Question

Connection to Practice: Final Assessment Case Study-Connecting the Dots: 100 points This case study counts towards 40% of your final assessment grade (the final assessment

Connection to Practice: Final Assessment Case Study-Connecting the Dots: 100 points\ This case study counts towards

40%of your final assessment grade (the final assessment is

10%of your\ total grades- so this assessment counts towards

(4)/(10_())points).\ Case\ After graduating from Union University, you have been hired at Daily Sports. Since you have an\ undergraduate degree in accounting and prior accounting internship experience, the head of accounting\ at the firm is keen for you to be promoted to the role of accounting manager supervising a team of\ junior accountants. The first task you have been assigned is to review and make any necessary\ corrections to the general ledger account for accounts receivable prepared by an intern as part of closing\ entries for March. You have verified that the March A/R beginning balance of

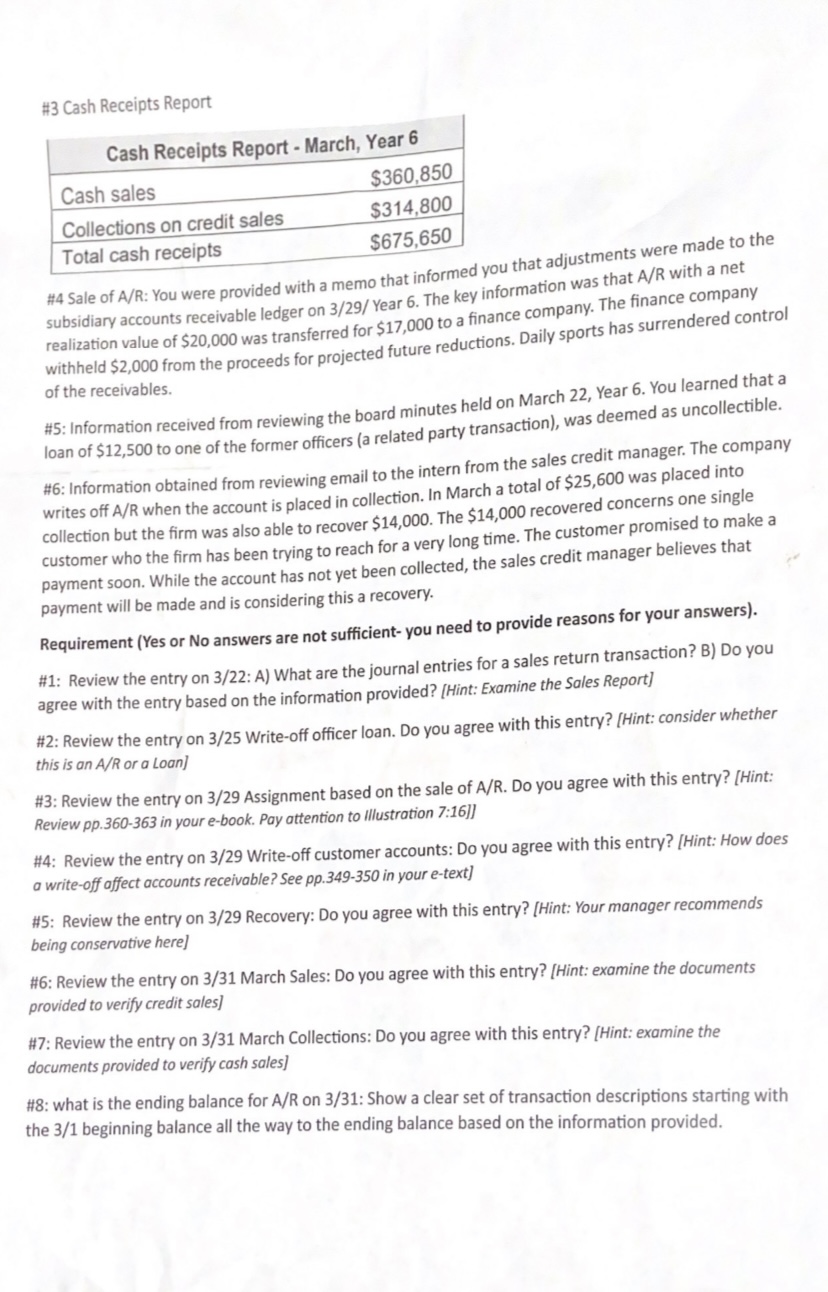

$489,300balanced with\ the A/R subledger as of March 1, Year 6 .\ Your task is to review the information the information used by the intern related to the A/R subsidiary\ ledger (subledger) in preparing the general ledger balance and to ensure that it is consistent and\ accurate with the information provided.\ Information\ #1: The General Ledger prepared by the intern.\ #2: Monthly Sales report\ (all sales returns are on credit)#4 Sale of A/R: You were provided with a memo that informed you that adjustments were made to the\ subsidiary accounts receivable ledger on

3/29 Year 6 . The key information was that

(A)/(R)with a net\ realization value of

$20,000was transferred for

$17,000to a finance company. The finance company\ withheld

$2,000from the proceeds for projected future reductions. Daily sports has surrendered control\ of the receivables.\ #5: Information received from reviewing the board minutes held on March 22, Year 6. You learned that a\ loan of

$12,500to one of the former officers (a related party transaction), was deemed as uncollectible.\ #6: Information obtained from reviewing email to the intern from the sales credit manager. The company\ writes off

(A)/(R)when the account is placed in collection. In March a total of

$25,600was placed into\ collection but the firm was also able to recover

$14,000. The

$14,000recovered concerns one single\ customer who the firm has been trying to reach for a very long time. The customer promised to make a\ payment soon. While the account has not yet been collected, the sales credit manager believes that\ payment will be made and is considering this a recovery.\ Requirement (Yes or No answers are not sufficient- you need to provide reasons for your answers).\ #1: Review the entry on 3/22: A) What are the journal entries for a sales return transaction? B) Do you\ agree with the entry based on the information provided? [Hint: Examine the Sales Report]\ #2: Review the entry on 3/25 Write-off officer loan. Do you agree with this entry? [Hint: consider whether\ this is an A/R or a Loan]\ #3: Review the entry on 3/29 Assignment based on the sale of A/R. Do you agree with this entry? [Hint:\ Review pp.360-363 in your e-book. Pay attention to Illustration 7:16]]\ #4: Review the entry on 3/29 Write-off customer accounts: Do you agree with this entry? [Hint: How does\ a write-off affect accounts receivable? See pp.349-350 in your e-text]\ #5: Review the entry on 3/29 Recovery: Do you agree with this entry? [Hint: Your manager recommends\ being conservative here]\ #6: Review the entry on 3/31 March Sales: Do you agree with this entry? [Hint: examine the documents\ provided to verify credit sales]\ #7: Review the entry on 3/31 March Collections: Do you agree with this entry? [Hint: examine the\ documents provided to verify cash sales]\ #8: what is the ending balance for

(A)/(R)on

3/31 : Show a clear set of transaction descriptions starting with\ the

3/1 beginning balance all the way to the ending balance based on the information provided.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started