Answered step by step

Verified Expert Solution

Question

1 Approved Answer

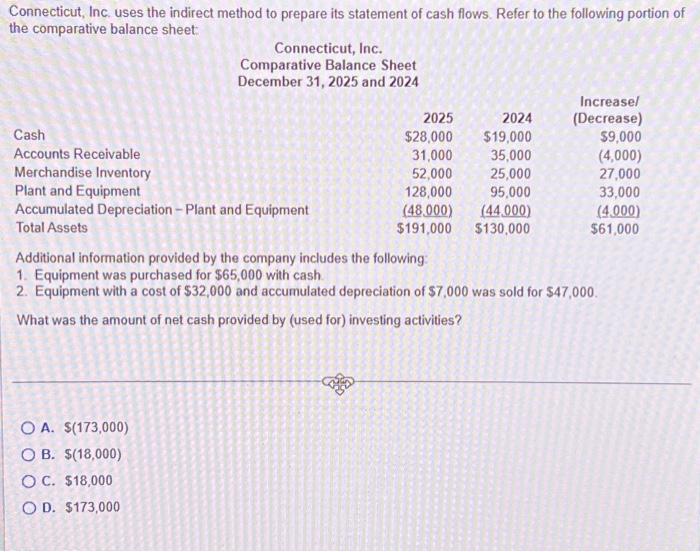

Connecticut, Inc. uses the indirect method to prepare its statement of cash flows. Refer to the following portion of the comparative balance sheet: Connecticut, Inc.

Connecticut, Inc. uses the indirect method to prepare its statement of cash flows. Refer to the following portion of the comparative balance sheet: Connecticut, Inc. Comparative Balance Sheet December 31, 2025 and 2024 Cash Accounts Receivable Merchandise Inventory Plant and Equipment Accumulated Depreciation - Plant and Equipment Total Assets OA. $(173,000) O B. $(18,000) OC. $18,000 O D. $173,000 2025 $28,000 31,000 52,000 2024 $19,000 35,000 25,000 128,000 95,000 (48,000) (44.000) $191,000 $130,000 of Increase/ (Decrease) Additional information provided by the company includes the following: 1. Equipment was purchased for $65,000 with cash. 2. Equipment with a cost of $32,000 and accumulated depreciation of $7,000 was sold for $47,000. What was the amount of net cash provided by (used for) investing activities? $9,000 (4,000) 27,000 33,000 (4.000) $61,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started