Question

Congratulations, you have finally arrived. After all those accounting classes at the University of Iowa, you have been hired as a tax accounting associate by

Congratulations, you have finally arrived. After all those accounting classes at the University of Iowa, you have been hired as a tax accounting associate by EY LLP. . Your first client is a calendar year C-corporation. The tax senior is still finishing up the prior engagement, but sends you to start work on the clients 2016 Form 1120. Your job is to prepare a book to tax reconciliation. That is, you start with the companys book income and make the necessary adjustments to convert it to taxable income. Then once you have determined taxable income, you are to prepare the schedule M-1 book to tax reconciliation for the tax return. Please bring two hardcopies of your completed worksheet to class, one to turn in, the other for notes when we go over the problem in class.

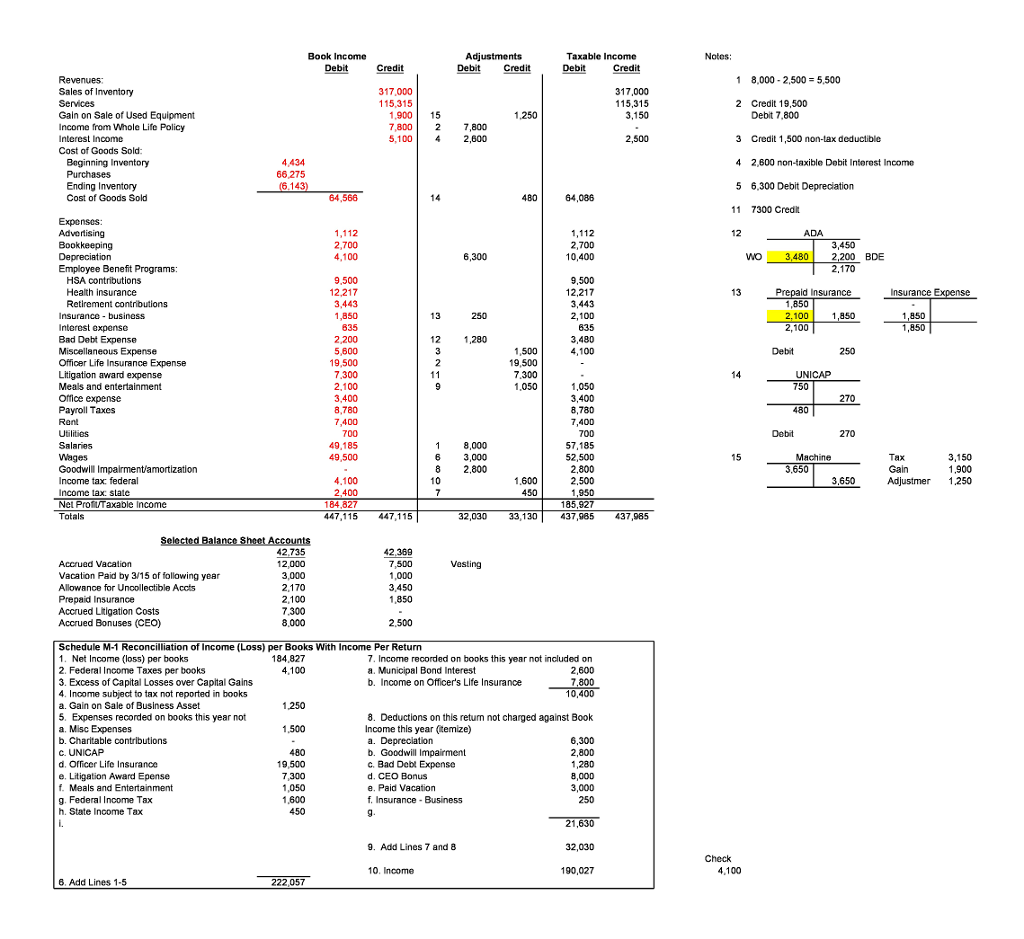

So far you have prepared the format for the book to tax reconciliation schedule and have dropped in the companys book income. (Find the EXCEL worksheet completed to this point.) Now you must determine the book/tax differences. After reviewing the companys audit report, trial balance and PBCs (prepared by client work papers) you have determined the following:

The Companys sole stockholder is the CEO, Mr. Kennedy, a cash basis taxpayer. Mr. Kennedy earns bonuses that are accrued by the company at year-end but paid after the first of the year (before March 15th of the following year.). The amount of the accrued bonus is shown on the selected balance sheet items. (Bonuses are coded to salaries.)

The Company owns and is the beneficiary of a $1 million policy on the life of Mr. Kennedy. In 2016, the corporation paid $19,500 in premiums. The cash surrender value of the whole life policy increased by $7,800.

Included in the miscellaneous expense account are fines and penalties of $750. The company van received parking tickets of $550 that were paid by the company. In addition, a company vendor charged a penalty of $200 for a late change on a special order.

Interest income includes $2,600 of interest received on municipal bonds that are owned by the company. These bonds are not private activity bonds.

Depreciation expense for book purposes was $4,100, while depreciation for tax purposes is $10,400.

Earned but unused vacation pay and the respective amounts paid by 3/15 of the following year are shown on the selected balance sheet items. (Assume vacation pay is coded to wages.)

On the previous year return, accrued state income taxes of $1,300 were deducted for federal income tax purposes. However, after the state income tax returns were prepared, the actual liability to the state income tax authorities was $850. The accrual for state income taxes for this year is $2,400.

The company acquired the assets of another company in 2015. The fair market value of the individual tangible assets was $42,000 below the price paid. Thus $42,000 in goodwill was recorded for both book and tax purposes. No impairment of the goodwill has taken place for financial reporting purposes.

The $2,100 in meals and entertainment expenses included $700 for taking potential clients out to lunch or dinner where substantive business discussion took place, $900 for meals for employees traveling away from home overnight, and $500 for the cost of the company picnic in which all employees and their families were invited.

The $4,100 of federal income tax expense is comprised of $2,500 of current tax expense and $1,600 of deferred tax expense.

The company is a defendant in a lawsuit as an employee was injured as he attempted to use the company lawnmower as a hedge trimmer on a cherry tree. In accordance with ASC 450 (FAS 5), the company has reserved $7,300 as an estimated loss on the case. (The company charged the account litigation award expense.) The trial is expected to be held in 2017.

Bad debt expense for book purposes is calculated using the allowance method. (percentage of sales). Based on sales, $2,200 was accrued for this purpose on the companys financial books during the year. The beginning and ending of the year balances of the allowance for uncollectible accounts are shown on the selected balance sheet items.

The company adopted the 12-month rule for prepaid insurance for tax purposes in 2012. The company pays for its one annual insurance policy on December 31 of each year. Refer to the selected balance sheet items for the balance of prepaid insurance.

The company is subject to UNICAP (ignore the fact that retailers below $10 million in revenue are exempt). The additional costs capitalized for inventory were $750 at 12/31/2015 and $480 at 12/31/2016.

The company reported a gain on the sale of used machinery of $1,900 in 2016. The net book value of the asset sold was $1,750. The tax basis was $500.

Where did I go wrong?

Book Income Debit Adjustments Taxable Income Debit CreditDebit Credit Credit Revenues 1 8,000-2.500=5.500 317,000 115,315 115,315 2 Credit 19,500 1,900 15 7,800 2 7,800 5,1004 2,600 Income from Whole Life Policy 3 Credit 1,500 non-tax deductible 2,600 non-taxible Debit Interest Income 6,300 Debit Depreciation 4 66,275 5 11 7300 Credi ADA 3,4802,200 BDE Insurance 250 12 ,280 Debit 7.300 UNICAP office expense Machine Goodwill Impairment/amortization Gain Adjustmer 1.250 447,115 447,115 32,030 33,130 437,985 437,985 Vacation Paid by 3/15 of following year Accrued Bonuses (CEO) Schedule M-1 Reconcilliation of Income (Loss) per Books With Income Per Return 7. Income recorded on books this yean a. Municipal Bond Interest b. Income on Officer's Life Insurance not included on 2. Federal Income Taxes per books 3. Excess of Capital Losses over Capital Gains 4. Income subject to tax not reported in books a. Gain on Sale of Business Asset 5. Expenses recorded on books this year not 8. Deductions on this return not charged against Book Income this year (temize) c. Bad Debl Expense 9. Add Lines 7 and 8 Check 10. Income Book Income Debit Adjustments Taxable Income Debit CreditDebit Credit Credit Revenues 1 8,000-2.500=5.500 317,000 115,315 115,315 2 Credit 19,500 1,900 15 7,800 2 7,800 5,1004 2,600 Income from Whole Life Policy 3 Credit 1,500 non-tax deductible 2,600 non-taxible Debit Interest Income 6,300 Debit Depreciation 4 66,275 5 11 7300 Credi ADA 3,4802,200 BDE Insurance 250 12 ,280 Debit 7.300 UNICAP office expense Machine Goodwill Impairment/amortization Gain Adjustmer 1.250 447,115 447,115 32,030 33,130 437,985 437,985 Vacation Paid by 3/15 of following year Accrued Bonuses (CEO) Schedule M-1 Reconcilliation of Income (Loss) per Books With Income Per Return 7. Income recorded on books this yean a. Municipal Bond Interest b. Income on Officer's Life Insurance not included on 2. Federal Income Taxes per books 3. Excess of Capital Losses over Capital Gains 4. Income subject to tax not reported in books a. Gain on Sale of Business Asset 5. Expenses recorded on books this year not 8. Deductions on this return not charged against Book Income this year (temize) c. Bad Debl Expense 9. Add Lines 7 and 8 Check 10. Income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started