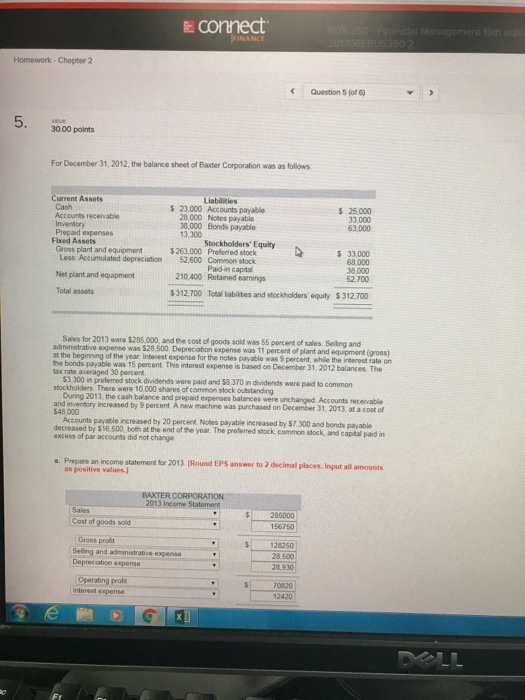

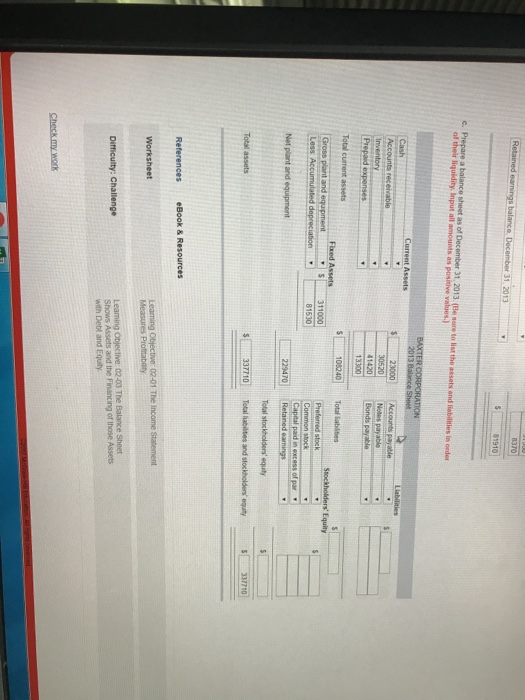

connect Homework-Chapter 2 Question 5 for 6) 30.00 points For December 31, 2012, the balance sheet of Baxter Corporation was as follows Current Assets S 25,000 33,000 63,000 $ 23,000 Accounts payable Cash Accounts receivable 28 000 Notes payable 38,000 Bonds payable 13,300 Prepaid expenses Fixed Assets Stockholders' Equity Gross plant and equipment $263,000 Preferred stock Less Accumulated depreciation 52,600 Common stock Paidin capital $ 33,000 68,000 38.000 52,700 210,400 Retained earnings Net plant and equipment Total assets 312,700 Total labilties and stockholders equiy $ 312.700 Sales for 2013 were S205000 and the cost of goods sold w55percent of sales Seling and admunstrative expense was at the beginning of the year Intarest expense for the notes payablo was 9 percent, while the interest rate on the bonds payable was 15 percent This interest expense is based on December 31, 2012 balances. The tax rate averaged 30 percent S3 300 preferred stock dividends were paid and $8 370 niidends stockholders There were 10,000 shares of common stock outstanding wore paid to common During 2013, the cash balance and prepaid expenses balances were unchanged Accounts receivable 31, 2013, at a cost of and inventory increased by 9 percent A new machne was purchased on $48,000 Accounts payable increased by 20 percent Notes payable increased by $7.300 and bonds payable decreased by $16.500, both at the end of the year. The preferred stock, common stock and excess of par accounts did not change capital paid in a. Prepare an income statement for 2013, (Round EPS answer to 2 decimal places Input all amounts as positive values BAXTER CORPORATION 2013 Income 285000 156750 Cost of goods sold Gross prolt 28250 28 500 28.930 Depreciation eapense 70820 2420 nterest expense connect Homework-Chapter 2 Question 5 for 6) 30.00 points For December 31, 2012, the balance sheet of Baxter Corporation was as follows Current Assets S 25,000 33,000 63,000 $ 23,000 Accounts payable Cash Accounts receivable 28 000 Notes payable 38,000 Bonds payable 13,300 Prepaid expenses Fixed Assets Stockholders' Equity Gross plant and equipment $263,000 Preferred stock Less Accumulated depreciation 52,600 Common stock Paidin capital $ 33,000 68,000 38.000 52,700 210,400 Retained earnings Net plant and equipment Total assets 312,700 Total labilties and stockholders equiy $ 312.700 Sales for 2013 were S205000 and the cost of goods sold w55percent of sales Seling and admunstrative expense was at the beginning of the year Intarest expense for the notes payablo was 9 percent, while the interest rate on the bonds payable was 15 percent This interest expense is based on December 31, 2012 balances. The tax rate averaged 30 percent S3 300 preferred stock dividends were paid and $8 370 niidends stockholders There were 10,000 shares of common stock outstanding wore paid to common During 2013, the cash balance and prepaid expenses balances were unchanged Accounts receivable 31, 2013, at a cost of and inventory increased by 9 percent A new machne was purchased on $48,000 Accounts payable increased by 20 percent Notes payable increased by $7.300 and bonds payable decreased by $16.500, both at the end of the year. The preferred stock, common stock and excess of par accounts did not change capital paid in a. Prepare an income statement for 2013, (Round EPS answer to 2 decimal places Input all amounts as positive values BAXTER CORPORATION 2013 Income 285000 156750 Cost of goods sold Gross prolt 28250 28 500 28.930 Depreciation eapense 70820 2420 nterest expense