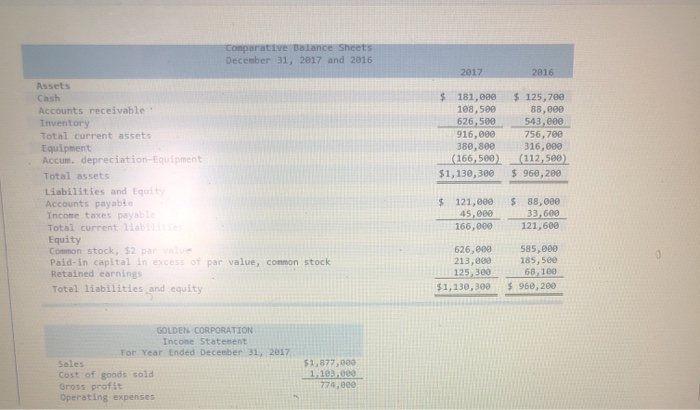

Connect Made & Soutwestem x + made con congestional browser launch AS2P%252Fnewconnectmheducation.com 252/activity/question dem 12.BA Soves Help Save & Check Required informes The folowe les to the questions displayed below Golden Con recently completed its 2017 operations. For the year, it all sales are credit sales (2) all effect cash receipts from customers. (3) all purchases of inventory are on credit, Mall cash payments for inventory (5) Other Expenses are all cash expenses, and any charge reflects the accrual and cash payment of taxes. The company's balance sheets and code Comparative stance Sheets $135.00 Accounts receive 03.10 636, 300,00 315.000 (22 Lettle 3 121,000 Total currenties 1 of 1 O e S 8 9 0 @ E R Y D 0 P S. F G . K L. Z B. N. . Comparative Balance Sheets December 31, 2017 and 2016 2017 2016 $ 181,000 108,500 626,500 916,000 380,800 (166,500) $1,130,300 $ 125,700 88,000 543,000 756,700 316,000 (112,500) $ 960,200 Assets Cash Accounts receivable Inventory Total current assets Equipment Accum. depreciation-Equipment Total assets Liabilities and Equity Accounts payable Income taxes payable Total current liabi Equity Common stock, $2 par Paid-in capital in excess of par value, common stock Retained earnings Total liabilities and equity $ 121,000 45,000 166,000 $ 88,000 33,600 121,600 626,000 213,000 125, 300 $1,130,300 585,000 185,500 68,100 $960,200 GOLDEN CORPORATION Income Statement For Year Ended December 31, 2017 Sales Cost of goods sold Gross profit Operating expenses $1,877,080 1.10,000 776,000 Connect Made & Soutwestem x + made con congestional browser launch AS2P%252Fnewconnectmheducation.com 252/activity/question dem 12.BA Soves Help Save & Check Required informes The folowe les to the questions displayed below Golden Con recently completed its 2017 operations. For the year, it all sales are credit sales (2) all effect cash receipts from customers. (3) all purchases of inventory are on credit, Mall cash payments for inventory (5) Other Expenses are all cash expenses, and any charge reflects the accrual and cash payment of taxes. The company's balance sheets and code Comparative stance Sheets $135.00 Accounts receive 03.10 636, 300,00 315.000 (22 Lettle 3 121,000 Total currenties 1 of 1 O e S 8 9 0 @ E R Y D 0 P S. F G . K L. Z B. N. . Comparative Balance Sheets December 31, 2017 and 2016 2017 2016 $ 181,000 108,500 626,500 916,000 380,800 (166,500) $1,130,300 $ 125,700 88,000 543,000 756,700 316,000 (112,500) $ 960,200 Assets Cash Accounts receivable Inventory Total current assets Equipment Accum. depreciation-Equipment Total assets Liabilities and Equity Accounts payable Income taxes payable Total current liabi Equity Common stock, $2 par Paid-in capital in excess of par value, common stock Retained earnings Total liabilities and equity $ 121,000 45,000 166,000 $ 88,000 33,600 121,600 626,000 213,000 125, 300 $1,130,300 585,000 185,500 68,100 $960,200 GOLDEN CORPORATION Income Statement For Year Ended December 31, 2017 Sales Cost of goods sold Gross profit Operating expenses $1,877,080 1.10,000 776,000