Answered step by step

Verified Expert Solution

Question

1 Approved Answer

confused on these plz Help!!! this is the tax table 1. Chris (is single) has a W-2 from Target that reads Box 1 $17,890 and

confused on these plz Help!!!

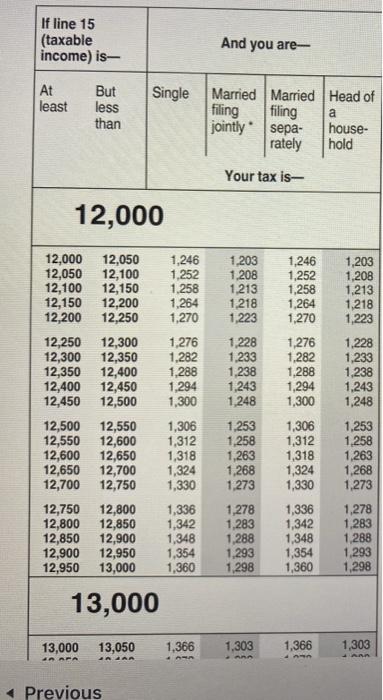

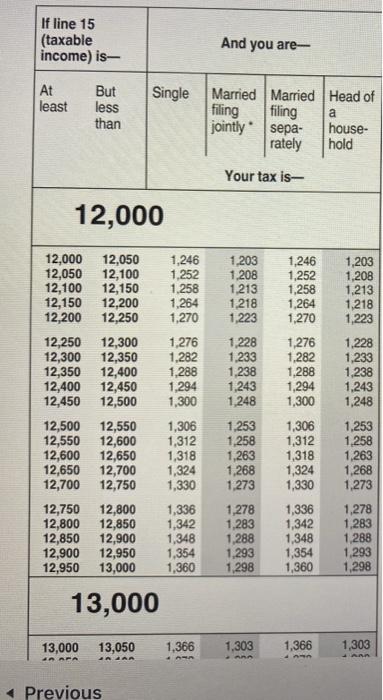

this is the tax table

this is the tax table

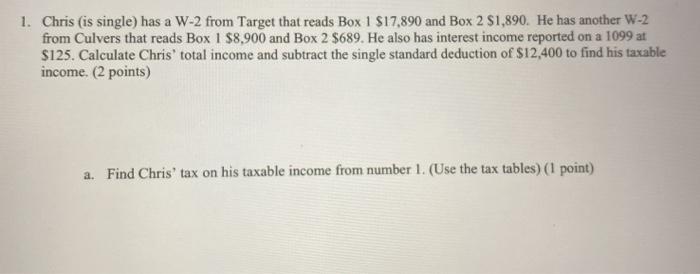

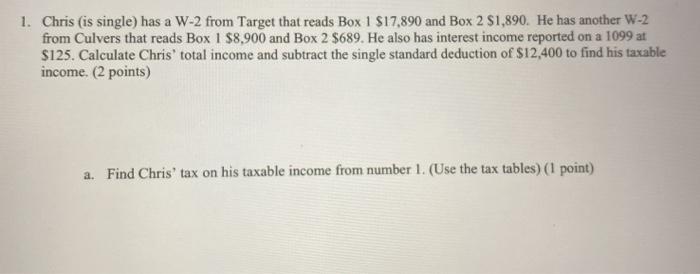

1. Chris (is single) has a W-2 from Target that reads Box 1 $17,890 and Box 2 S1,890. He has another W-2 from Culvers that reads Box 1 $8,900 and Box 2 $689. He also has interest income reported on a 1099 at $125. Calculate Chris' total income and subtract the single standard deduction of $12,400 to find his taxable income. (2 points) a. Find Chris' tax on his taxable income from number 1. (Use the tax tables) (1 point) If line 15 (taxable income) is- And you are At least Single But less than Married Married Head of filing filing a jointly sepa- house- rately hold Your tax is- 12,000 1,246 1.252 1,258 1,264 1,270 1,246 1,252 1,258 1,264 1,270 12,050 12,100 12,150 12,200 12,250 12,300 12,350 12,400 12,450 12,500 12,550 12,600 12,650 12,700 12,750 1.203 1.208 1.213 1,218 1,223 1,228 1,233 1,238 1,243 1,248 12,000 12,050 12,100 12,150 12,200 12,250 12,300 12,350 12,400 12,450 12,500 12,550 12,600 12,650 12,700 12,750 12,800 12,850 12,900 12,950 1,203 1,208 1.213 1,218 1.223 1.228 1,233 1,238 1,243 1,248 1,276 1,282 1.288 1,294 1,300 1,306 1,312 1,318 1,324 1,330 1,336 1,342 1,348 1,354 1,360 1,276 1,282 1,288 1,294 1,300 1,306 1,312 1,318 1,324 1,330 1,253 1,258 1,263 1,268 1,273 1,253 1,258 1,263 1,268 1,273 12,800 12,850 12,900 12,950 13,000 1,278 1,283 1.288 1.293 1,336 1,342 1,348 1,354 1,360 1,278 1,283 1.288 1,293 1,298 1,298 13,000 13,000 13,050 1,366 1,303 1,366 1,303 HAFA Previous

this is the tax table

this is the tax tableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started