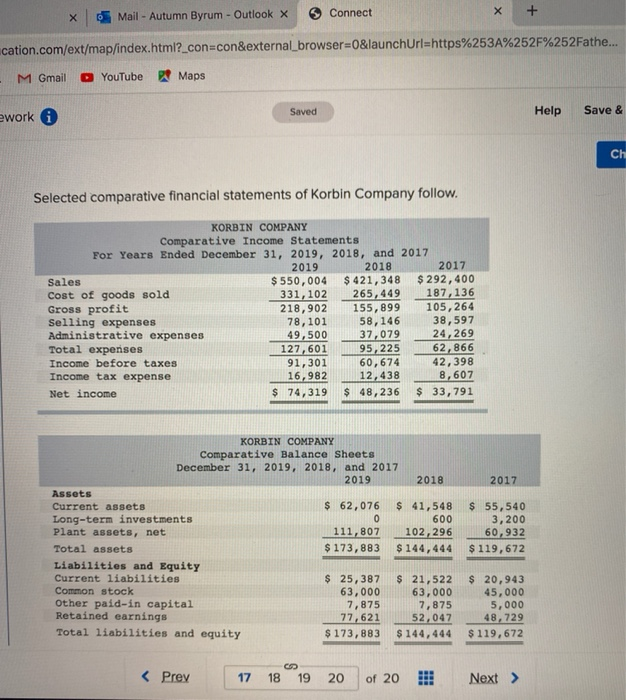

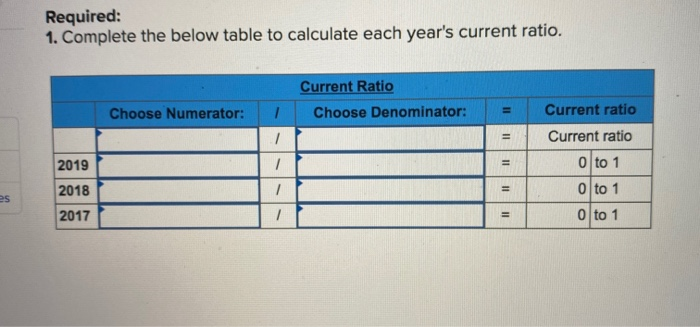

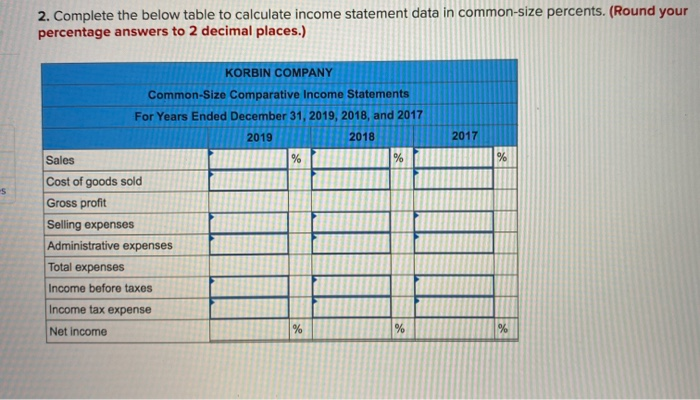

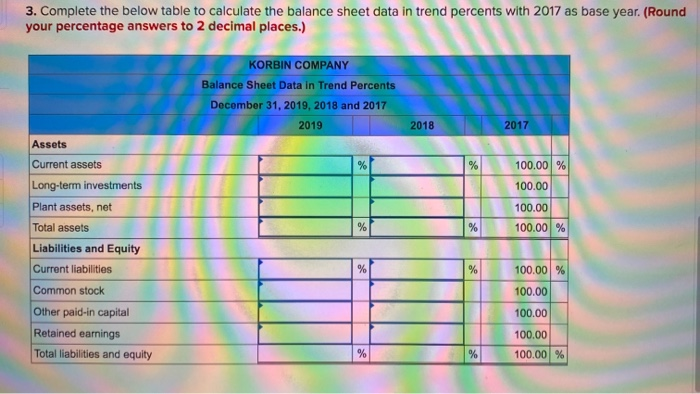

Connect X + Mail - Autumn Byrum - Outlook X cation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fathe... M Gmail YouTube Maps Saved Help ework i Save & Ch Selected comparative financial statements of Korbin Company follow. KORBIN COMPANY Comparative Income Statements For Years Ended December 31, 2019, 2018, and 2017 2019 2018 2017 Sales $ 550,004 $ 421,348 $ 292,400 Cost of goods sold 331, 102 265,449 187,136 Gross profit 218,902 155,899 105,264 Selling expenses 78,101 58,146 38,597 Administrative expenses 49,500 37,079 24,269 Total expenses 127,601 95, 225 62,866 Income before taxes 91, 301 60,674 42,398 Income tax expense 16,982 12,438 8,607 Net income $ 74,319 $ 48,236 $ 33,791 2017 KORBIN COMPANY Comparative Balance Sheets December 31, 2019, 2018, and 2017 2019 2018 Assets Current assets $ 62,076 $ 41,548 Long-term investments 0 600 Plant assets, net 111,807 102,296 Total assets $ 173,883 $ 144,444 Liabilities and Equity Current liabilities $ 25,387 $ 21,522 Common stock 63,000 63,000 Other paid-in capital 7,875 7,875 Retained earnings 77,621 52,047 Total liabilities and equity $ 173,883 $ 144,444 $ 55, 540 3,200 60,932 $ 119,672 $ 20,943 45,000 5,000 48,729 $ 119,672 Required: 1. Complete the below table to calculate each year's current ratio. Current Ratio Choose Denominator: Choose Numerator: 1 Current ratio 1 = Current ratio 2019 / 11 2018 O to 1 0 to 1 oto 1 1 1 es II 2017 2. Complete the below table to calculate income statement data in common-size percents. (Round your percentage answers to 2 decimal places.) 2017 % 5 KORBIN COMPANY Common-Size Comparative Income Statements For Years Ended December 31, 2019, 2018, and 2017 2019 2018 Sales % % Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income tax expense Net income % % 3. Complete the below table to calculate the balance sheet data in trend percents with 2017 as base year. (Round your percentage answers to 2 decimal places.) KORBIN COMPANY Balance Sheet Data in Trend Percents December 31, 2019, 2018 and 2017 2019 2018 2017 % % 100.00 % 100.00 100.00 % % 100.00 % Assets Current assets Long-term investments Plant assets, net Total assets Liabilities and Equity Current liabilities Common stock Other paid-in capital Retained earnings Total liabilities and equity % % 100.00 % 100.00 100.00 100.00 100.00 % % %