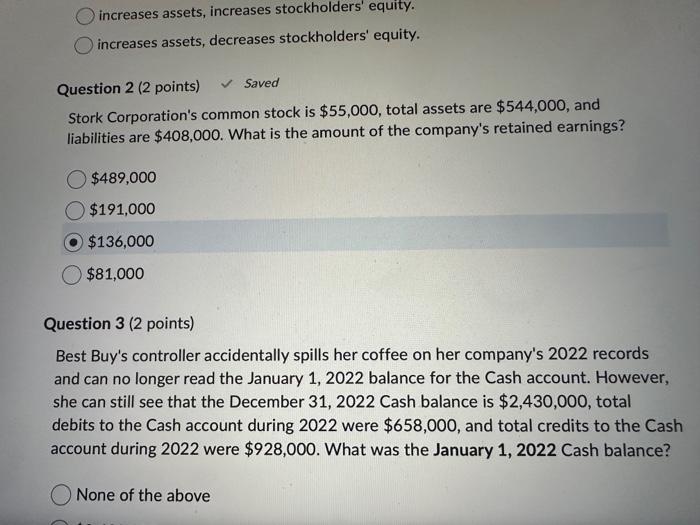

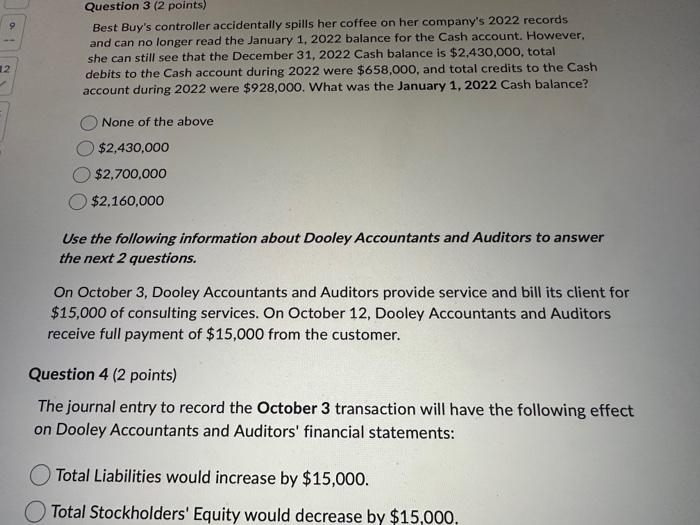

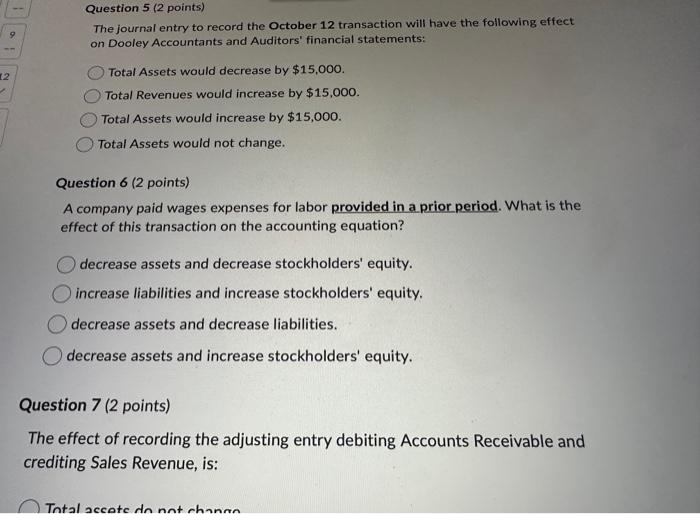

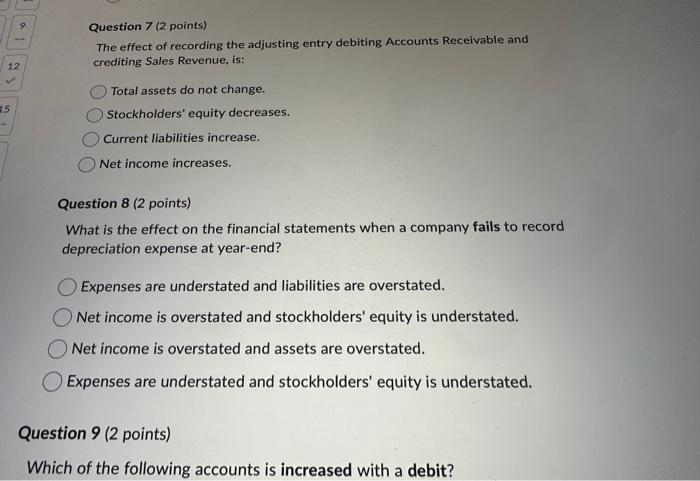

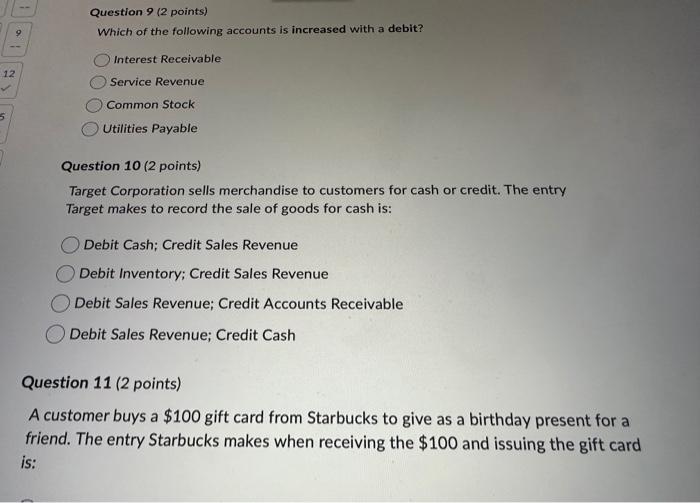

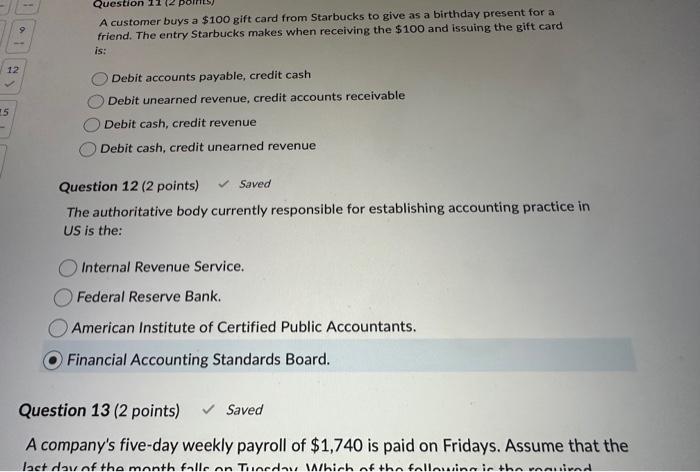

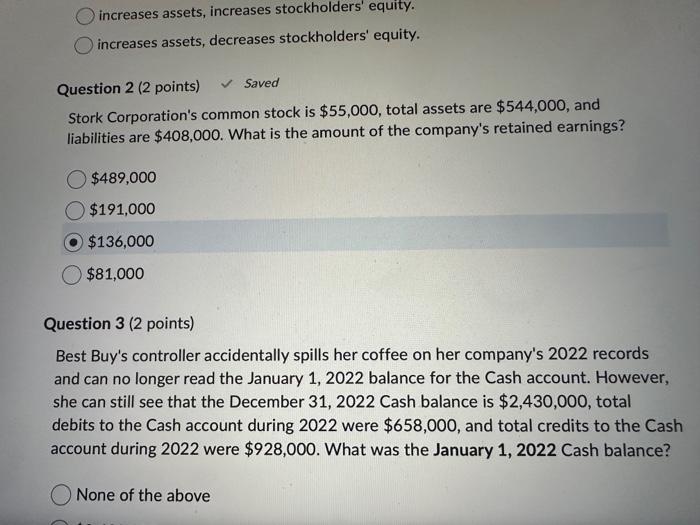

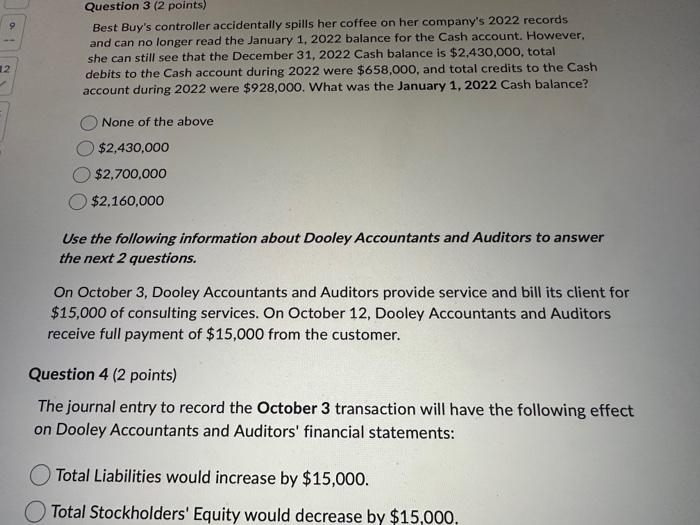

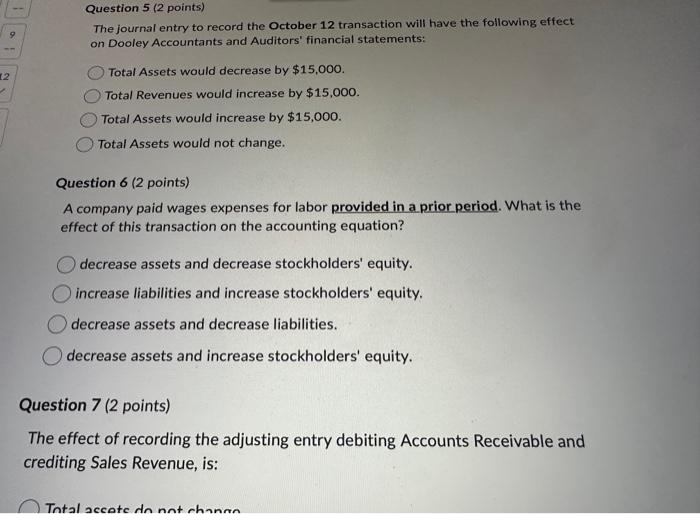

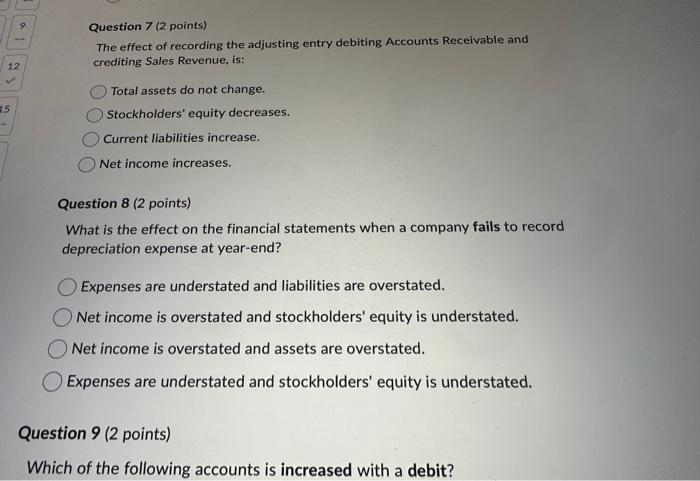

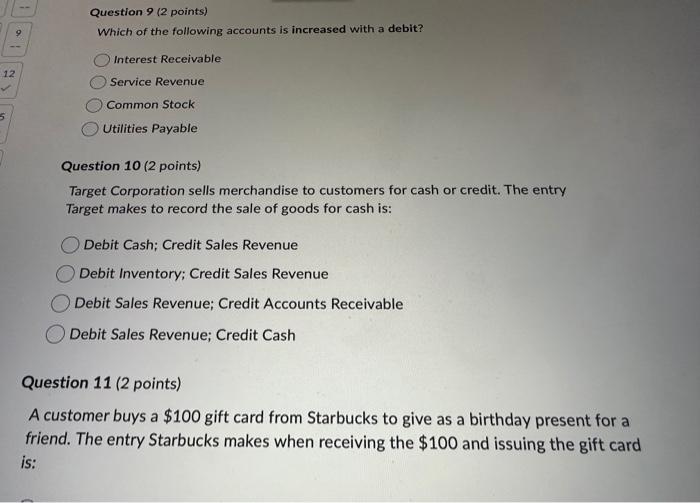

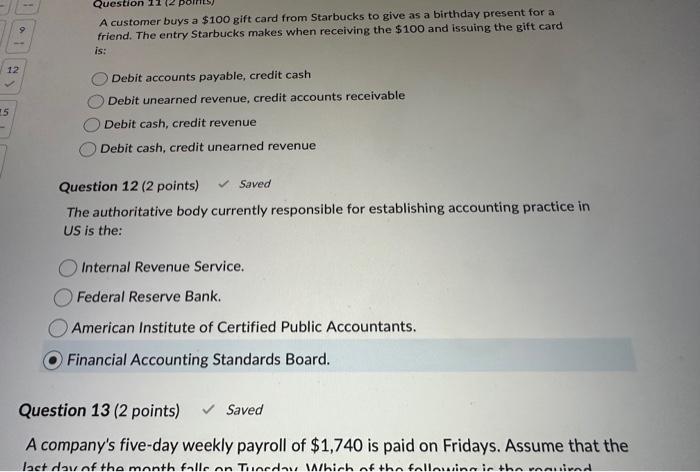

increases assets, increases stockholders' equity. increases assets, decreases stockholders' equity. Question 2 ( 2 points) Saved Stork Corporation's common stock is $55,000, total assets are $544,000, and liabilities are $408,000. What is the amount of the company's retained earnings? $489,000 $191,000 $136,000 $81,000 Question 3 ( 2 points) Best Buy's controller accidentally spills her coffee on her company's 2022 records and can no longer read the January 1, 2022 balance for the Cash account. However, she can still see that the December 31,2022 Cash balance is $2,430,000, total debits to the Cash account during 2022 were $658,000, and total credits to the Cash account during 2022 were $928,000. What was the January 1,2022 Cash balance? None of the above Best Buy's controller accidentally spills her coffee on her company's 2022 records and can no longer read the January 1, 2022 balance for the Cash account. However. she can still see that the December 31,2022 Cash balance is $2,430,000, total debits to the Cash account during 2022 were $658,000, and total credits to the Cash account during 2022 were $928,000. What was the January 1,2022 Cash balance? None of the above $2,430,000 $2,700,000 $2,160,000 Use the following information about Dooley Accountants and Auditors to answer the next 2 questions. On October 3, Dooley Accountants and Auditors provide service and bill its client for $15,000 of consulting services. On October 12, Dooley Accountants and Auditors receive full payment of $15,000 from the customer. Question 4 (2 points) The journal entry to record the October 3 transaction will have the following effect on Dooley Accountants and Auditors' financial statements: Total Liabilities would increase by $15,000. Total Stockholders' Equity would decrease by $15,000. The journal entry to record the October 12 transaction will have the following effect on Dooley Accountants and Auditors' financial statements: Total Assets would decrease by $15,000 Total Revenues would increase by $15,000. Total Assets would increase by $15,000. Total Assets would not change. Question 6 (2 points) A company paid wages expenses for labor provided in a prior period. What is the effect of this transaction on the accounting equation? decrease assets and decrease stockholders' equity. increase liabilities and increase stockholders' equity. decrease assets and decrease liabilities. decrease assets and increase stockholders' equity. Question 7 ( 2 points) The effect of recording the adjusting entry debiting Accounts Receivable and crediting Sales Revenue, is: The effect of recording the adjusting entry debiting Accounts Receivable and crediting Sales Revenue, is: Total assets do not change. Stockholders' equity decreases. Current liabilities increase. Net income increases. Question 8 (2 points) What is the effect on the financial statements when a company fails to record depreciation expense at year-end? Expenses are understated and liabilities are overstated. Net income is overstated and stockholders' equity is understated. Net income is overstated and assets are overstated. Expenses are understated and stockholders' equity is understated. Question 9 (2 points) Which of the following accounts is increased with a debit? Which of the following accounts is increased with a debit? Interest Receivable Service Revenue Common Stock Utilities Payable Question 10 ( 2 points) Target Corporation sells merchandise to customers for cash or credit. The entry Target makes to record the sale of goods for cash is: Debit Cash; Credit Sales Revenue Debit Inventory; Credit Sales Revenue Debit Sales Revenue; Credit Accounts Receivable Debit Sales Revenue; Credit Cash Question 11 (2 points) A customer buys a $100 gift card from Starbucks to give as a birthday present for a friend. The entry Starbucks makes when receiving the $100 and issuing the gift card is: A customer buys a $100 gift card from Starbucks to give as a birthday present for a friend. The entry Starbucks makes when receiving the $100 and issuing the gift card is: Debit accounts payable, credit cash Debit unearned revenue, credit accounts receivable Debit cash, credit revenue Debit cash, credit unearned revenue Question 12 (2 points) Saved The authoritative body currently responsible for establishing accounting practice in US is the: Internal Revenue Service. Federal Reserve Bank. American Institute of Certified Public Accountants. Financial Accounting Standards Board. Question 13 ( 2 points) Saved A company's five-day weekly payroll of $1,740 is paid on Fridays. Assume that the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started