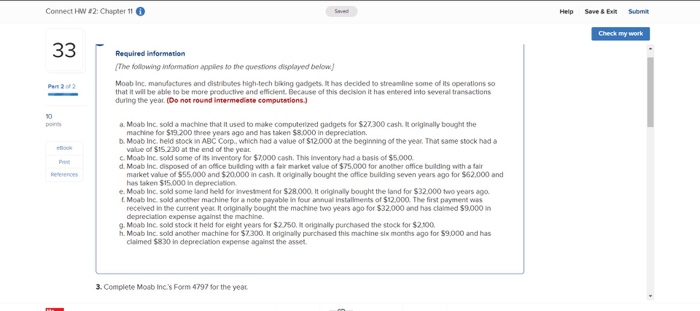

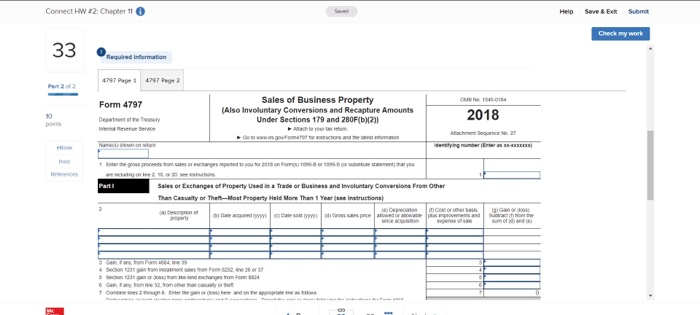

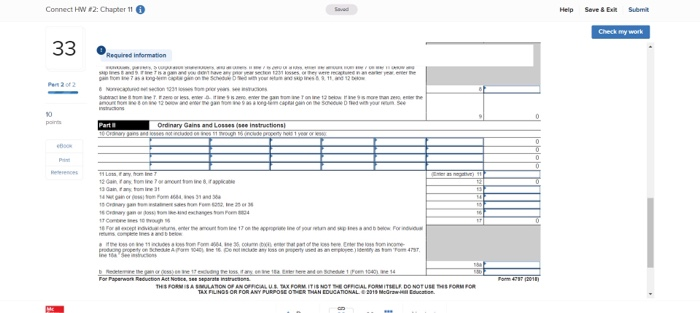

Connect W 22: Chapter 11 Help Save & Exh Submit Check my work 33 Required information (The following information applies to the questions displayed below) Moab Inc. manufactures and distributes high-tech biking gadgets. It has decided to streamline some of its operations so that it will be able to be more productive and efficient. Because of this decision it has entered into several transactions during the year. (Do not round Intermediate computations.) Part 2 of 2 30 References a. Moab Inc. sold a machine that it used to make computerized gadgets for $27.300 cash. It originally bought the b. Moab Inc held stock in ABC Corp. which had a value of $12.000 at the beginning of the year. The same stock had a value of $15.230 at the end of the year c. Moab Inc. sold some of its inventory for $7000 cash. This inventory had a basis of $5.000 d. Moab Inc, disposed of an office building with a far market value of $75,000 for another office building with a fair market value of $55.000 and $20.000 in cash. It originally bought the office building seven years ago for $62.000 and has taken $15.000 in depreciation e. Moab Inc. sold some and held for investment for $28,000. It originally bought the land for $32,000 two years ago Moab Inc. sold another machine for a note payable in four annual installments of $12.000. The first payment was received in the current year it originally bought the machine two years ago for $32,000 and has claimed 59.000 in 9. Moab Inc. sold stock it held for eight years for $2750. It originally purchased the stock for $2500. h. Moab Inc. sold another machine for $2.300. It originally purchased this machine six months ago for $9.000 and has claimed $830 in depreciation expense against the asset 3. Complete Moab Inc.'s Form 4797 for the year Connect HW #2: Chapter 11 Help Save & Sum Check my work 33 Required information 4797 Page 14797 Page 2 Part 2 of 2 Form 4797 Department of Sales of Business Property (Also involuntary Conversions and Recapture Amounts Under Sections 179 and 280F(b)(2) to www.goufomart Structions and the latest non 2018 Nonton ediying number - interthe gross proces trois rechargested to you for 2018 on Fotostaty Parti Sales or Exchange of property Used in a Trade or Business and involuntary Conversion From Other Than Casualty or Theft-Host Property Held More Than 1 Year(se instructions Corner de Grece and pas movements and Ger Gain Concoromine Section 180 groom 02.2009 Secon 131 tommend changes from om 6 Camomine 32 Tare este terre Connect HW 2: Chapter 11 Help Seve & Exit Submit Check my work 33 Required information STO S. Per 2012 Tresse more on the sed 30 por Part Ordinary Gains and Losses (ne Instruction Tras estos tres 11 de property hot your 0 11 Lantay foreire 12 anfon from ine 7oramountaine 8. roplice 19 Crayson Foto 2 1 Corone mes to us For prodong properly on the form 100 me i po Retre ve Tee 1021m 10001 e 14 For Paperworection Act No. 1 THIS FORM IBA SULATION OF AN OFFICIALUS TAX FORM. ITIS NOT ME OFFICIAL FORMITHELE DO NOT USE THE FORM FOR TAX FILINOS OR FOR ANY PURPOSE OTHER THAN EDUCATIONALE 2019 Merawat Connect W 22: Chapter 11 Help Save & Exh Submit Check my work 33 Required information (The following information applies to the questions displayed below) Moab Inc. manufactures and distributes high-tech biking gadgets. It has decided to streamline some of its operations so that it will be able to be more productive and efficient. Because of this decision it has entered into several transactions during the year. (Do not round Intermediate computations.) Part 2 of 2 30 References a. Moab Inc. sold a machine that it used to make computerized gadgets for $27.300 cash. It originally bought the b. Moab Inc held stock in ABC Corp. which had a value of $12.000 at the beginning of the year. The same stock had a value of $15.230 at the end of the year c. Moab Inc. sold some of its inventory for $7000 cash. This inventory had a basis of $5.000 d. Moab Inc, disposed of an office building with a far market value of $75,000 for another office building with a fair market value of $55.000 and $20.000 in cash. It originally bought the office building seven years ago for $62.000 and has taken $15.000 in depreciation e. Moab Inc. sold some and held for investment for $28,000. It originally bought the land for $32,000 two years ago Moab Inc. sold another machine for a note payable in four annual installments of $12.000. The first payment was received in the current year it originally bought the machine two years ago for $32,000 and has claimed 59.000 in 9. Moab Inc. sold stock it held for eight years for $2750. It originally purchased the stock for $2500. h. Moab Inc. sold another machine for $2.300. It originally purchased this machine six months ago for $9.000 and has claimed $830 in depreciation expense against the asset 3. Complete Moab Inc.'s Form 4797 for the year Connect HW #2: Chapter 11 Help Save & Sum Check my work 33 Required information 4797 Page 14797 Page 2 Part 2 of 2 Form 4797 Department of Sales of Business Property (Also involuntary Conversions and Recapture Amounts Under Sections 179 and 280F(b)(2) to www.goufomart Structions and the latest non 2018 Nonton ediying number - interthe gross proces trois rechargested to you for 2018 on Fotostaty Parti Sales or Exchange of property Used in a Trade or Business and involuntary Conversion From Other Than Casualty or Theft-Host Property Held More Than 1 Year(se instructions Corner de Grece and pas movements and Ger Gain Concoromine Section 180 groom 02.2009 Secon 131 tommend changes from om 6 Camomine 32 Tare este terre Connect HW 2: Chapter 11 Help Seve & Exit Submit Check my work 33 Required information STO S. Per 2012 Tresse more on the sed 30 por Part Ordinary Gains and Losses (ne Instruction Tras estos tres 11 de property hot your 0 11 Lantay foreire 12 anfon from ine 7oramountaine 8. roplice 19 Crayson Foto 2 1 Corone mes to us For prodong properly on the form 100 me i po Retre ve Tee 1021m 10001 e 14 For Paperworection Act No. 1 THIS FORM IBA SULATION OF AN OFFICIALUS TAX FORM. ITIS NOT ME OFFICIAL FORMITHELE DO NOT USE THE FORM FOR TAX FILINOS OR FOR ANY PURPOSE OTHER THAN EDUCATIONALE 2019 Merawat